Investors Who Bought Shenzhen Neptunus Interlong Bio-technique (HKG:8329) Shares Five Years Ago Are Now Down 61%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example the Shenzhen Neptunus Interlong Bio-technique Company Limited (HKG:8329) share price dropped 61% over five years. That is extremely sub-optimal, to say the least. The falls have accelerated recently, with the share price down 11% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Shenzhen Neptunus Interlong Bio-technique

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, Shenzhen Neptunus Interlong Bio-technique actually saw its earnings per share (EPS) improve by 5.2% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS. Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

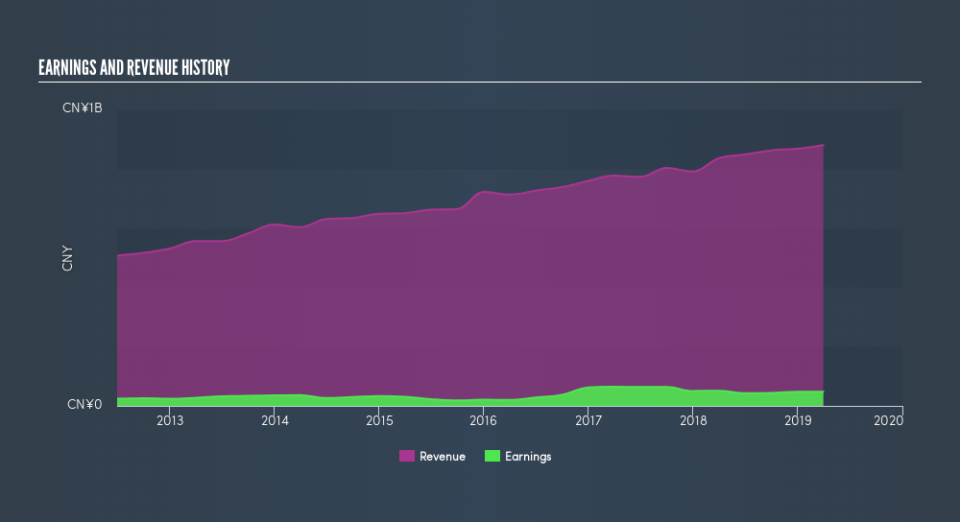

Revenue is actually up 7.5% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While it's certainly disappointing to see that Shenzhen Neptunus Interlong Bio-technique shares lost 8.6% throughout the year, that wasn't as bad as the market loss of 11%. Of far more concern is the 17% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. Before forming an opinion on Shenzhen Neptunus Interlong Bio-technique you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.