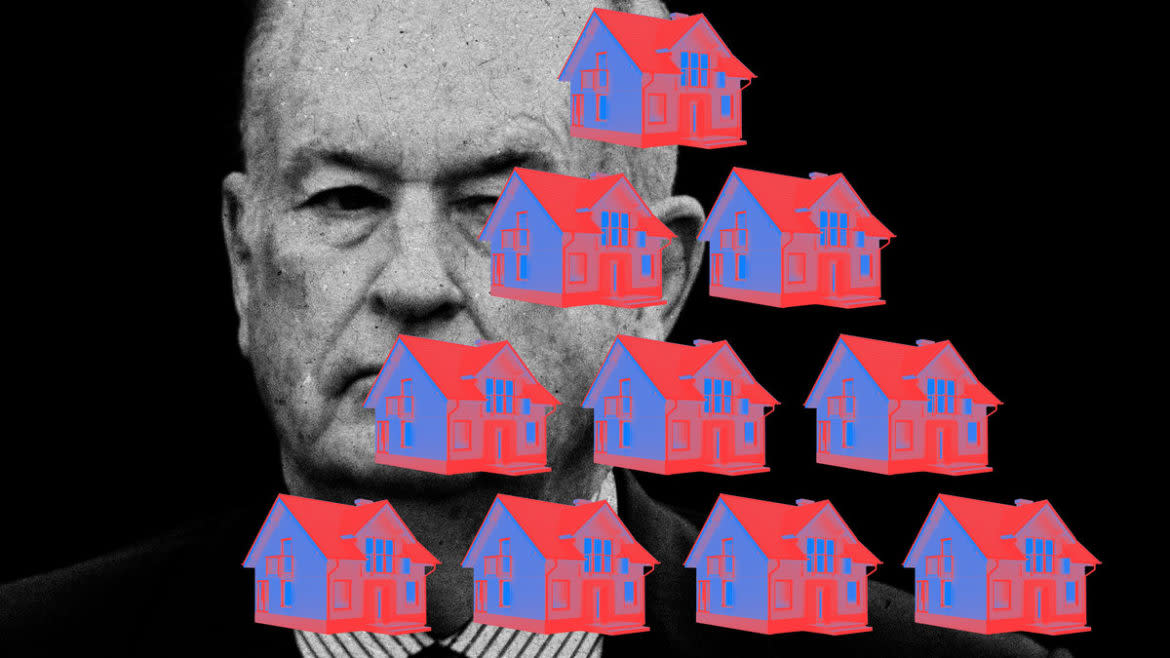

Investment Hyped by Bill O’Reilly Was Ponzi Scheme, Feds Say

- Oops!Something went wrong.Please try again later.

For years, National Realty Investment Advisors promised their clients an easy way to get rich. And they had bold-faced names like Bill O’Reilly and Lawrence Taylor making their case.

After investing a few thousand dollars, the New Jersey-based group focused on high-end real estate in gentrifying neighborhoods claimed, clients might see returns of at least 12 percent. The message was repeated in thousands of emails, on huge billboards at the Lincoln and Holland tunnel, and even radio ads featuring the former Fox News host and ex-NFL star.

But on Thursday, prosecutors alleged that the investment company’s president and an associate were in fact participating in a brazen $650 million Ponzi scheme that defrauded thousands of investors.

The U.S. Attorney’s Office in New Jersey announced an 18-count indictment, including charges of securities and wire fraud, against Thomas Nicholas Salzano and Rey E. Grabato II for their role in the almost four-year-long alleged scheme. The pair also allegedly tried to evade $26 million in taxes.

Salzano was also charged with aggravated identity theft, tax evasion, and subscribing to false tax returns. Prosecutors said he was arrested on Wednesday, while Grabato was on the lam. Lawyers for Salzano did not immediately respond to a request for comment.

Neither O’Reilly nor Taylor—nor any other celebrity endorser—was charged with any offenses, and prosecutors did not indicate one way or the other whether they were aware of the firm’s alleged web of deceit. Neither immediately responded to requests for comment.

The Securities and Exchange Commission on Thursday also charged NRIA and four of its former executives—including Salzano and Grabato—with bilking 2,000 investors by falsely promising to use their money to buy and develop real estate properties. The group solicited investigators with promises of returns “of up to 20 percent.”

