Introducing Xinjiang Tianye Water Saving Irrigation System (HKG:840), The Stock That Slid 58% In The Last Three Years

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Xinjiang Tianye Water Saving Irrigation System Company Limited (HKG:840) shareholders. Sadly for them, the share price is down 58% in that time. The silver lining is that the stock is up 1.5% in about a week.

View our latest analysis for Xinjiang Tianye Water Saving Irrigation System

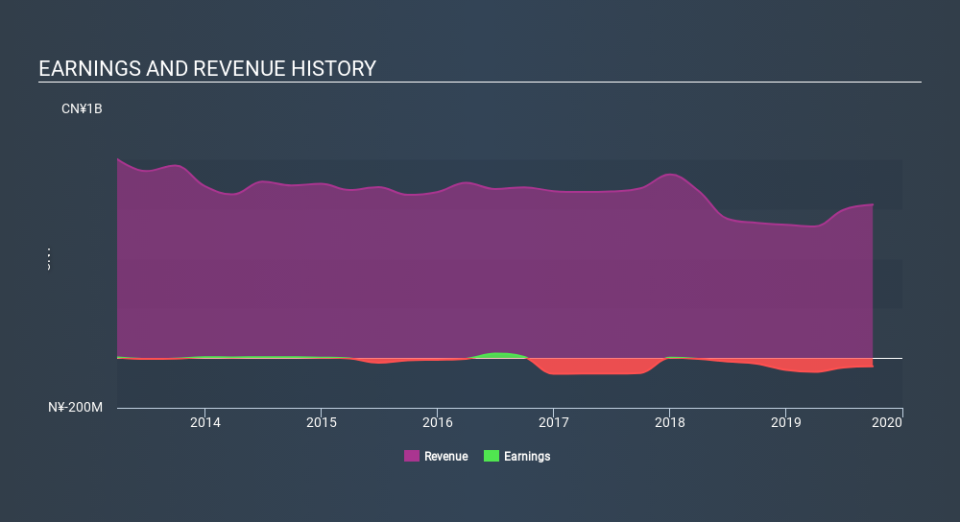

Xinjiang Tianye Water Saving Irrigation System isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Xinjiang Tianye Water Saving Irrigation System saw its revenue shrink by 7.7% per year. That is not a good result. The share price decline of 25% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Xinjiang Tianye Water Saving Irrigation System's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 10% in the last year, Xinjiang Tianye Water Saving Irrigation System shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 14% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Xinjiang Tianye Water Saving Irrigation System (1 is concerning) that you should be aware of.

Of course Xinjiang Tianye Water Saving Irrigation System may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.