Investors Who Bought UltraTech Cement (NSE:ULTRACEMCO) Shares Five Years Ago Are Now Up 105%

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term UltraTech Cement Limited (NSE:ULTRACEMCO) shareholders would be well aware of this, since the stock is up 105% in five years. On top of that, the share price is up 11% in about a quarter. But this could be related to the strong market, which is up 5.9% in the last three months.

Check out our latest analysis for UltraTech Cement

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, UltraTech Cement actually saw its EPS drop 3.5% per year. So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

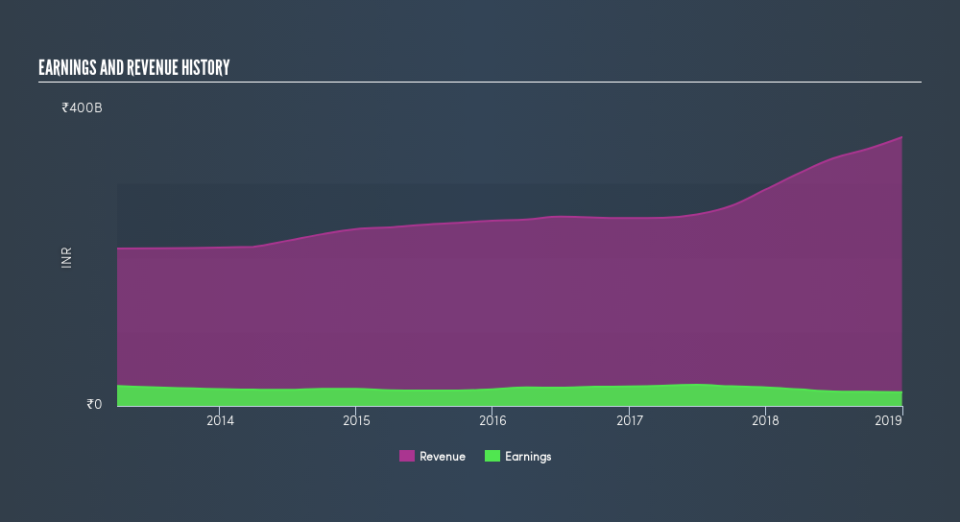

The modest 0.2% dividend yield is unlikely to be propping up the share price. On the other hand, UltraTech Cement's revenue is growing nicely, at a compound rate of 9.4% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

UltraTech Cement is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, UltraTech Cement's TSR for the last 5 years was 108%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that UltraTech Cement shareholders have received a total shareholder return of 4.7% over the last year. Of course, that includes the dividend. However, the TSR over five years, coming in at 16% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. If you would like to research UltraTech Cement in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like UltraTech Cement better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.