Investors Who Bought New Provenance Everlasting Holdings (HKG:2326) Shares Three Years Ago Are Now Down 94%

It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So consider, for a moment, the misfortune of New Provenance Everlasting Holdings Limited (HKG:2326) investors who have held the stock for three years as it declined a whopping 94%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 68% lower in that time. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 8.4% in the same timeframe.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for New Provenance Everlasting Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, New Provenance Everlasting Holdings actually saw its earnings per share (EPS) improve by 4.4% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed. After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

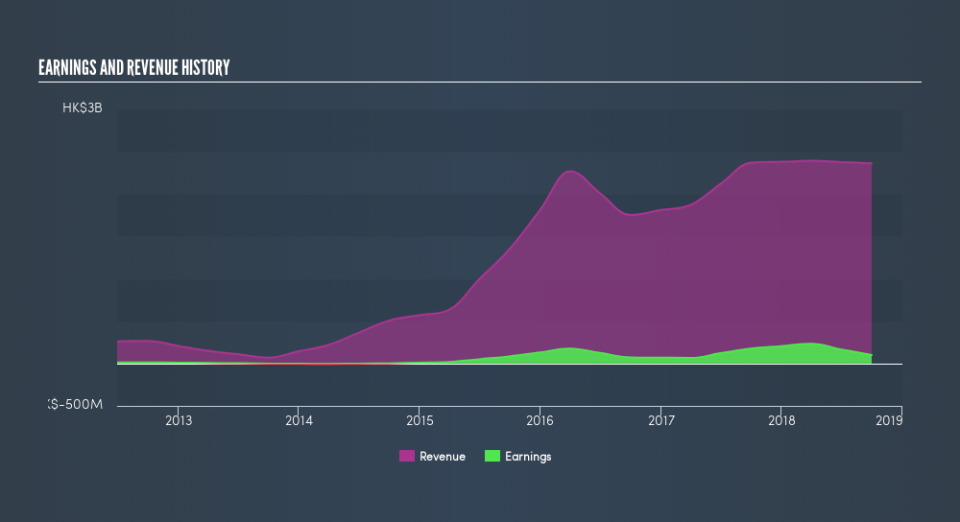

We note that, in three years, revenue has actually grown at a 13% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching New Provenance Everlasting Holdings more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that New Provenance Everlasting Holdings shareholders are down 68% for the year. Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on New Provenance Everlasting Holdings you might want to consider these 3 valuation metrics.

We will like New Provenance Everlasting Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.