Investors Who Bought On Real International Holdings (HKG:8245) Shares Three Years Ago Are Now Down 97%

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of On Real International Holdings Limited (HKG:8245); the share price is down a whopping 97% in the last three years. That would be a disturbing experience. The falls have accelerated recently, with the share price down 38% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for On Real International Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, On Real International Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

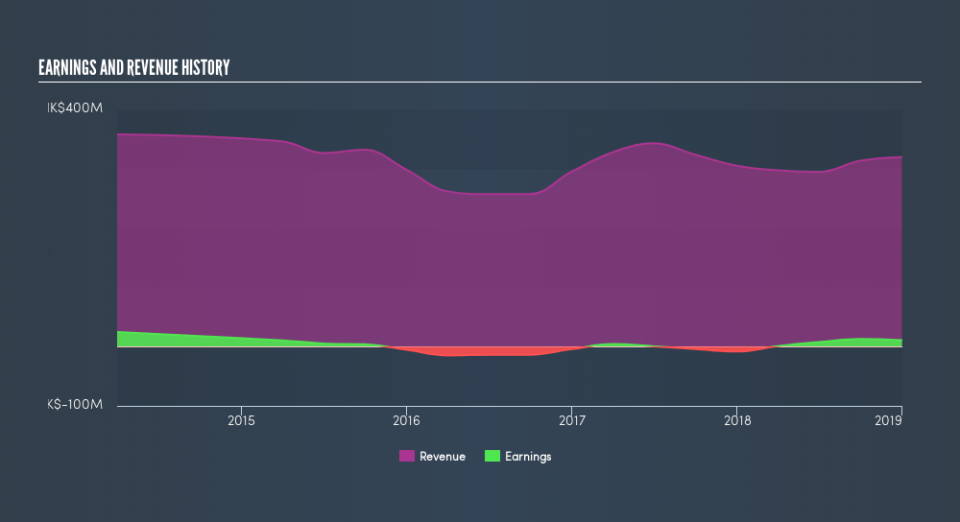

Revenue is actually up 4.9% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worht worth investigating On Real International Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on On Real International Holdings's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for On Real International Holdings shares, which performed worse than the market, costing holders 20%. The market shed around 7.5%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 69% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.