Invesco European Growth Fund's Top 2nd-Quarter Trades

Earlier this week, the Invesco European Growth Fund (Trades, Portfolio) disclosed its portfolio updates for its second quarter of fiscal 2020, which ended on April 30.

Invesco is a global financial services company with headquarters in Atlanta and offices in 25 countries around the world. The Invesco European Growth Fund (Trades, Portfolio) seeks long-term exposure to high-quality growth opportunities in both developed and emerging European markets.

As of the quarter's end, the equity portfolio consisted of positions in 59 stocks valued at $878 million. It established 11 new positions, sold out of eight stocks and added to or reduced several other holdings for a turnover rate of 12%.

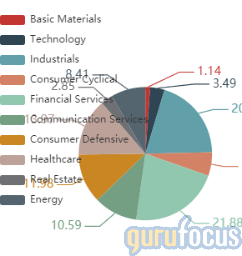

The fund's top equity positions were London-based marketing group DCC PLC (LSE:DCC) at 5.24% of the equity portfolio, Sberbank of Russia PJSC (MIC:SBERP) with 5.2% and Deutsche Boerse AG with 3.36%. In terms of sector weighting, the fund was most heavily invested in financial services and industrials.

Based on its investing criteria, the fund's biggest buys for the quarter were in Nestle SA (XSWX:NESN) and Roche Holding AG (XSWX:ROG), while its biggest sells were in Vinci SA (XPAR:DG) and Reckitt Benckiser Group PLC (LSE:RB.).

Nestle

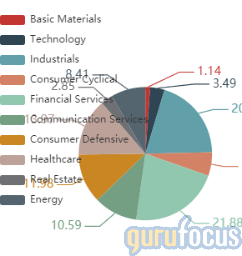

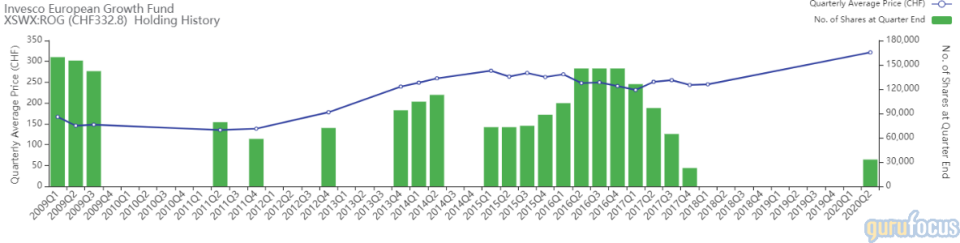

The fund established a new position of 179,030 shares in Nestle after selling out of its previous investment in the company in the third quarter of 2014. The trade impacted the equity portfolio by 2.15%. During the quarter, shares traded for an average price of 102.61 Swiss francs ($108.52).

Switzerland-based Nestle is the world's largest food and beverage company in terms of revenue. Products include several shelf-stable foods and drink powders, as well as coffee, dairy, sweets and pet food. The company owns iconic brands such as Kit-Kat, Gerber, Stouffer's and Purina.

