Investors Who Bought Lajin Entertainment Network Group (HKG:8172) Shares Five Years Ago Are Now Down 92%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Lajin Entertainment Network Group Limited (HKG:8172) for five whole years - as the share price tanked 92%. We also note that the stock has performed poorly over the last year, with the share price down 37%. And the share price decline continued over the last week, dropping some 5.7%.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Lajin Entertainment Network Group

Lajin Entertainment Network Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

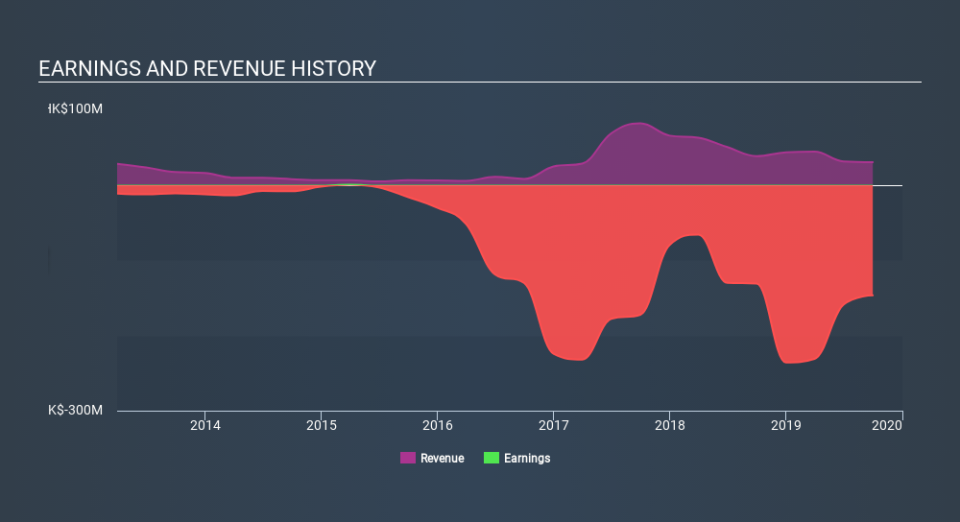

Over five years, Lajin Entertainment Network Group grew its revenue at 35% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 39% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Lajin Entertainment Network Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Lajin Entertainment Network Group shareholders are down 37% for the year. Unfortunately, that's worse than the broader market decline of 0.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 39% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Lajin Entertainment Network Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Lajin Entertainment Network Group (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.