Introducing Vienna Insurance Group (VIE:VIG), The Stock That Dropped 36% In The Last Five Years

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Vienna Insurance Group AG (VIE:VIG), since the last five years saw the share price fall 36%. It's down 2.9% in the last seven days.

View our latest analysis for Vienna Insurance Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

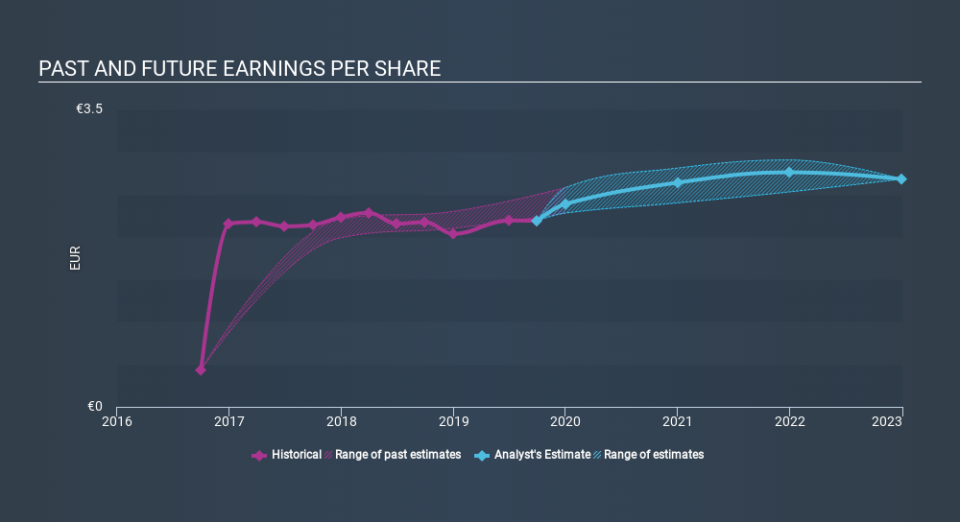

Looking back five years, both Vienna Insurance Group's share price and EPS declined; the latter at a rate of 1.7% per year. This reduction in EPS is less than the 8.6% annual reduction in the share price. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 11.28 further reflects this reticence.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Vienna Insurance Group has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Vienna Insurance Group, it has a TSR of -23% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Vienna Insurance Group shareholders have received a total shareholder return of 21% over the last year. Of course, that includes the dividend. That certainly beats the loss of about 5.2% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Vienna Insurance Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Vienna Insurance Group you should know about.

We will like Vienna Insurance Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.