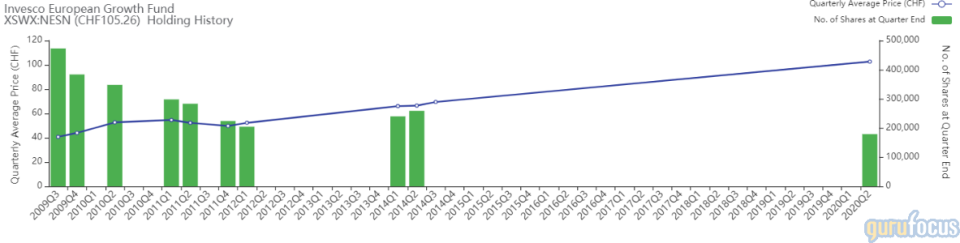

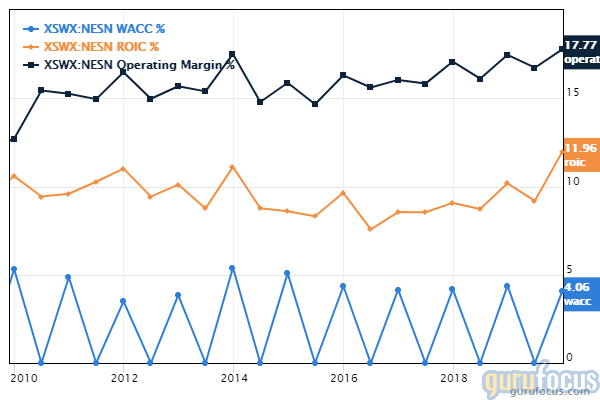

On July 2, shares of Nestle traded around 105.26 francs for a market cap of 303.15 billion francs and a price-earnings ratio of 24.48. According to the Peter Lynch chart, shares are trading above their intrinsic value but near their median historical valuation.

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rating of 7 out of 10, a valuation rating of 1 out of 10 and a business predictability rating of 2.5 out of 5 stars.

The cash-debt ratio of 0.28 is below the industry median of 0.41, but the Altman Z-Score of 4.46 indicates that the company is not in danger of bankruptcy. The operating margin of 17.26% is higher than 89.72% of competitors and the return on invested capital exceeds the weighted average cost of capital, indicating profitability.

Roche Holding

The fund also invested in 33,032 new shares of Roche Holding after selling out of its previous position in the company during the first quarter of 2018. The trade had a 1.31% impact on the equity portfolio. Shares traded for an average price of 321.47 francs during the quarter.

Roche is a pharmaceutical company based in Switzerland. Founded in 1896, the company researches, develops and manufactures pharmaceutical and diagnostic products mainly in the following fields: cardiovascular, autoimmune, infectious diseases, respiratory diseases, oncology, dermatology, metabolic disorders and transplantation.

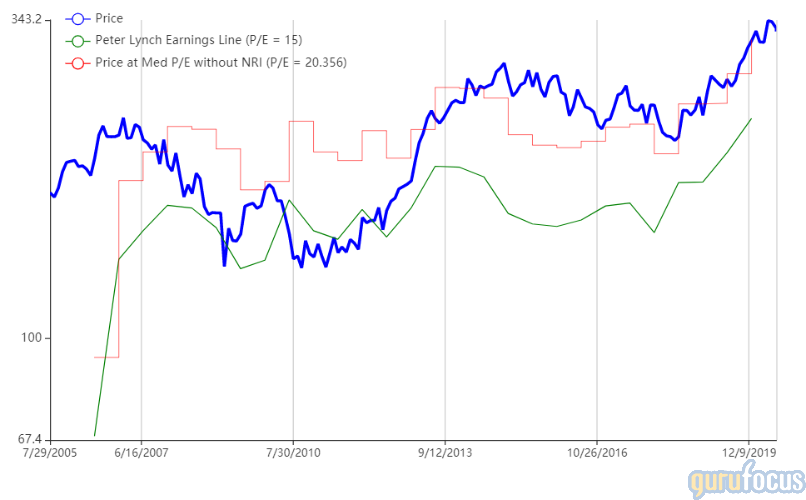

On July 2, shares of Roche traded around 332.80 francs for a market cap of 284.38 billion francs and a price-earnings ratio of 21.32. The Peter Lynch chart indicates that the stock trades above both its intrinsic value and its historical median valuation.

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rating of 8 out of 10, a valuation rating of 3 out of 10 and a business predictability rating of 1 out of 5 stars.

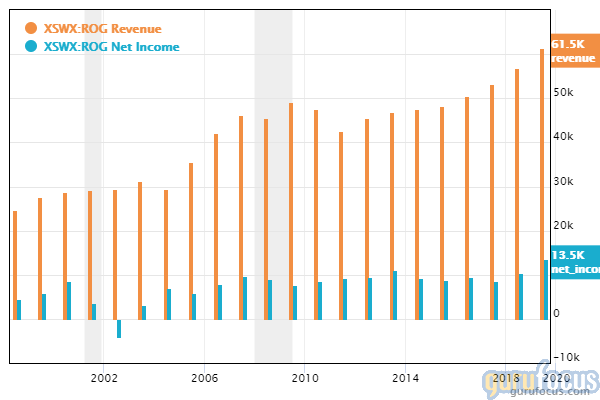

Roche's interest coverage ratio of 23.09 and Altman Z-Score of 5.83 are higher than 60.59% of competitors. The operating margin of 28.55% is beating 92.75% of competitors, and the company has managed to steadily grow its revenue and net income over the past several years.

