Investors Who Bought Cambium Networks (NASDAQ:CMBM) Shares A Year Ago Are Now Up 903%

The Cambium Networks Corporation (NASDAQ:CMBM) share price has had a bad week, falling 11%. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 903% rise, throughout the period. So the recent fall isn't enough to negate the good performance. Only time will tell if there is still too much optimism currently reflected in the share price.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for Cambium Networks

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Cambium Networks went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 4.3% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

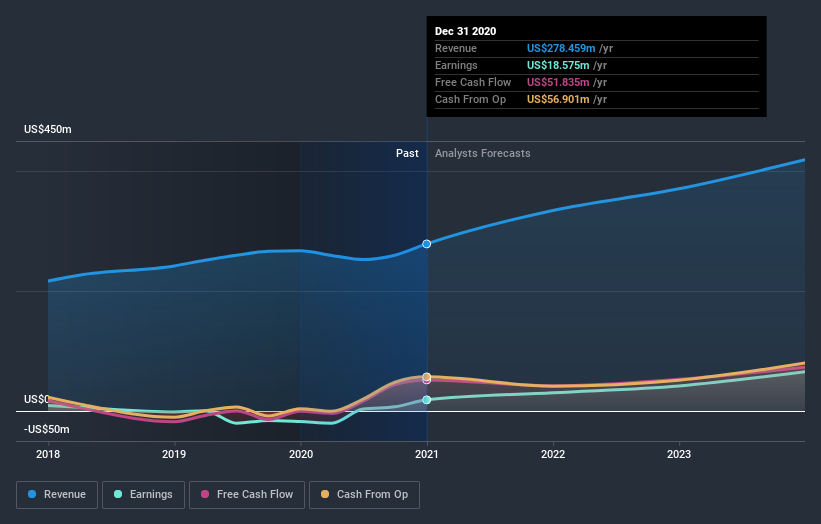

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Cambium Networks

A Different Perspective

It's nice to see that Cambium Networks shareholders have gained 903% over the last year. That's better than the more recent three month gain of 77%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It's always interesting to track share price performance over the longer term. But to understand Cambium Networks better, we need to consider many other factors. For instance, we've identified 3 warning signs for Cambium Networks that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.