Introducing Sin Heng Heavy Machinery (SGX:BKA), The Stock That Tanked 75%

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Sin Heng Heavy Machinery Limited (SGX:BKA) during the five years that saw its share price drop a whopping 75%. And some of the more recent buyers are probably worried, too, with the stock falling 43% in the last year. Furthermore, it's down 10% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Sin Heng Heavy Machinery

Sin Heng Heavy Machinery isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

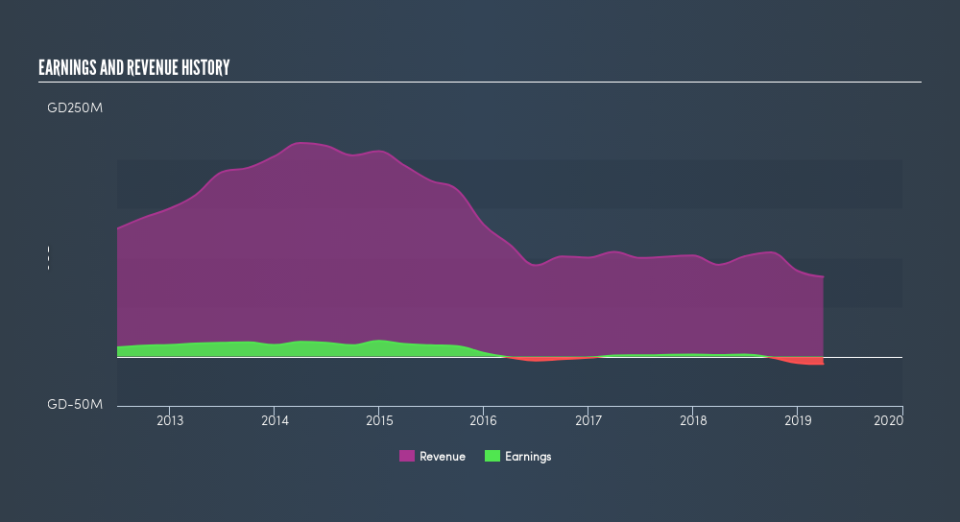

In the last five years Sin Heng Heavy Machinery saw its revenue shrink by 21% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 24% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Sin Heng Heavy Machinery's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Sin Heng Heavy Machinery's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Sin Heng Heavy Machinery shareholders, and that cash payout explains why its total shareholder loss of 71%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 5.2% in the twelve months, Sin Heng Heavy Machinery shareholders did even worse, losing 43%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 22% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.