Investors Who Bought Hess Midstream (NYSE:HESM) Shares A Year Ago Are Now Up 14%

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Hess Midstream LP (NYSE:HESM) share price is up 14% in the last year, that falls short of the market return. However, the longer term returns haven't been so impressive, with the stock up just 8.7% in the last three years.

Check out our latest analysis for Hess Midstream

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Hess Midstream actually saw its earnings per share drop 64%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We note that the most recent dividend payment is higher than the payment a year ago, so that may have assisted the share price. It could be that the company is reaching maturity and dividend investors are buying for the yield, pushing the price up in the process. Furthermore, the revenue growth of 29% probably also encouraged buyers.

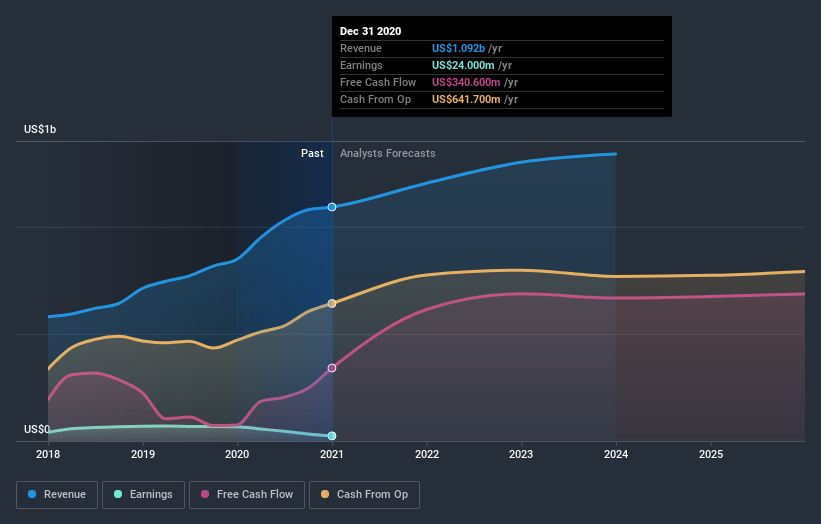

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Hess Midstream's TSR for the last year was 26%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Hess Midstream produced a TSR of 26% over the last year. Unfortunately this falls short of the market return of around 45%. On the other hand, the TSR over three years was worse, at just 11% per year. This suggests the company's position is improving. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Hess Midstream (including 2 which are significant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.