Vinci

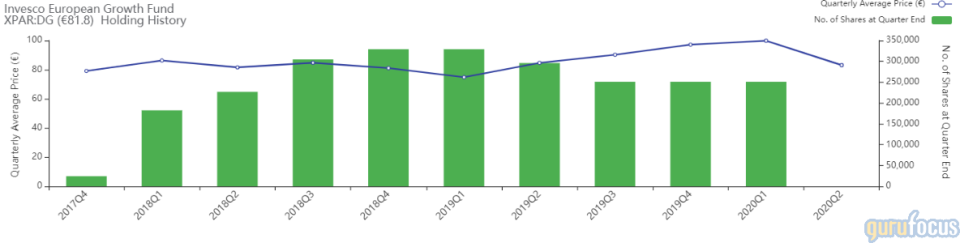

The fund sold out of its 250,967-share position in Vinci, which had a -2.28% impact on the equity portfolio. During the quarter, shares traded for an average price of 83.10 euros ($93.38).

Vinci is a French concessions and construction company with headquarters in Paris. The international company primarily designs, finances, builds and operates public infrastructure and facilities with a focus on sustainability, community and mobility.

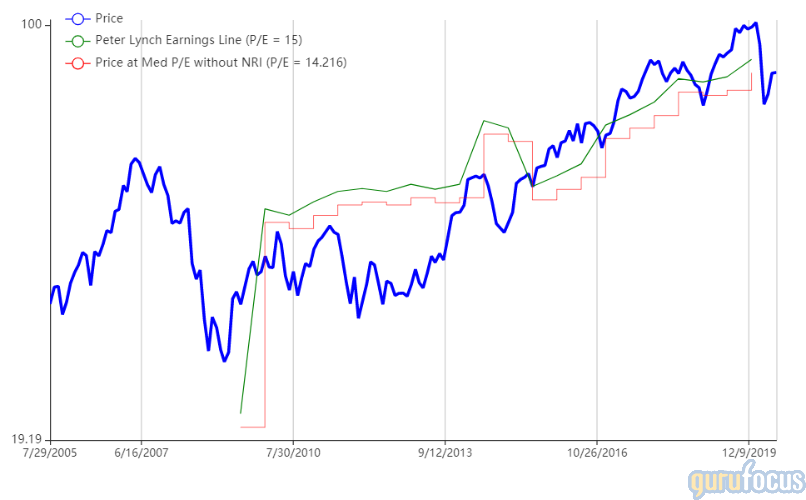

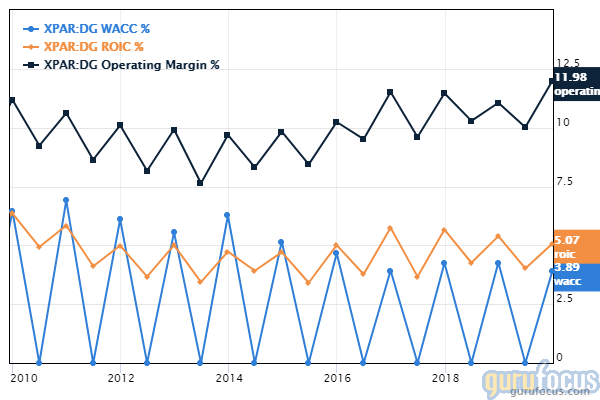

On July 2, shares of Vinci traded around 81.80 euros for a market cap of 45.35 billion euros and a price-earnings ratio of 14.04. The Peter Lynch chart shows that the company is trading below its intrinsic value, but in line with its median historical valuation.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rating of 7 out of 10, a valuation rating of 3 out of 10 and a business predictability rating of 3 out of 5 stars.

