Investors Who Bought Bulletin Resources (ASX:BNR) Shares Three Years Ago Are Now Down 63%

Investors are understandably disappointed when a stock they own declines in value. But when the market is down, you’re bound to have some losers. The Bulletin Resources Limited (ASX:BNR) is down 63% over three years, but the total shareholder return is 101% once you include the dividend. And that total return actually beats the market return of 36%. And over the last year the share price fell 58%, so we doubt many shareholders are delighted. Furthermore, it’s down 26% in about a quarter. That’s not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Bulletin Resources

We don’t think Bulletin Resources’s revenue of AU$15,134 is enough to establish significant demand. This state of affairs suggests that venture capitalists won’t provide funds on attractive terms. So it seems that the investors more focused on would could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Bulletin Resources will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. The is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Bulletin Resources investors have already had a taste of the bitterness stocks like this can leave in the mouth.

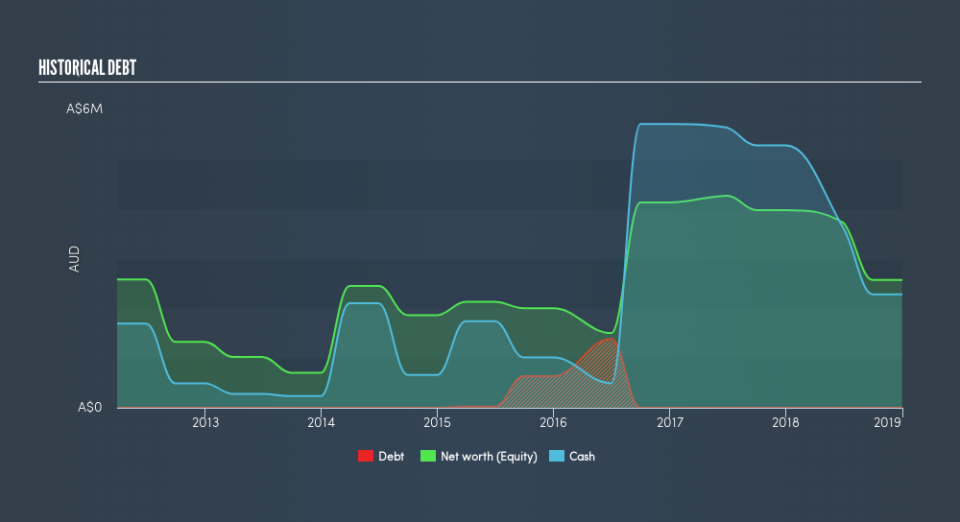

When it reported in December 2018 Bulletin Resources had minimal net cash consider its expenditure: just AU$2.2m to be specific. So if it hasn’t remedied the situation already, it will almost certainly have to raise more capital soon. With that in mind, you can understand why the share price dropped 28% per year, over 3 years. The image belows shows how Bulletin Resources’s balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it’s hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I’d like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

What about the Total Shareholder Return (TSR)?

Investors should note that there’s a difference between Bulletin Resources’s total shareholder return (TSR) and its share price change, which we’ve covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. We note that Bulletin Resources’s TSR, at 101% is higher than its share price rise of -63%. When you consider it hasn’t been paying a dividend, this data suggests shareholders may have had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Bulletin Resources shareholders are down 58% for the year, but the market itself is up 8.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 53% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Bulletin Resources better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.