“Among the investors were 382 retirees who contributed more than $94.8 million from retirement accounts,” the SEC complaint states.

The SEC says that in reality, the group used the money “to pay distributions to other investors, to fund an executive’s family’s personal and luxury purchases, and to pay reputation management firms to thwart investors’ due diligence of the executives.” The federal indictment says the money was also used to pay for high-end cars, at least one week-long trip to the Jersey shore that included a banquet and hotel rooms for a dozen friends and family, and to pay Salzano’s wife at least $3,000 a week for a no-show job.

“These defendants schemed to create a high-pressure, fraudulent marketing campaign to hoodwink investors into believing that their bogus real estate venture generated substantial profits,” U.S. Attorney Philip Sellinger said in a press release announcing the charges. “In reality, their criminal tactics were straight out of the Ponzi scheme playbook so that they could cheat their investors and line their own pockets.”

The indictment against Salzano and Grabato marks the latest episode in the spectacular collapse of a seemingly successful real estate investment firm—albeit one that had attracted skepticism from news outlets in multiple states. Arthur Scutaro, the firm’s former head of sales, who was also charged by the SEC, pleaded guilty on Thursday to one count of conspiracy to commit securities fraud in the alleged Ponzi scheme. An attorney for Scutaro could not be immediately reached. Last year, Salzano was arrested by the FBI after an hours-long police standoff, and the firm filed for bankruptcy in June before being shut down by the state of New Jersey.

Prosecutors say that the scheme began in February 2018, when NRIA formed the investment fund “that purportedly acquired equity interests in limited liability companies that invested in real estate assets.” The SEC complaint notes that the fund owned properties in New York, New Jersey, Florida, and Pennsylvania.

“As part of their investments, the Fund provided investors with monthly distributions, typically between six percent and ten percent of their original principal investment on an annual basis, through a direct transfer to their bank accounts,” the indictment states. “Each investor in the Fund also received a written guarantee from NRIA of an annual return of at least twelve percent per year for a period of five years plus a full return of their investment, or else any shortfall would be paid by NRIA.”

To market the fund, Scutaro and Salzano allegedly used an “aggressive multi-year nationwide marketing campaign that involved thousands of emails to investors; advertisements on billboards, television, and radio; and meetings and presentations to investors.” While the marketing deemed the fund solvent, the indictment states that in reality NRIA “generated little to no profits and operated as a Ponzi scheme, which was kept afloat by new Fund investors.”

Prosecutors went on to say that Salzano, who operated as NRIA’s “shadow chief executive officer,” was the “guiding force” of the company and “concealed his managerial role… to avoid scrutiny from investors and the IRS.” One main reason he wanted to avoid detection, the indictment claims, was his ugly history—which included Federal Trade Commission charges in 2006.

Those charges alleged he defrauded non-profits, churches, and small businesses when he was the chief managing officer of a New Jersey telecommunications company. Seven years later, Salzano pleaded guilty to theft by fraud in Louisiana for defrauding small businesses in that state by “falsely promising consumers that they would receive cost savings on telecommunications services.” (The FTC case was settled in 2006 and the Louisiana charges were later expunged.)

To conceal Salzano’s past, prosecutors allege that he used Grabato, who was the president of NRIA, as the public face of the company, having him sign all bank accounts used with NRIA and documents issued to investors. As the scheme grew, prosecutors allege, the pair began to orchestrate a separate conspiracy to defraud the IRS to conceal the millions that Salzano owed to the IRS. This allegedly involved the pair lying to the government, using several bank accounts for fake entities, and even falsifying company documents.

Eventually, prosecutors say, some duped investors began to demand documentation about the supposedly bulletproof investment scheme. In response to one of those demands, Salzano allegedly sent a client a forged letter about an investment property in North Bergen, New Jersey. The letter ultimately ended up in the hands of the FBI—leading to Salzano’s arrest in 2021.

But if a top dog getting popped might have amounted to a hint his colleagues should play nice, prosecutors say, Grabato did not get the memo.

“Following Salzano’s arrest, Grabato continued to divert at least approximately $1.4 million from Fund investors to Salzano and other family members and friends of Salzano through a web of shell companies and nominee accounts,” the indictment says.

Get the Daily Beast's biggest scoops and scandals delivered right to your inbox. Sign up now.

Stay informed and gain unlimited access to the Daily Beast's unmatched reporting. Subscribe now.