Investors Who Bought Xinhua Winshare Publishing and Media (HKG:811) Shares Three Years Ago Are Now Down 29%

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Xinhua Winshare Publishing and Media Co., Ltd. (HKG:811) shareholders have had that experience, with the share price dropping 29% in three years, versus a market return of about 20%. It's down 1.1% in the last seven days.

Check out our latest analysis for Xinhua Winshare Publishing and Media

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Xinhua Winshare Publishing and Media actually saw its earnings per share (EPS) improve by 17% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. We like that Xinhua Winshare Publishing and Media has actually grown its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

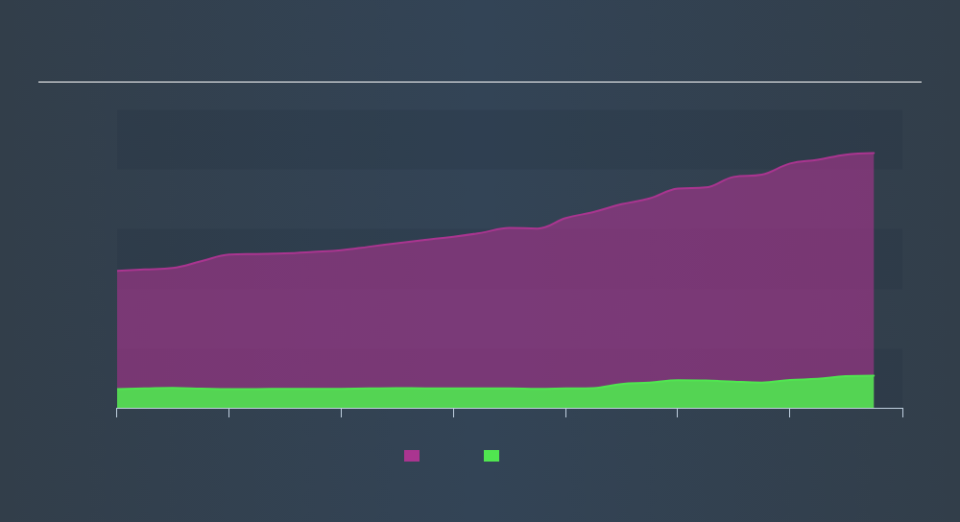

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Xinhua Winshare Publishing and Media has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Xinhua Winshare Publishing and Media in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Xinhua Winshare Publishing and Media's TSR for the last 3 years was -12%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Xinhua Winshare Publishing and Media shareholders have received a total shareholder return of 14% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 2.5%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Keeping this in mind, a solid next step might be to take a look at Xinhua Winshare Publishing and Media's dividend track record. This free interactive graph is a great place to start.

But note: Xinhua Winshare Publishing and Media may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.