Investors Who Bought Chong Kin Group Holdings (HKG:1609) Shares Three Years Ago Are Now Up 627%

It hasn't been the best quarter for Chong Kin Group Holdings Limited (HKG:1609) shareholders, since the share price has fallen 26% in that time. But over the last three years the stock has shone bright like a diamond. Indeed, the share price is up a whopping 627% in that time. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The thing to consider is whether there is still too much elation around the company's prospects.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Chong Kin Group Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

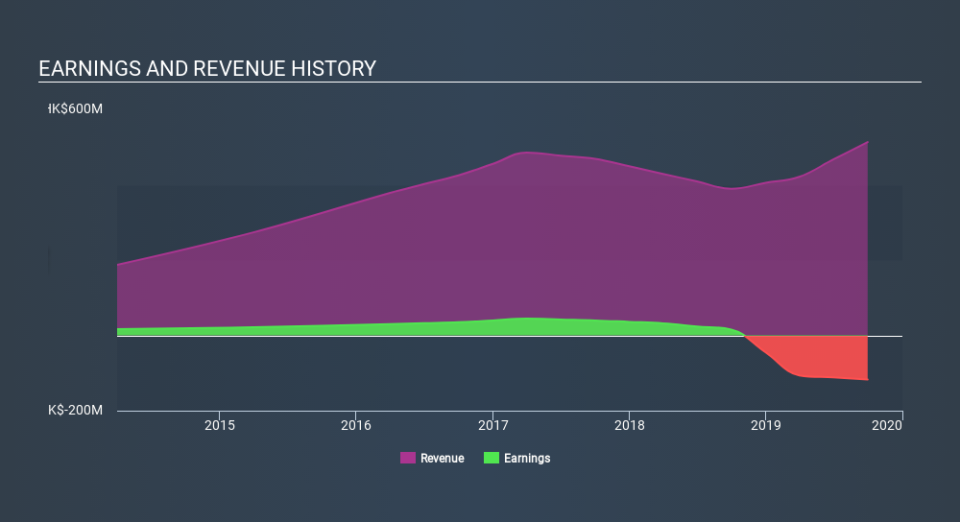

During the three years of share price growth, Chong Kin Group Holdings actually saw its earnings per share (EPS) drop 106% per year.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, we think it's worth considering other metrics as well.

The revenue drop of 0.4% is as underwhelming as some politicians. What's clear is that historic earnings and revenue aren't matching up with the share price action, very well. So you might have to dig deeper to get a grasp of the situation

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Chong Kin Group Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Chong Kin Group Holdings shares, which performed worse than the market, costing holders 21%. The market shed around 0.4%, no doubt weighing on the stock price. Investors are up over three years, booking 94% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.