Investors Who Bought Global Palm Resources Holdings (SGX:BLW) Shares Five Years Ago Are Now Down 65%

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Global Palm Resources Holdings Limited (SGX:BLW) share price dropped 65% in the last half decade. That is extremely sub-optimal, to say the least. And some of the more recent buyers are probably worried, too, with the stock falling 35% in the last year. The falls have accelerated recently, with the share price down 16% in the last three months. But this could be related to the weak market, which is down 24% in the same period.

See our latest analysis for Global Palm Resources Holdings

Global Palm Resources Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Global Palm Resources Holdings reduced its trailing twelve month revenue by 4.7% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 19% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

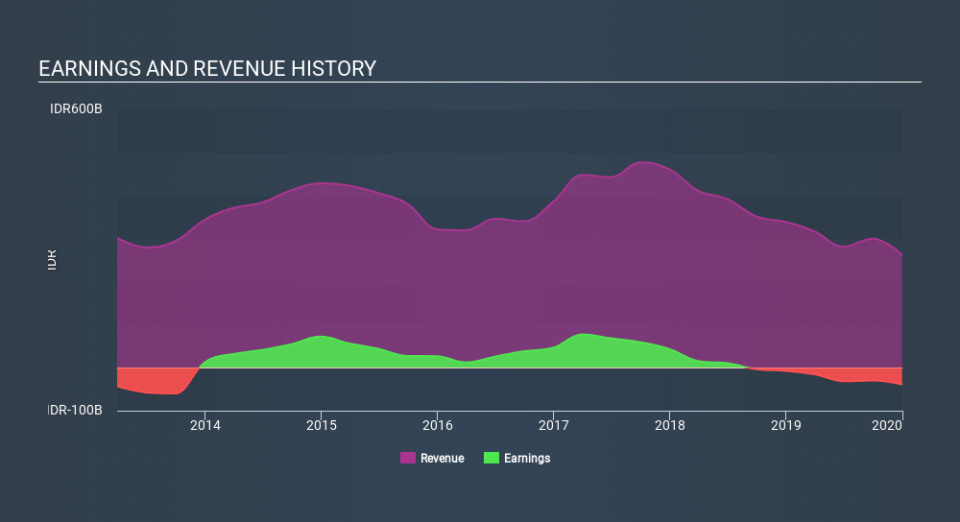

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Global Palm Resources Holdings's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Global Palm Resources Holdings's TSR, which was a 59% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 21% in the twelve months, Global Palm Resources Holdings shareholders did even worse, losing 35%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 16% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Global Palm Resources Holdings better, we need to consider many other factors. For instance, we've identified 3 warning signs for Global Palm Resources Holdings (2 are a bit unpleasant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.