Investors Who Bought Mason Graphite (CVE:LLG) Shares A Year Ago Are Now Down 78%

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame Mason Graphite Inc. (CVE:LLG) shareholders if they were still in shock after the stock dropped like a lead balloon, down 78% in just one year. That'd be a striking reminder about the importance of diversification. Notably, shareholders had a tough run over the longer term, too, with a drop of 52% in the last three years.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Mason Graphite

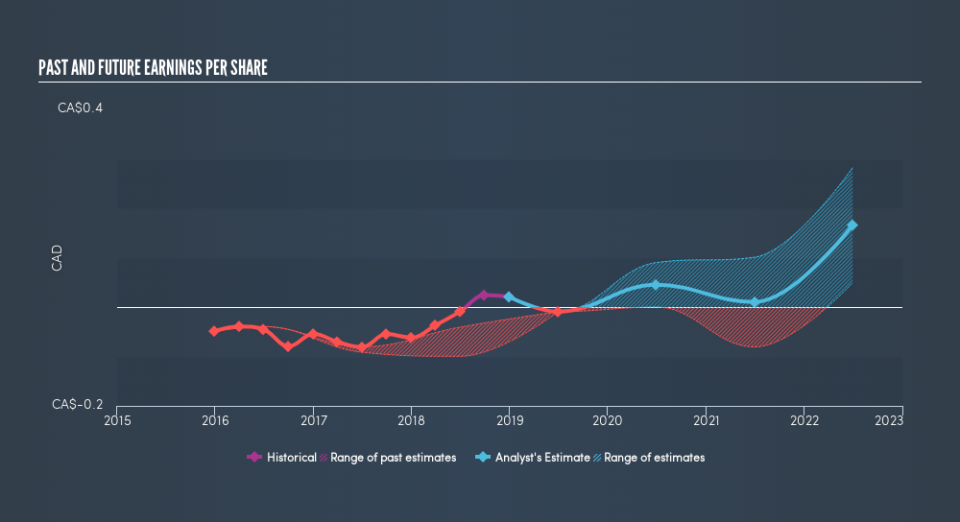

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Mason Graphite grew its earnings per share, moving from a loss to a profit. We're surprised that the share price is lower given that improvement. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Mason Graphite has grown profits over the years, but the future is more important for shareholders. This free interactive report on Mason Graphite's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Mason Graphite shareholders are down 78% for the year, but the market itself is up 1.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.8% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is Mason Graphite cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Mason Graphite may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.