Investor Guide to Poland’s Election: Populists Stay or a U-Turn?

(Bloomberg) -- Poland’s general election on Sunday will determine the fate of its eight-year populist drift away from the European mainstream, which if ended may boost the country’s financial assets.

Most Read from Bloomberg

Israel Latest: Israeli Army Strikes Hezbollah Posts in Lebanon

Top House Republican Wants Help From Democrats to Pick a Speaker

Wider War in Middle East Could Tip the World Economy Into Recession

NYC Boosts Security Ahead of ‘All Out for Palestine’ Protest

Canada’s Supreme Court Voids Most of Trudeau Environment Law

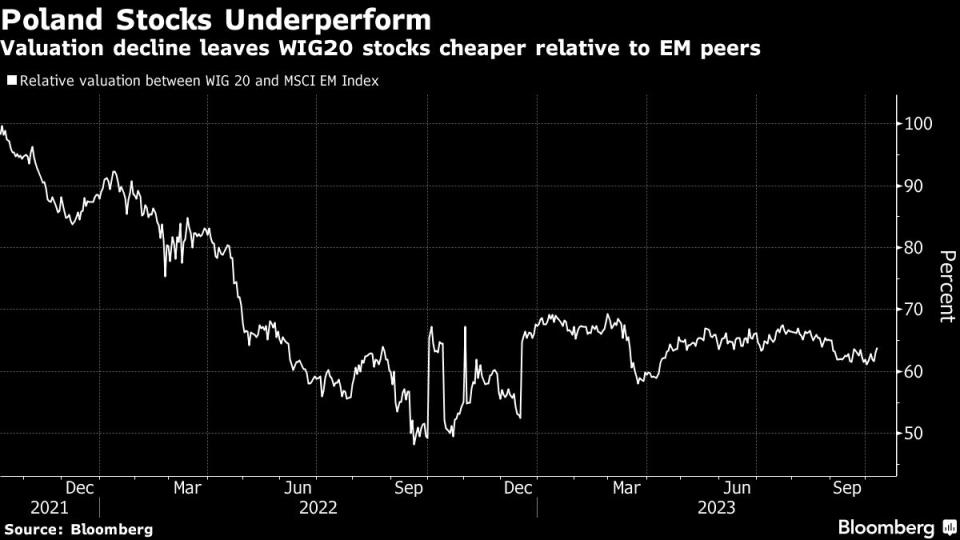

While most opinion polls suggest the ruling Law & Justice party is in the driver’s seat to retain power, some surveys show the opposition might have the edge. That’s a rosy scenario for markets as Polish stocks have had very poor returns, compared to their emerging markets counterparts, during the current government’s two terms in power.

