Introducing Pennsylvania Real Estate Investment Trust (NYSE:PEI), The Stock That Tanked 71%

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Pennsylvania Real Estate Investment Trust (NYSE:PEI) have had an unfortunate run in the last three years. Unfortunately, they have held through a 71% decline in the share price in that time. And over the last year the share price fell 36%, so we doubt many shareholders are delighted. Unfortunately the share price momentum is still quite negative, with prices down 8.5% in thirty days.

Check out our latest analysis for Pennsylvania Real Estate Investment Trust

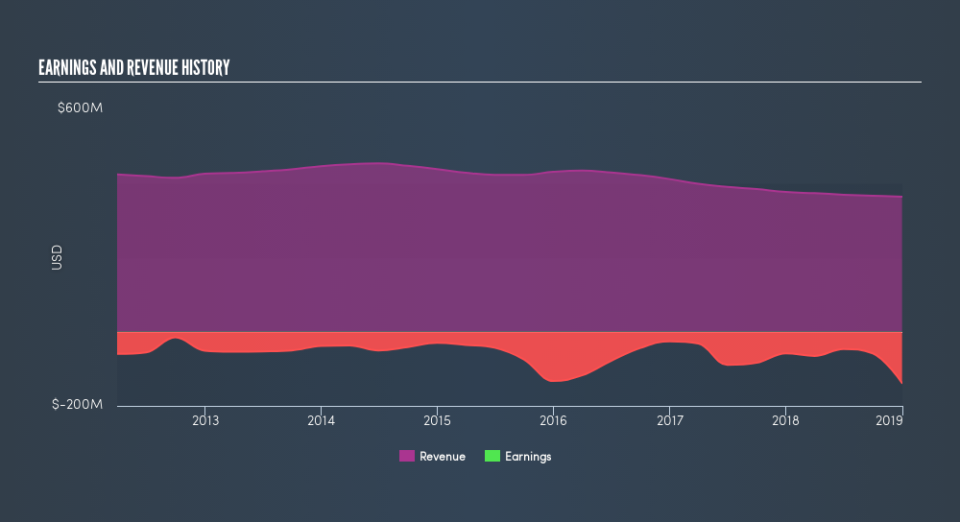

Pennsylvania Real Estate Investment Trust isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years Pennsylvania Real Estate Investment Trust saw its revenue shrink by 6.7% per year. That is not a good result. Having said that the 34% annualized share price decline highlights the risk of investing in unprofitable companies. We’re generally averse to companies with declining revenues, but we’re not alone in that. There’s no more than a snowball’s chance in hell that share price will head back to its old highs, in the short term.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Pennsylvania Real Estate Investment Trust, it has a TSR of -63% for the last 3 years. That exceeds its share price return that we previously mentioned. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 7.9% in the last year, Pennsylvania Real Estate Investment Trust shareholders lost 29% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 14% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Pennsylvania Real Estate Investment Trust you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

But note: Pennsylvania Real Estate Investment Trust may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.