The cash-debt ratio of 0.27 is lower than 69.42% of competitors, and the Altman Z-Score of 1.16 indicates that the company could be in danger of bankruptcy if it cannot secure additional funding. The operating margin of 11.09% is above the industry median of 5.71%, and the ROIC is higher than the WACC, indicating overall profitability.

Reckitt Benckiser Group

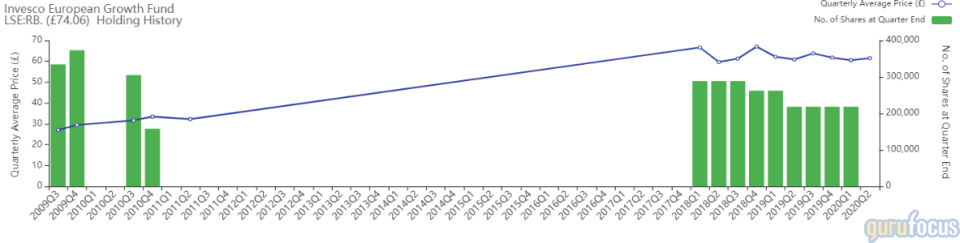

The fund also sold all 218,249 of its shares in Reckitt Benckiser Group PLC, impacting the equity portfolio by -1.48%. Shares traded for an average price of 61.53 British pounds ($76.69) during the quarter.

Formed in 1999 by the merger of Reckitt & Colman PLC and Benckiser NV, Reckitt Benckiser Group is a British multinational consumer goods company. It primarily produces health, hygiene and home products, and its popular brand names include Lysol, Mucinex and Scholl.

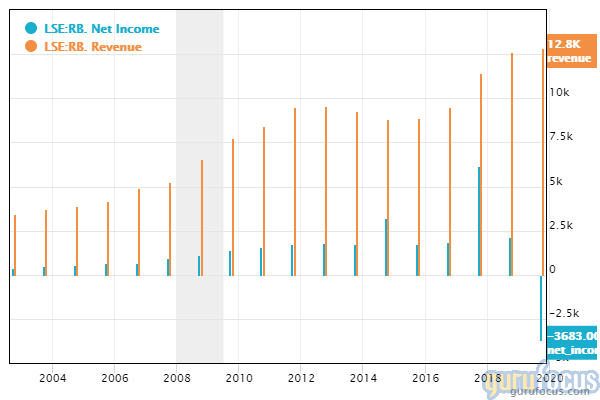

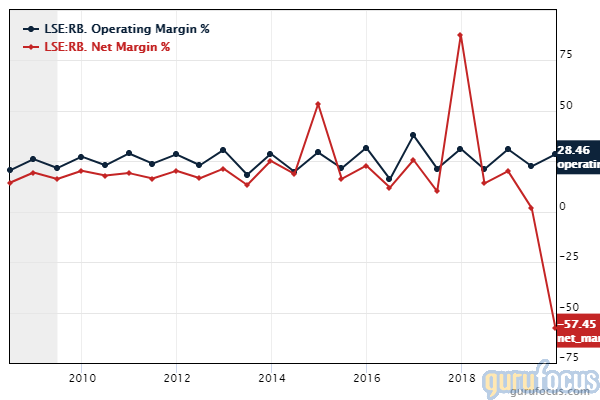

On July 2, shares of Reckitt Benckiser traded around 74.06 pounds for a market cap of 52.66 billion pounds. The company has seen sharp declines in its net income in recent years, despite improving revenue.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rating of 8 out of 10, a valuation rating of 2 out of 10 and a business predictability rating of 2 out of 5 stars.

The cash-debt ratio of 0.13 is lower than 74.48% of competitors, while the Altman Z-Score of 2.39 indicates that the company is in the grey area, with bankruptcy being unlikely but not improbable. The operating margin of 25.58% seems high, but the net margin of -28.67% indicates that the company may not be so profitable after taking debt and taxes into consideration.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Video: Mastering the GuruFocus Site, Episode 1

Nike Shares Drop on 4th-Quarter Earnings Report

Behind the Scenes of 2020's Biggest Energy Deal

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.