Investors blame owner’s ‘lavish lifestyle’ for problems at Belleville shopping center

- Oops!Something went wrong.Please try again later.

Belleville opened its Home Depot store in 2007 with soaring optimism.

The late Mayor Mark Eckert wore one of the chain’s bright-orange aprons and used a power saw to cut a piece of plywood instead of a ribbon. He spoke of the city’s future along the Illinois 15 corridor.

“This represents the real retail beginning of this whole Belleville Crossing shopping center,” Eckert told the crowd. “We’ve known for years that Route 15 is our new front door.”

Sixteen years later, the 50-acre development of retail stores, restaurants and other businesses has hit a rough patch.

Tenants and city officials have been complaining about tall weeds, malfunctioning signs, overflowing trash receptacles and potholes in the parking lot for years. Several large storefronts are empty.

The main strip mall within the shopping center is in court-ordered receivership due to defaults on bank loans. Earlier this year, four investors sued the principal owners and other executives for allegedly failing to maintain the property, renew leases, fill vacancies or pay dividends, property taxes, insurance and utility bills.

Owner Jonathan Larmore and his family “have been diverting Company assets to fund their unbelievably lavish lifestyle,” according to a civil lawsuit filed in May and voluntarily dismissed without prejudice in October in federal court. It could be filed again.

The lawsuit pointed to the family’s 12 residences, two airplanes, boats, vehicles and other “luxury toys” and accused them of throwing “six-figure” parties, including one for their dog’s birthday.

Larmore couldn’t be reached for comment. Attorneys for Larmore, the investors and the bank didn’t return phone calls, nor did representatives of Trigild, the receiver, which is now operating the strip mall.

Cliff Cross, the city’s director of economic development, planning and zoning, acknowledges that Belleville Crossing has had maintenance issues and store closings, but he discourages residents from reading too much into a “phase of bad management.”

“I think if people get the perception that this shopping center is going to fail, that’s not accurate,” he said.

The Home Depot and Target are established anchors with solid customer bases, and representatives of other chains report strong business at that location, according to Cross.

Long drive-thru lines are common at the Freddy’s Frozen Custard & Steakburgers restaurant, which opened in March. An automatic Take 5 car wash is nearing completion, and Discount Tire plans to build a garage next year.

“I see no reason to believe (the shopping center) will not do very well as we move forward,” Cross said, adding that its high visibility along Illinois 15 gives it a big advantage.

Major city investment

Belleville Crossing is on the northeast corner of the intersection of Illinois 15 and Frank Scott Parkway West.

In 2006, Belleville City Council annexed 127 acres, created tax-increment-financing and business districts and expanded an enterprise zone. That allowed it to offer an incentive package of $18 million in property and sales tax rebates to the developer, The DESCO Group, based in Clayton, Missouri.

“This is one of the largest of the developments that we typically do,” then Vice President for Development Scott Sachtleben said of the $90 million project. “Often we’re constricted by the amount of real estate that is available, but that wasn’t the case here.”

Half of property taxes in the TIF district and an additional 1% sales tax in the business district are still going toward the city’s $18 million pledge, according to Finance Director Jamie Maitret.

City officials also promised a 17th Street extension, which was completed in 2012 to connect Main Street with Frank Scott Parkway West and provide better access to the shopping center.

The Home Depot and Target became part of the main “inline” strip mall of retail stores. In addition, two smaller strip malls and several free-standing restaurants (White Castle, Popeyes, St. Louis Bread Co. and Arby’s) were built on “outlots” across the parking lot. Dreams of a hotel at the site never materialized.

In 2011, DESCO sold the three strip malls and a parcel of vacant land zoned for multifamily residential for about $16.7 million, St. Clair County records show. The buyers were two limited-liability companies formed under the umbrella of Larmore’s Arciterra Companies, based in Phoenix, Arizona, which owns about 80 retail properties in 26 states.

The sale didn’t include The Home Depot or Target properties, which are owned by those corporations, or outlots sold to other buyers, according to Mike Anthon, DESCO’s vice president of retail development.

“We still own about 50 acres, give or take,” he said, noting most of that is vacant land between The Home Depot and the David Taylor Chrysler-Dodge-Jeep-Ram dealership.

