Investors Who Bought Glory Sun Financial Group (HKG:1282) Shares Three Years Ago Are Now Down 64%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Glory Sun Financial Group Limited (HKG:1282) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 64% in that time. And more recent buyers are having a tough time too, with a drop of 24% in the last year. Furthermore, it's down 17% in about a quarter. That's not much fun for holders.

See our latest analysis for Glory Sun Financial Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Glory Sun Financial Group actually saw its earnings per share (EPS) improve by 29% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

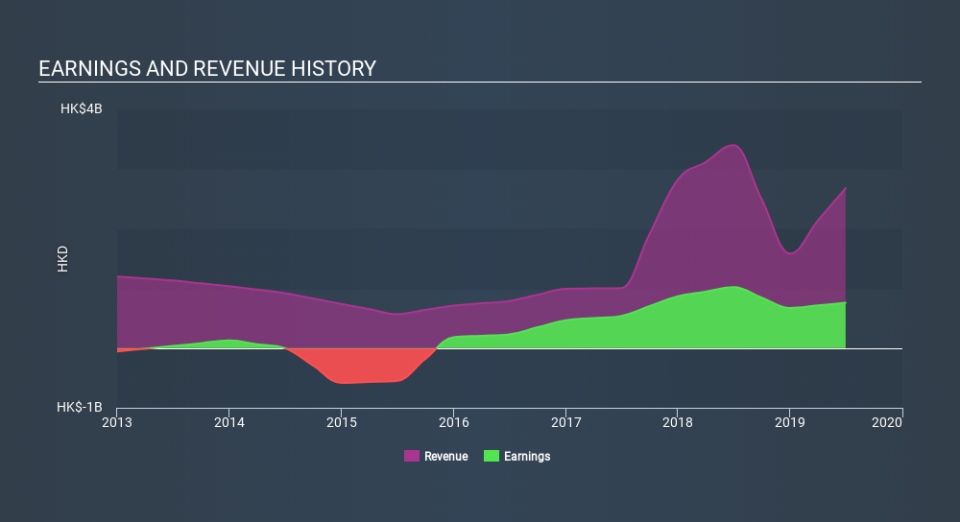

The modest 0.7% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 35% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Glory Sun Financial Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Glory Sun Financial Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Glory Sun Financial Group's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Glory Sun Financial Group's TSR, which was a 63% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Investors in Glory Sun Financial Group had a tough year, with a total loss of 23% (including dividends) , against a market gain of about 0.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5.9% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Glory Sun Financial Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.