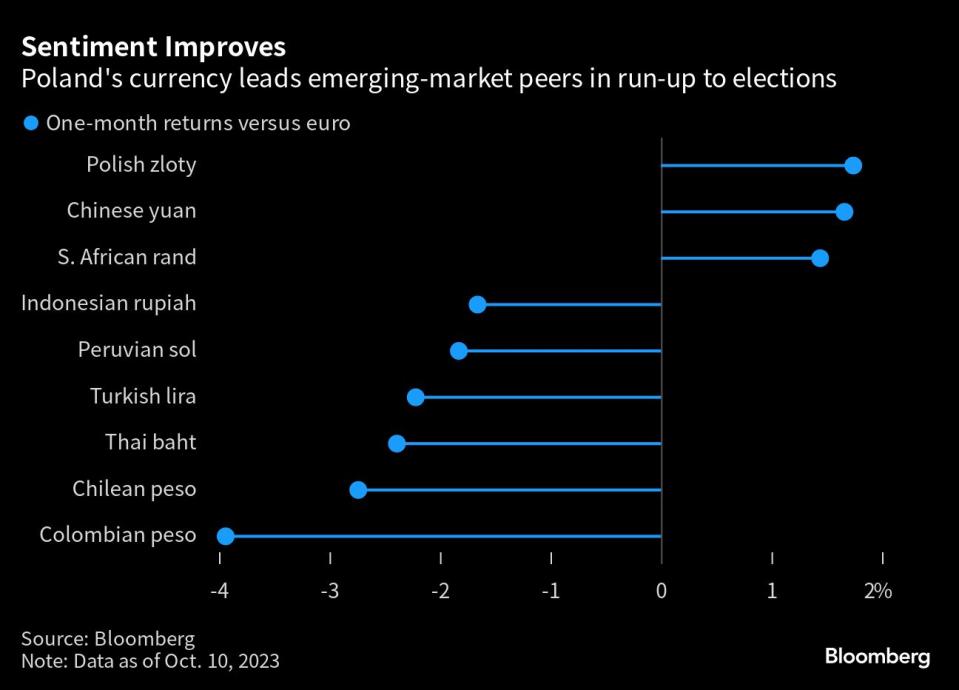

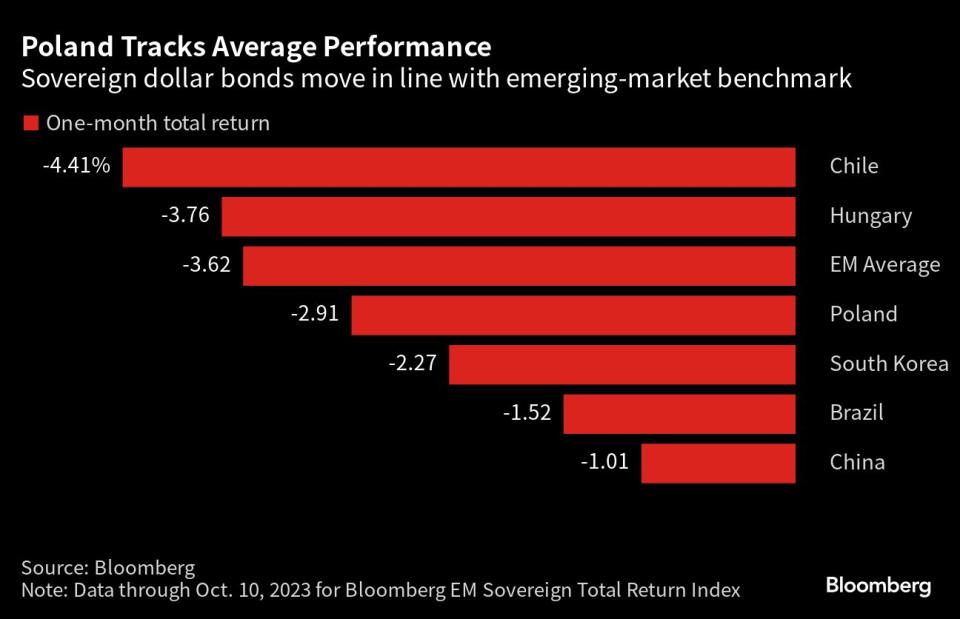

Indeed, news about the rising chances of an upset victory by a three-party opposition bloc has fueled gains in Warsaw stocks and the zloty this week. Poland’s dollar bonds have tracked their developing peers.

The election is crucial for the European Union’s political trajectory. Under Law & Justice rule, the country has seen some EU funding blocked for rule of law infringements, but also emerged as the biggest hub for aid and weapons en route to Ukraine.

“We remain sidelined going into Sunday’s election,” Sergey Dergachev, a portfolio manager and emerging-market corporate debt chief at Union Investment Privatfonds GmbH. “A stronger Law & Justice could be more negative for sentiment, with questions around a more difficult relationship with Brussels, and the risk of more vetoing on EU themes.”

He’s marketweight on Polish government debt and slightly overweight on the country’s corporate bonds, expecting the ballot to “predominantly” impact the currency and rate markets.

Opinion polls indicate three main scenarios: a third term for Law & Justice, albeit probably in a minority administration; the pro-EU opposition bloc ekes out a majority in the lower house of parliament; and a hung legislature, with neither side strong enough to rule for long.

Third Term Scenario

VERDICT: Extension of current policies, including fiscal loosening, and problems with tapping European funds — especially if Law & Justice has to work with an anti-EU, far-right group to stay in power. The central bank would probably stay dovish, helping short-term bonds but possibly hurting the zloty. Stock performance would remain subdued.

Both of Law & Justice and the opposition bloc seek to ramp up spending. The ruling party has pledged big-ticket investments, while continuing to tighten control over companies and the economy.

This has contributed to a downward repricing of Warsaw-listed stocks, which were also hit by Russia’s invasion of neighboring Ukraine. The benchmark WIG20 equities index trades at a 36% discount to the MSCI Emerging Markets Index, compared with near parity two years ago, based on their price to estimated earnings ratios.

Steven Quattry, a money manager at Morgan Stanley Investment Management in New York, said markets appear to be pricing in a victory by the ruling party, noting that state-influenced companies trade at a large “Law & Justice discount” relative to peers. In the past eight years, Warsaw’s WIG20 index has given a negative 2% return, counted in dollars, compared with a 38% gain in developing-market stocks and a 99% jump in the MSCI ACWI Index encompassing emerging and developed markets.

