Investors Who Bought Boyuan Holdings (ASX:BHL) Shares A Year Ago Are Now Down 65%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. Unfortunately, shareholders of Boyuan Holdings Limited (ASX:BHL) have suffered share price declines over the last year. The share price is down a hefty 65% in that time. Boyuan Holdings may have better days ahead, of course; we've only looked at a one year period. On top of that, the share price has dropped a further 15% in a month.

Check out our latest analysis for Boyuan Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Boyuan Holdings managed to increase earnings per share from a loss to a profit, over the last 12 months. Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

Boyuan Holdings's revenue is actually up 675% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

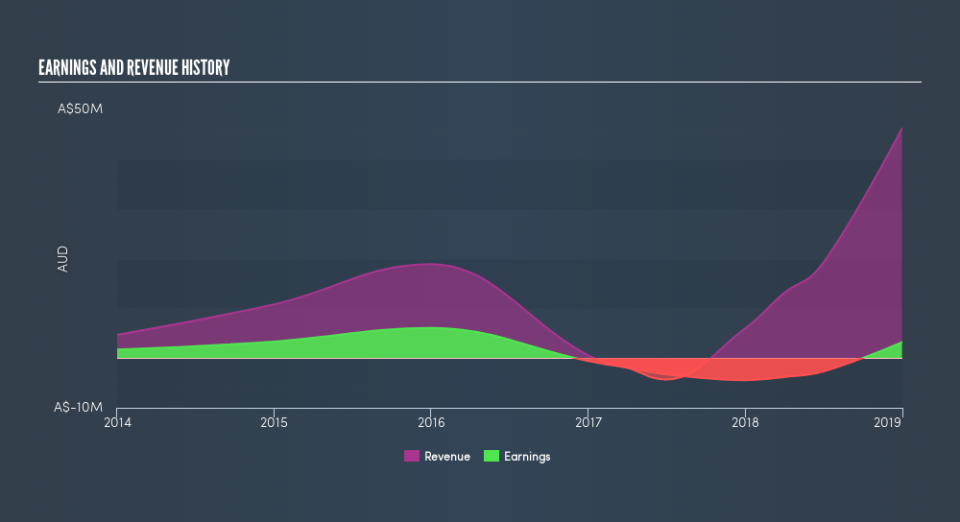

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Boyuan Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While Boyuan Holdings shareholders are down 65% for the year, the market itself is up 12%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 11%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Is Boyuan Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Boyuan Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.