Investors Who Bought IVF Hartmann Holding (VTX:VBSN) Shares Three Years Ago Are Now Down 25%

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term IVF Hartmann Holding AG (VTX:VBSN) shareholders, since the share price is down 25% in the last three years, falling well short of the market return of around 16%. The falls have accelerated recently, with the share price down 15% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 6.7% in the same timeframe.

See our latest analysis for IVF Hartmann Holding

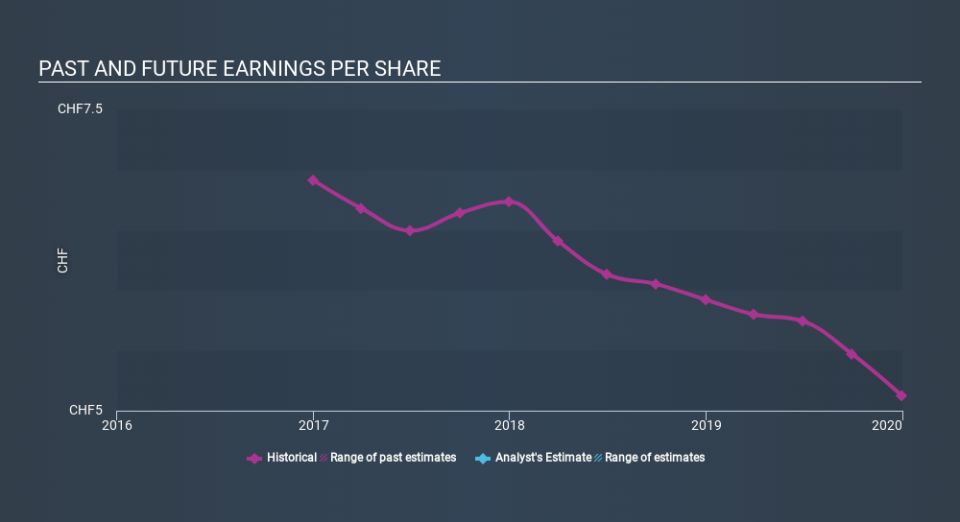

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

IVF Hartmann Holding saw its EPS decline at a compound rate of 9.5% per year, over the last three years. So do you think it's a coincidence that the share price has dropped 9.3% per year, a very similar rate to the EPS? We don't. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on IVF Hartmann Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for IVF Hartmann Holding the TSR over the last 3 years was -22%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

IVF Hartmann Holding provided a TSR of 2.3% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 2.4% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand IVF Hartmann Holding better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with IVF Hartmann Holding , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.