Introducing Volt Resources (ASX:VRC), The Stock That Slid 64% In The Last Three Years

This month, we saw the Volt Resources Limited (ASX:VRC) up an impressive 100%. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 64% in the last three years. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

View our latest analysis for Volt Resources

With zero revenue generated over twelve months, we don't think that Volt Resources has proved its business plan yet. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Volt Resources will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Volt Resources has already given some investors a taste of the bitter losses that high risk investing can cause.

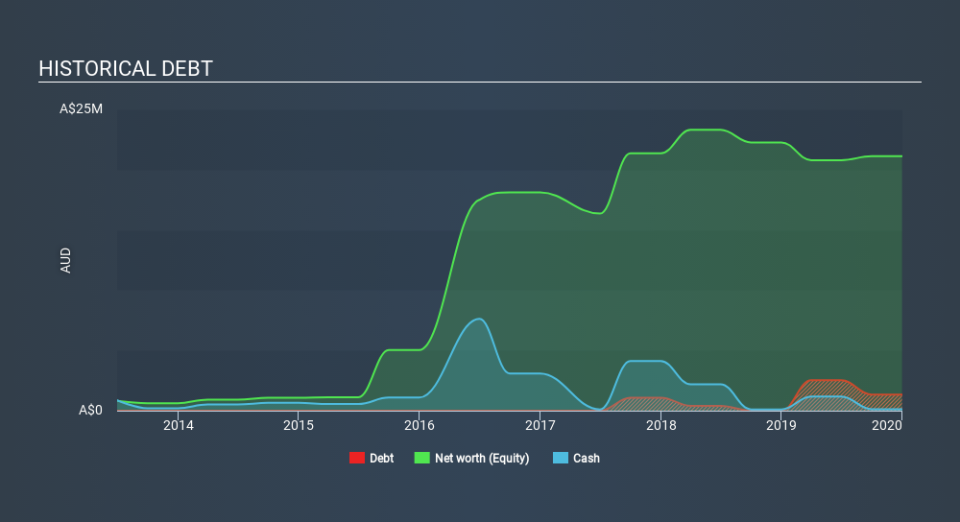

Our data indicates that Volt Resources had more in total liabilities than it had cash, when it last reported. That put it in the highest risk category, according to our analysis. But with the share price diving 29% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can see in the image below, how Volt Resources's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

We regret to report that Volt Resources shareholders are down 36% for the year. Unfortunately, that's worse than the broader market decline of 10%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Volt Resources is showing 5 warning signs in our investment analysis , and 2 of those are a bit concerning...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.