Investors Who Bought Collector (STO:COLL) Shares Three Years Ago Are Now Down 51%

Investing in stocks inevitably means buying into some companies that perform poorly. Long term Collector AB (publ) (STO:COLL) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 51% decline in the share price in that time.

See our latest analysis for Collector

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

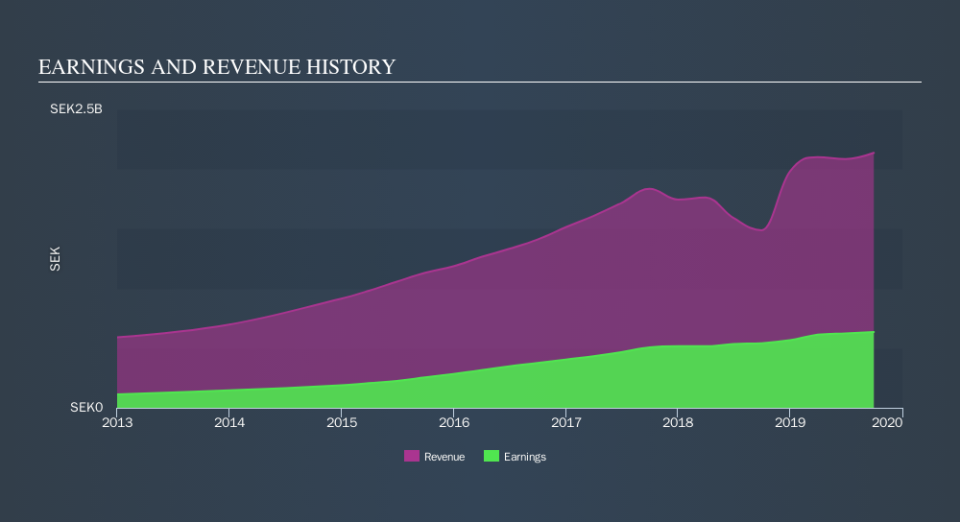

During the unfortunate three years of share price decline, Collector actually saw its earnings per share (EPS) improve by 15% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that, in three years, revenue has actually grown at a 11% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Collector more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Collector has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Collector stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Collector shareholders are down 14% for the year, but the broader market is up 23%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 21% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. Before forming an opinion on Collector you might want to consider these 3 valuation metrics.

Of course Collector may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.