Investors Who Bought Reach New Holdings (HKG:8471) Shares A Year Ago Are Now Up 65%

Reach New Holdings Limited (HKG:8471) shareholders might be concerned after seeing the share price drop 13% in the last month. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 65% in that time.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Reach New Holdings

Because Reach New Holdings is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Reach New Holdings actually shrunk its revenue over the last year, with a reduction of 5.3%. The stock is up 65% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

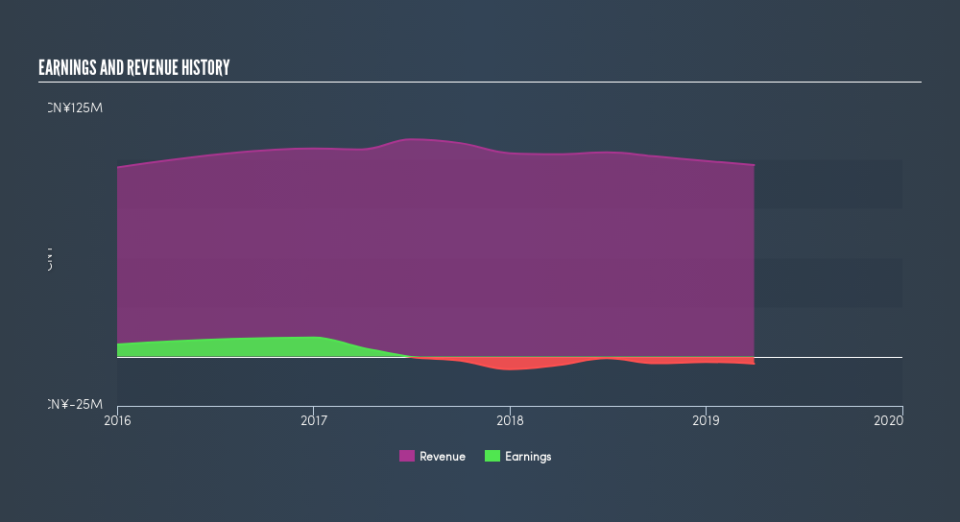

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Reach New Holdings's financial health with this free report on its balance sheet.

A Different Perspective

Reach New Holdings boasts a total shareholder return of 65% for the last year. And the share price momentum remains respectable, with a gain of 27% in the last three months. This suggests the company is continuing to win over new investors. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.