Investors Who Bought Jinchuan Group International Resources (HKG:2362) Shares Five Years Ago Are Now Up 39%

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Jinchuan Group International Resources share price has climbed 39% in five years, easily topping the market return of 5.5% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 4.9% in the last year , including dividends .

View our latest analysis for Jinchuan Group International Resources

While Jinchuan Group International Resources made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Jinchuan Group International Resources saw its revenue grow at 21% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 6.8%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at Jinchuan Group International Resources. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

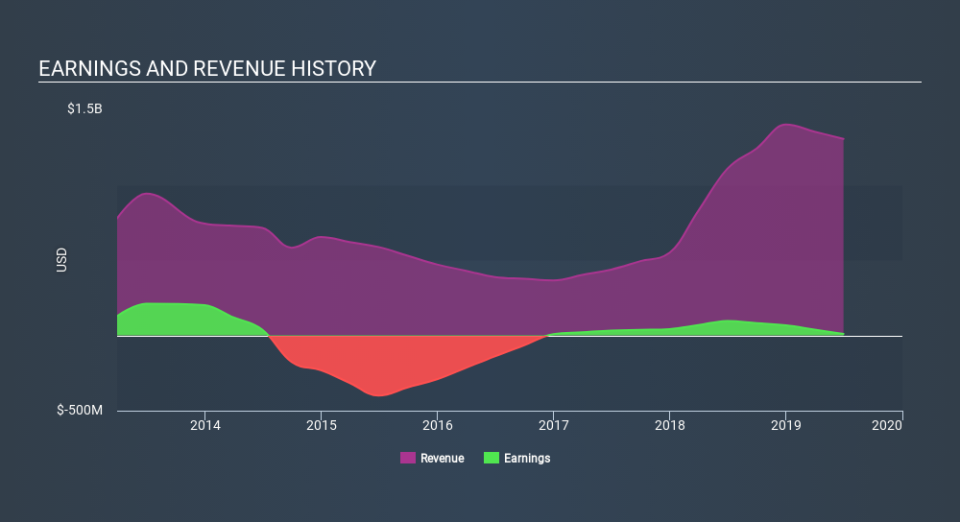

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Jinchuan Group International Resources's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Jinchuan Group International Resources shareholders are up 4.9% for the year (even including dividends) . Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 6.8% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Jinchuan Group International Resources (including 2 which is are concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.