Investors Who Bought Café de Coral Holdings (HKG:341) Shares A Year Ago Are Now Up 27%

While Café de Coral Holdings Limited (HKG:341) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 27%.

See our latest analysis for Café de Coral Holdings

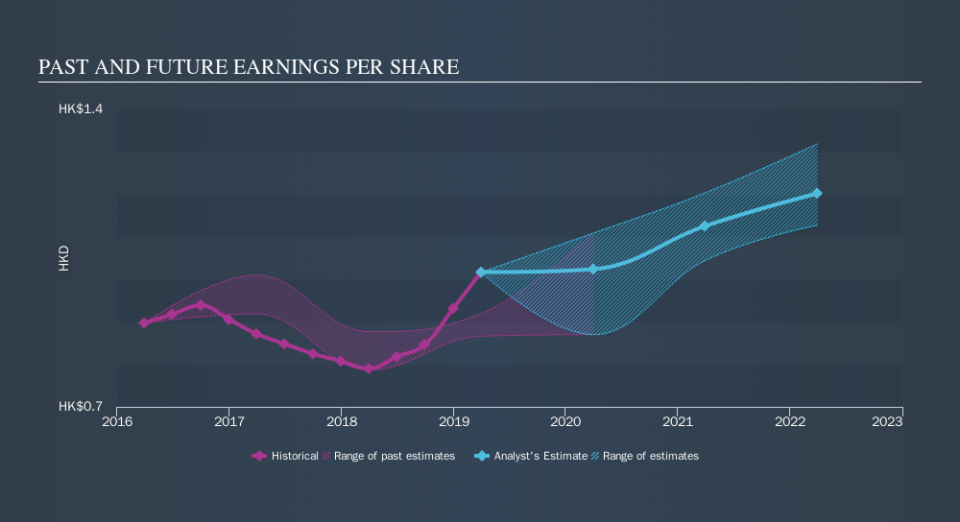

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Café de Coral Holdings grew its earnings per share (EPS) by 29%. We note that the earnings per share growth isn't far from the share price growth (of 27%). This makes us think the market hasn't really changed its sentiment around the company, in the last year. It makes intuitive sense that the share price and EPS would grow at similar rates.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Café de Coral Holdings has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Café de Coral Holdings, it has a TSR of 31% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Café de Coral Holdings shareholders have received a total shareholder return of 31% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 0.3% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Keeping this in mind, a solid next step might be to take a look at Café de Coral Holdings's dividend track record. This free interactive graph is a great place to start.

We will like Café de Coral Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.