Investors Who Bought Dynemic Products (NSE:DYNPRO) Shares A Year Ago Are Now Down 20%

Dynemic Products Limited (NSE:DYNPRO) shareholders should be happy to see the share price up 14% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 20% in the last year, significantly under-performing the market.

See our latest analysis for Dynemic Products

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Dynemic Products share price fell, it actually saw its earnings per share (EPS) improve by 2.4%. It's quite possible that growth expectations may have been unreasonable in the past. By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

Given the yield is quite low, at 1.3%, we doubt the dividend can shed much light on the share price. Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

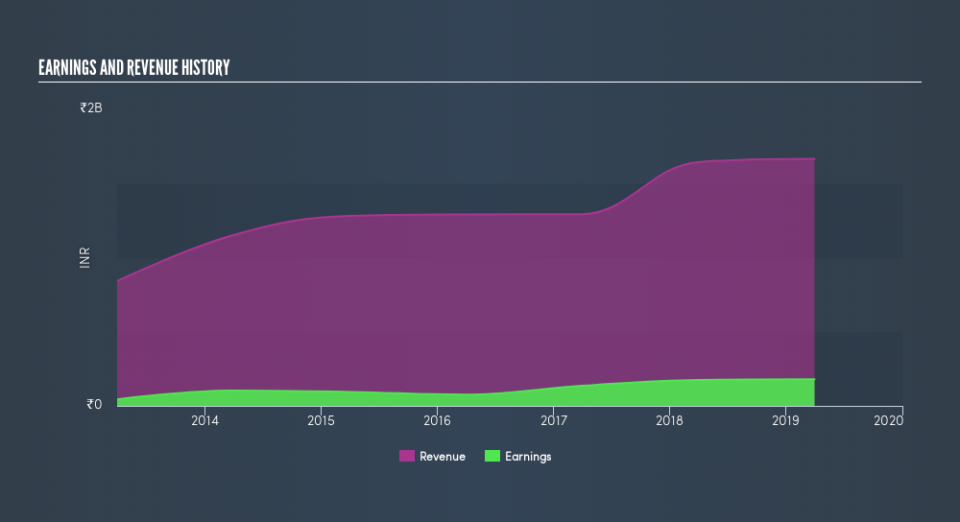

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Dynemic Products will earn in the future (free profit forecasts).

A Different Perspective

Dynemic Products shareholders are down 19% for the year (even including dividends), even worse than the market loss of 13%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 14%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Dynemic Products is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.