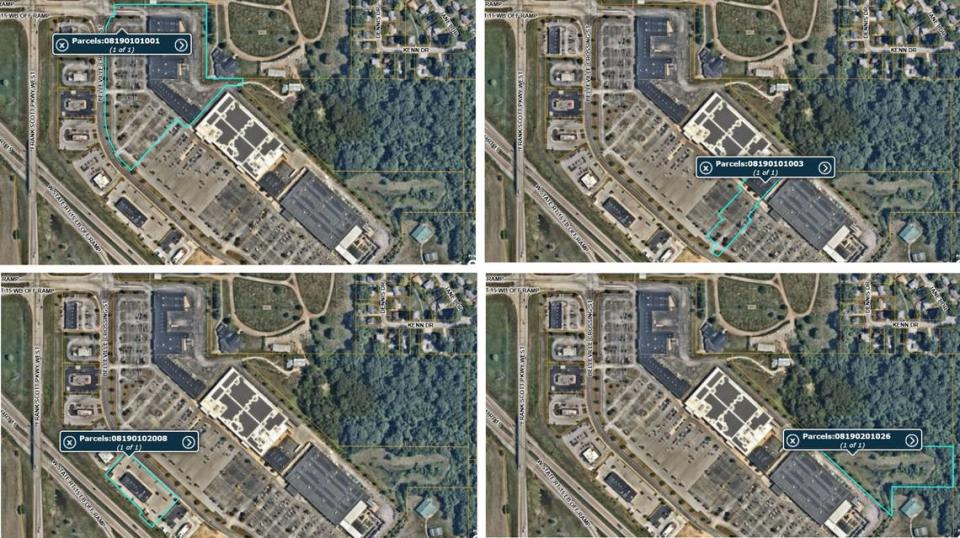

The main strip mall, which has been in receivership since May, is owned by AT Belleville Crossing IL Inline, county records show. It’s an Arciterra company with a Phoenix address.

Tenants in the 86,392-square-foot strip mall are Dollar Tree, PetSmart, Famous Footwear, Jan’s Hallmark, Hibbett Sports, Great Clips, T-Mobile (Sprint) and Maurices. There are five vacant spaces, including those formerly occupied by OfficeMax, Dressbarn and Sleep Solutions.

Another Arciterra company known as AT Belleville Crossing IL Outlots, which bought the two small strip malls in 2011, sold one in 2014 to three limited-liability companies with a California address. It’s full of tenants, including AT&T, Qdoba, Nail Spa and General Nutrition Center.

AT Belleville Crossing IL Outlots sold the other small strip mall in 2019 to Belleville IL Outlot 6, another Arciterra company. It’s empty except for All About Eyes and a Bank of America ATM. Three vacant spaces were formerly occupied by Buffalo Wild Wings, Sally Beauty and T-Mobile.

Maintenance problems

Scott Tyler, the city’s director of health, housing and building, recalls that tenants and others were already complaining about lack of maintenance at Belleville Crossing when he took the position in spring 2021.

Problems included tall grass and weeds in islands and other common areas, blowing trash and overflowing receptacles, a leaky roof for an extended period at Dollar Tree, potholes in the parking lot and two giant pylon signs that weren’t lighting up at night.

“That sign (on Frank Scott Parkway West) was off for over a year with them telling us that the electricians had been out there,” Tyler said. “Come to find out, Ameren had turned the power off because the bill wasn’t paid. There were so many stories that turned out not to be true.”

At one point, the city hired a landscaper to get the strip mall’s property back in shape and sent Arciterra a bill for $3,500.

Tyler emphasized that officials have never had issues with upkeep of properties owned by The Home Depot or Target, only those owned by Arciterra. Trigild was hired as property manager in December before being appointed receiver in May, court records show.

“Trigild has been much easier to work with,” Tyler said.

On a recent weekday, the strip mall’s grass was mowed, but the parking lot still had potholes, and several islands were filled with weeds and small amounts of trash. “For lease” signs on the former OfficeMax space provided contact information for a property manager who’s no longer involved.

Trigild is a national fiduciary services, commercial real estate and hospitality firm with a Chicago office. Multiple attempts by the BND to reach Managing Partner Chris Neilson and Chief Operating Officer David Wallace, who have been involved in the receivership, were unsuccessful.

Although The DESCO Group doesn’t own the strip malls anymore, Anthon has been keeping a close eye on the shopping center’s condition because he’s still trying to sell vacant land for development.

“Everyone wants it to look the best it can,” he said.

Most websites, promotional materials and tax records list Arciterra’s home base as Phoenix, but some include an address in Punta Gorda, Florida. The company website is down, and callers to its telephone number get a constant busy signal.

Larmore’s LinkedIn page identifies him as manager and principal of Arciterra Companies, chief executive officer of Arciterra REIT and Arciterra National REIT and manager, president and principal of CSL and JMMAL.

“Since 2005, I have acquired vast experience in various aspects of the real estate industry including the acquisition, leasing, financing, repositioning, and disposition of assets valued at over $500 million,” his bio states.

“I have personally invested in more than $450 million of real estate since 1998. My depth of knowledge and practical experience in the industry has given Arciterra clients an added advantage.

“Prior to founding Arciterra, I served as Executive Vice President and Managing Director of Real Estate for Cole Capital Partners, LLC and Cole Real Estate Services, Inc. I earned my Bachelor of Science Degree from the Kelley School of Business, Indiana University, with a major in Business Management.”

Default on bank loans

On May 22, First Guaranty Bank in Hammond, Louisiana, filed a complaint in U.S. District Court for the Western District of Louisiana in Shreveport, alleging that Larmore and 11 companies under the Arciterra umbrella had defaulted on more than $35 million in loans.

Promissory notes show that this included AT Belleville Crossing IL Inline, which borrowed $8.6 million in 2021; and five other companies with shopping centers in Bloomington, South Elgin and Naperville, Illinois; Louisville, Kentucky, and Rochester, Minnesota.