Financial stocks — including PKO Bank Polski SA, Bank Pekao SA and Santander Bank Polska SA — may be in focus for equity investors as Law & Justice plans to extend mortgage moratoriums for borrowers, if it stays in power. The WIG-Bank index has surged 37% this year, compared with a 10% increase in the benchmark WIG20 gauge, in part because of government efforts to stimulate demand for new mortgages.

It’s unclear whether state-controlled Orlen SA, the country’s leading oil refiner, will maintain its price policy which has given the country the EU’s cheapest fuel in the run-up to the election. The move raised questions about margins and led to shortages at gas stations.

“We don’t believe all the bad news is in the price,” said Paul Greer, a money manager at Fidelity International in London. “We expect more weakness in Polish sentiment if the ruling party wins.”

Søren Mørch, head of emerging-market debt at Danske Bank Asset Management, said he expects the ruling party to “back down” in its conflict with the EU after elections in order to get EU funding, even as reaching a deal with Brussels is expected to be difficult.

“We would be skeptical on the likelihood of Poland doing enough to unlock EU recovery funds,” Roger Mark, a fixed income analyst at Ninety One UK Limited, said. He expects the zloty to “resume its downward drift” if the government wins a third term amid reduced rate differentials and a weakened economic growth outlook.

Opposition Majority

VERDICT: Reset in EU relations may help Poland access the bloc’s funds and help improve sentiment. Nevertheless, continued fiscal expansion is expected and the coalition will likely struggle to cooperate with President Andrzej Duda, a former Law & Justice lawmaker. The central bank — which some analysts accused of front-loading rate cuts to help the current government before the ballot — may turn less dovish.

“We would anticipate an initial relief rally if the opposition wins,” said Anders Faergemann, a senior money manager at Pinebridge Investments in London. However, “market positivity may quickly wane.”

Ninety One’s Mark said that in this scenario, he expects the “central bank to actually turn more hawkish – so despite better sentiment to Polish assets in general it may remain a challenging outlook for the country’s local bonds.”

Paul McNamara, a London-based fund manager at GAM UK Ltd, said a majority by pro-EU groups was unlikely, although such a result would trigger a “sharp rally in the zloty and Polish assets.” It may also lead to a reduction in the inflation levels tolerated by the government.

“The alternative scenario of an opposition win looks somewhat under-priced,” according to Eldar Vakhitov, an emerging markets sovereign analyst at M&G Investments in London. “The financing outlook would improve due to a likely significant increase in EU funds,” even as fiscal consolidation is set to remain “gradual.”

For stock investors, an opposition win could upend plans to transform power utilities — such as PGE SA and Tauron Polska Energia SA — into companies free of coal assets, which has helped boost their valuations in past months. Meanwhile, Poland’s costly plans to embrace nuclear power are likely to be revised by the new cabinet.

Hung Parliament

VERDICT: An increase in political risk as another ballot looms, with little chance to tap frozen EU funds. There would also be potential for more policy loosening as the election campaign rolls into 2024.

“Markets are likely to underperform mildly, expecting an extension of the pre-election period of expansionary fiscal and monetary policies,” said M&G’s Vakhitov.

Fidelity’s Greer said “a period of prolonged political risk would likely reduce our desire to own Polish assets,” while Union Investment’s Dergachev said another election in 2024 would coincide with “many challenging themes” in ballots due in the US and the EU.

However, some stocks may benefit — at least in the short-term — from additional social spending promises. Local retailers, including LPP SA, Dino Polska SA and Pepco Group NV, have seen their valuations jump as outlays to families and wages boomed under Law & Justice. In this scenario, it’s not clear whether inflation-relief programs, including lower value-added taxes, will be prolonged into next year.

GAM’s McNamara said that compared with a scenario where the far-right Confederation party plays king-maker, a hung parliament “doesn’t strike me as a bad thing at all.”

“An outright opposition win will be considered the best outcome for markets, while the hung parliament may be the next best option,” Sergey Goncharov, a Miami-based money manager at Vontobel Asset Management. “Similar to Israel, in the context of the newly emerged conflict, Poland is a priori a less volatile country due to its high credit quality base, hence any market moves should not be exaggerated.”

--With assistance from Srinivasan Sivabalan.

Most Read from Bloomberg Businessweek

The War in Israel Shows How Social Media’s Idealistic Era Has Ended

Business Schools Aim to Build Entrepreneurs With Expanded Programs

©2023 Bloomberg L.P.