Introducing TOMO Holdings (HKG:8463), The Stock That Dropped 45% In The Last Year

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the TOMO Holdings Limited (HKG:8463) share price slid 45% over twelve months. That contrasts poorly with the market return of -3.1%. TOMO Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 13% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for TOMO Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

TOMO Holdings stole the show with its EPS rocketing, in the last year. While the business is unlikely to sustain such a high growth rate for long, it's great to see. As you can imagine, the share price action therefore perturbs us. Some different data might shed some more light on the situation.

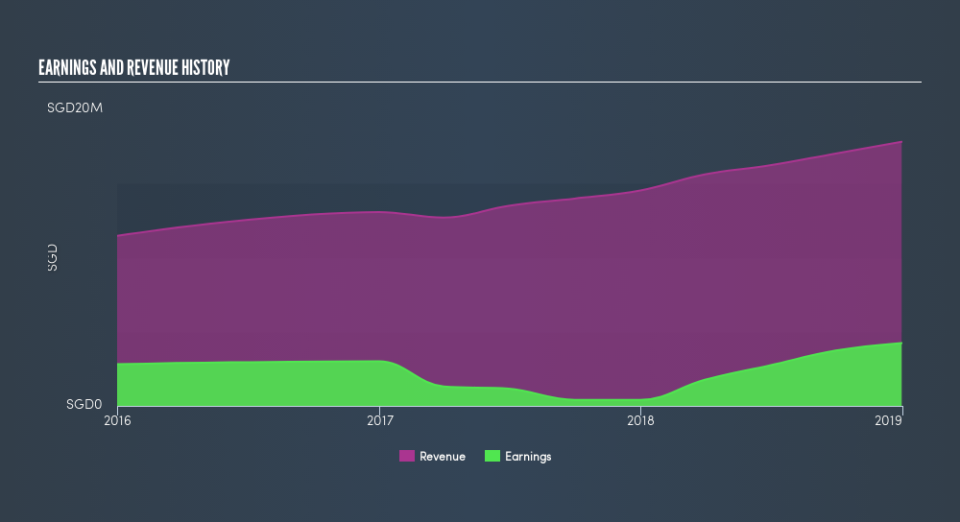

TOMO Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on TOMO Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

TOMO Holdings shareholders are down 45% for the year, even worse than the market loss of 3.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 13%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before deciding if you like the current share price, check how TOMO Holdings scores on these 3 valuation metrics.

Of course TOMO Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.