Matthew Hudnall, a bank vice president and northwest regional manager, filed a declaration asking the court to appoint a receiver for all six properties.

“In addition to widespread non-payment across all Loans, certain Borrowers also failed to pay property taxes due for the shopping centers in 2021 and 2022, which forced Lender either to redeem properties sold at tax sale or to pay the current taxes to protect the properties from a tax sale,” the declaration stated.

The former happened with AT Belleville Crossing IL Inline properties. Its delinquent tax bills were sold to private buyers and later redeemed, according to Whitney Strohmeyer, president of Joseph E. Meyer & Associates, St. Clair County’s delinquent-tax agent.

Hudnall referred questions to the bank’s general counsel, Amanda Barnett, who didn’t respond to a request for comment.

Bradley Drell and Heather Matthews, the bank’s lawyers in the default case, didn’t return phone calls, nor did Larmore’s attorneys, W. Michael Adams, Stacey Williams or McLaurine Zentner.

One exhibit with Hudnall’s declaration was an email that Larmore apparently sent to everyone on his contact list in April titled “The Perfect Storm Sale/Loss of Father/Hurricane/Divorce/New Beginning/Business Retreat Invitation - Lake Wawasee/Syracuse Indiana.”

The email included a long list of assets Larmore was offering to sell, including commercial properties, homes and their furnishings, a Nautique Paragon and other boats, an Aston Martin and other vehicles, jewelry and artwork, ski equipment and a golf cart.

“I have realized over the past several months that the best path for me moving forward is to shed the baggage of my past and start fresh,” the email read. “I would like to provide an opportunity for each of you to reach out regarding any assets you believe you should be given custody of and how you will use it for a good wholesome reason.”

In the same email, Larmore invited people to a “fun” business retreat at Lake Wawasee the following weekend.

The email prompted concern by First Guaranty Bank that Larmore was no longer a “stable principal” of the entities that owned properties used to secure their loans, according to Hudnall’s declaration.

Lawsuit by investors

The same week that First Guaranty went to court in Louisiana, four Arciterra investors filed a shareholder derivative complaint in U.S. District Court for the Southern District of Illinois in East St. Louis.

B. Brad and Monica Mason TIC, a Texas-based real-estate-investment entity; Diana K. Hamilton, of Indiana, and John F. Cardarelli, of Massachusetts, asked for at least $2 million in damages from Jonathan Larmore, his wife, Michelle Larmore, his mother, Marsha Larmore, Arciterra Companies, Arciterra Strategic Income Corp.-Belleville Crossing IL and four company executives.

The complaint alleged that the defendants had breached their duties to properly maintain Belleville Crossing for five years while transferring cash to pay for “exorbitant family expenses” and that they had stopped paying dividends to 177 investors in 2019.

The complaint described assets worth millions of dollars and behavior that involved large expenditures for recreation and travel.

“They purchased a $250,000 wake surf boat and then hired a private helicopter and pilot to fly behind it so kids could jump with surf boards from the helicopter onto the boat’s wake,” the complaint states.

“They regularly charter luxury yachts in exotic locations. They have purchased numerous boats, cars and luxury toys. They frequently throw lavish parties costing six figures. In the summer of 2022, they threw such a six-figure party, flying in friends and family on their private aircraft. One such party was to celebrate the birthday of their Boston Terrier, Spike.”

The investors argued that, while all this was going on, Belleville Crossing was falling into disrepair with tenants complaining of:

Vendors not getting paid.

3-foot-tall weeds in planting beds.

Overflowing and accumulating trash.

Water damage from leaky roofs.

Lack of snow or ice removal.

Water turned off in September 2022.

Insurance lapse in November 2022.

Delinquent property tax bills.

Long delays in renewing leases.

The complaint alleged that Jonathan and Michelle Larmore bought an 87-foot Cheoy Lee motor yacht for $2.5 million just weeks after the shopping center’s delinquent property-tax bills were sold.

The complaint alleged that the defendants neglected to reasonably pursue new tenants that had expressed an interest in leasing space, including Five Below, Popshelf, Charter Communications (Spectrum), O’Reilly Auto Parts, Mercy Health and Old Navy.

The complaint didn’t stop with Belleville Crossing. It accused the Larmores and their employees of raising $187 million through investment offerings by multiple companies since 2013 and defrauding more than 2,000 investors who stopped receiving dividends in 2019 or earlier.

“It is part of the Defendants’ overall scheme to ‘wait out’ investors until they succumb to death or attrition, simply giving up on any hopes of recovering their investments and allowing the Defendants to simply keep as their own the nearly $200,000,000 raised from their unsuspecting investors,” the complaint stated.

In August, a Southern District of Illinois judge ordered mandatory mediation. In October, the investors voluntarily dismissed the lawsuit without prejudice, meaning it could be refiled at a later date or in a different jurisdiction. They didn’t give a reason.

Their attorney, Mark Maddox, didn’t return phone calls, nor did defense attorneys Michael Kelly or John McIntyre.