Should Investors Buy CrowdStrike after its IPO?

It has been an explosive year for the initial public offering (IPO) market. A wave of companies came to the public market, with many surpassing original expectations. Based on a list created by the Bernstein Research firm, the average return of these IPOs has been 26% since day one on the market. Among the group, Beyond Meat, Inc. (BYND) saw a 163% gain on its first day while Zoom Video Communications, Inc. (ZM) was up 72%.

CrowdStrike Holdings, Inc. (CRWD) stands out as one of the recent IPOs that is set to outperform. On its first day of trading, the stock surged by as much as 97%.

With many analysts saying the company’s growth is only going to continue, we wanted to take a closer look to see if CrowdStrike really can make waves.

Strong IPO

CrowdStrike rose to fame after it uncovered the alleged hacking of the Democratic National Committee’s servers during the U.S. presidential campaign in 2016.

When the company went public on June 12, its original $34 share price offering surged to $63.50. This is up from the expected range of $28 to $30 a share. In total, the IPO raised $612 million and gave CRWD an almost $6.6 billion market valuation. Since then, the stock has settled at 71% causing its market cap to reach over $11 billion.

One of a Kind Cybersecurity Technology

CrowdStrike has been able to soar past its competitors because of its unique approach to online threat detection. The technology uses artificial intelligence (AI) tools such as pattern matching against a larger data set to discover threats in real time. Identified threats are then stored in a central database which is used to build a catalog of all known threats.

The company’s cloud-based platform makes it easy to implement across multiple device types so organizations can eliminate security gaps between on and off-premises devices. Its effective software solution has allowed the company to cement its place as a leader in the endpoint security space.

Impressive Growth

Management attributes their innovative product to the strong growth they’ve witnessed over the last year.

The company sells the platform as a software-as-a-subscription to enterprises of all shapes and sizes. So far, the company’s strategy has been to replace a single aspect of the business’s cybersecurity software and then upsell on other CrowdStrike software.

This strategy is clearly working with pre-existing customer spending up an average of 47% over the last year. Total revenue for the year ending January 31 grew 110% to $250 million, up from $119 million the year before. Over the same time period, gross profit margin increased from 54% to 65%.

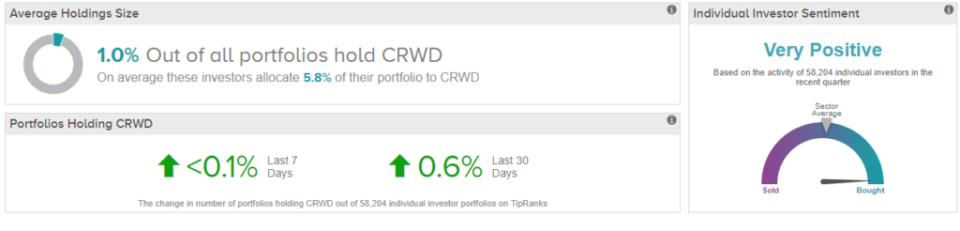

It is important to note that CrowdStrike is still not profitable and reported losses of $140 million for the year ending January 31. Despite this loss, investor sentiment surrounding the company remains positive.

Analysts See Growth Opportunities

On July 8, at least eleven analysts initiated coverage on CRWD all with a Buy rating.

Five-star analyst, Gregg Moskowitz, sees big growth potential for the cybersecurity company. “In our view, CrowdStrike's highly differentiated cloud platform has been critical in helping the company to rise above a tough competitive field, as evidenced by [annual recurring revenue] growth well in excess of 100% from FY17-19,” he said. Along with his Buy rating, he set a price target of $80. Moskowitz has a 73% success rate as well as a 22% average return per rating.

Another top analyst, Shaul Eyal, set a $90 price target with his coverage initiation. He believes the company's “innovative technology, its continued ability to disrupt and gain market share from legacy and next generation antivirus vendors, the industry's shift to consolidate point product solutions and a shortage of cyber-skilled talents should drive customers to seek a holistic solution like CrowdStrike's.” He said, “We estimate its large and expanding TAM to exceed $30B by 2022, and a hypergrowth rate over 30% over the next several years.”

The Bottom Line

The Street is optimistic, with the analyst consensus being that the stock is a ‘Moderate Buy’. CRWD has an average price target of $78, suggesting 12% upside potential.