Introducing Orbital Energy Group (NASDAQ:OEG), The Stock That Soared 304% In The Last Year

Orbital Energy Group, Inc. (NASDAQ:OEG) shareholders might understandably be very concerned that the share price has dropped 70% in the last quarter. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 304% boost to the share price. So the recent fall isn't enough to negate the good performance. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

Check out our latest analysis for Orbital Energy Group

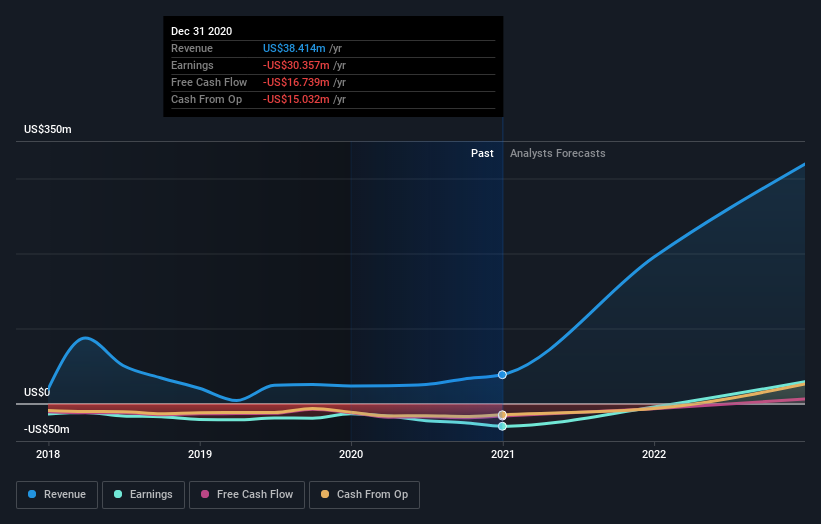

Orbital Energy Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Orbital Energy Group saw its revenue grow by 64%. That's well above most other pre-profit companies. But the share price has really rocketed in response gaining 304% as previously mentioned. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Orbital Energy Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Orbital Energy Group has rewarded shareholders with a total shareholder return of 304% in the last twelve months. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Orbital Energy Group better, we need to consider many other factors. Take risks, for example - Orbital Energy Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.