Investors Who Bought Scout Security (ASX:SCT) Shares A Year Ago Are Now Down 60%

It's nice to see the Scout Security Limited (ASX:SCT) share price up 20% in a week. But that's not enough to compensate for the decline over the last twelve months. Like a receding glacier in a warming world, the share price has melted 60% in that period. The share price recovery is not so impressive when you consider the fall. It may be that the fall was an overreaction.

View our latest analysis for Scout Security

Because Scout Security is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Scout Security saw its revenue grow by 54%. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 60%. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

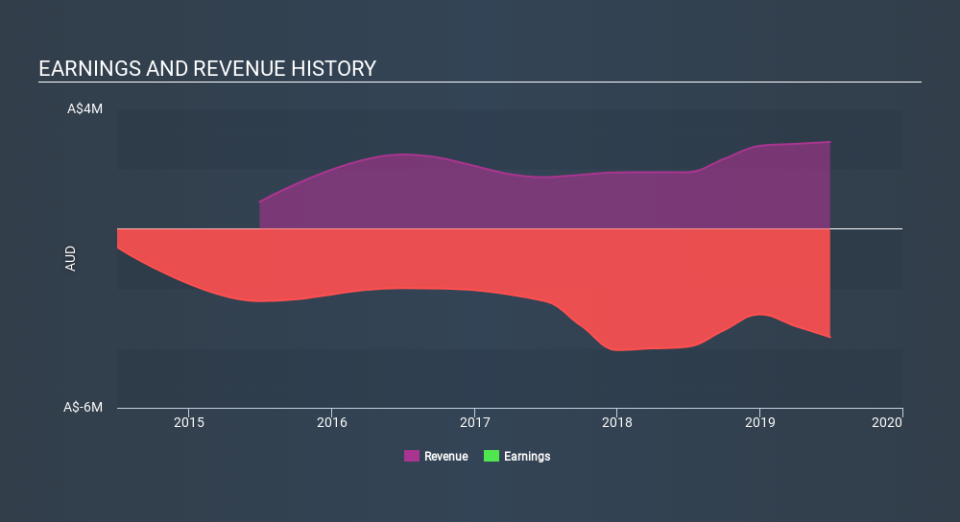

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Given that the market gained 25% in the last year, Scout Security shareholders might be miffed that they lost 60%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 2.9% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before spending more time on Scout Security it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.