Introducing Peabody Energy (NYSE:BTU), The Stock That Tanked 90%

As an investor, mistakes are inevitable. But really bad investments should be rare. So consider, for a moment, the misfortune of Peabody Energy Corporation (NYSE:BTU) investors who have held the stock for three years as it declined a whopping 90%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 89%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 71% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Peabody Energy

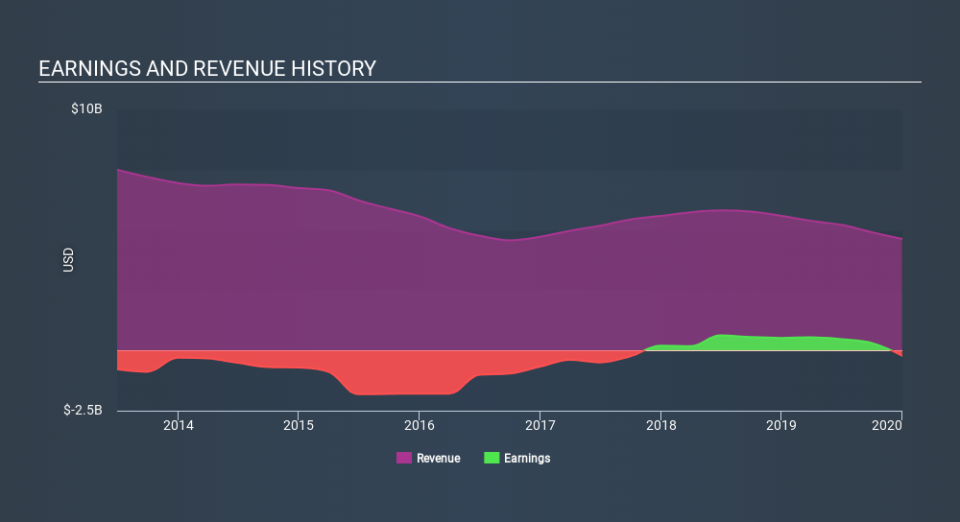

Because Peabody Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Peabody Energy's revenue dropped 0.4% per year. That's not what investors generally want to see. Having said that the 53% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Peabody Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Peabody Energy shareholders are down 89% for the year, falling short of the market return. Meanwhile, the broader market slid about 8.9%, likely weighing on the stock. The three-year loss of 51% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Peabody Energy , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.