Investors Who Bought Mordovia Energy Retail Company (MCX:MRSB) Shares Five Years Ago Are Now Down -505%

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Don’t believe it? Then look at the Mordovia Energy Retail Company Public Joint-Stock Company (MCX:MRSB) share price. It’s 505% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 18% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 7.3% in 90 days).

It really delights us to see such great share price performance for investors.

View our latest analysis for Mordovia Energy Retail Company

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

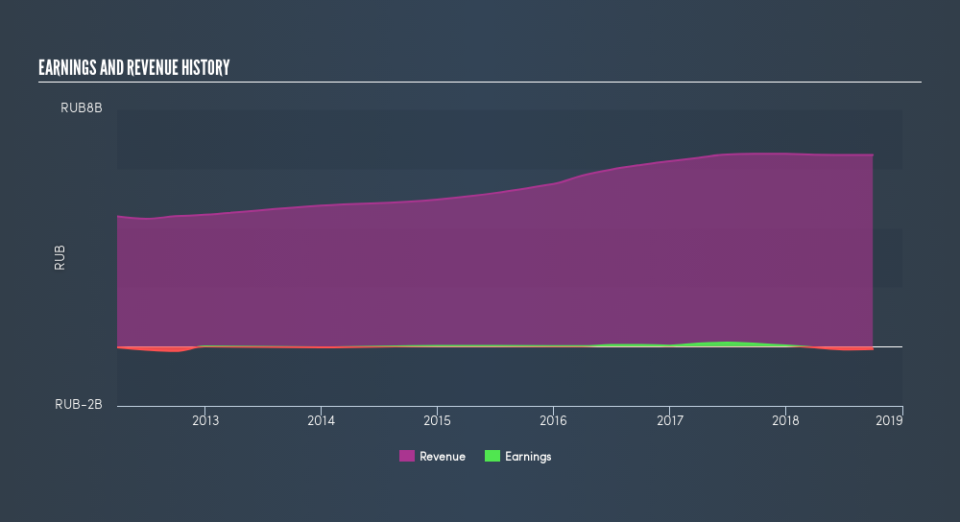

Mordovia Energy Retail Company isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Mordovia Energy Retail Company can boast revenue growth at a rate of 6.9% per year. That’s a pretty good long term growth rate. However, the share price gain of 43% during the period is considerably stronger. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Mordovia Energy Retail Company’s financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Mordovia Energy Retail Company, it has a TSR of 747% for the last 5 years. That exceeds its share price return that we previously mentioned. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 8.0% in the last year, Mordovia Energy Retail Company shareholders lost 16% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn’t be so upset, since they would have made 53%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.