Investors Who Bought Vico International Holdings (HKG:1621) Shares A Year Ago Are Now Down 31%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Vico International Holdings Limited (HKG:1621) share price slid 31% over twelve months. That falls noticeably short of the market return of around -3.2%. Because Vico International Holdings hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 9.5% decline in the broader market, throughout the period.

Check out our latest analysis for Vico International Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Vico International Holdings share price fell, it actually saw its earnings per share (EPS) improve by 88%. Of course, the situation might betray previous over-optimism about growth. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

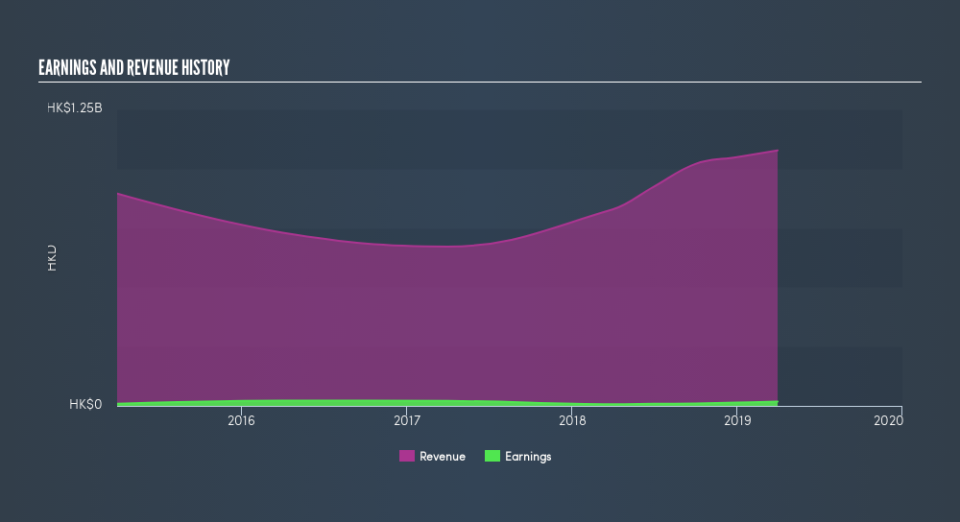

We don't see any weakness in the Vico International Holdings's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Vico International Holdings's earnings, revenue and cash flow.

A Different Perspective

We doubt Vico International Holdings shareholders are happy with the loss of 31% over twelve months (even including dividends). That falls short of the market, which lost 3.2%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 12%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Vico International Holdings you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.