Investors In Gaztransport & Technigaz SA (EPA:GTT) Should Consider This, First

Is Gaztransport & Technigaz SA (EPA:GTT) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Gaztransport & Technigaz is a new dividend aristocrat in the making. We'd agree the yield does look enticing. Some simple analysis can reduce the risk of holding Gaztransport & Technigaz for its dividend, and we'll focus on the most important aspects below.

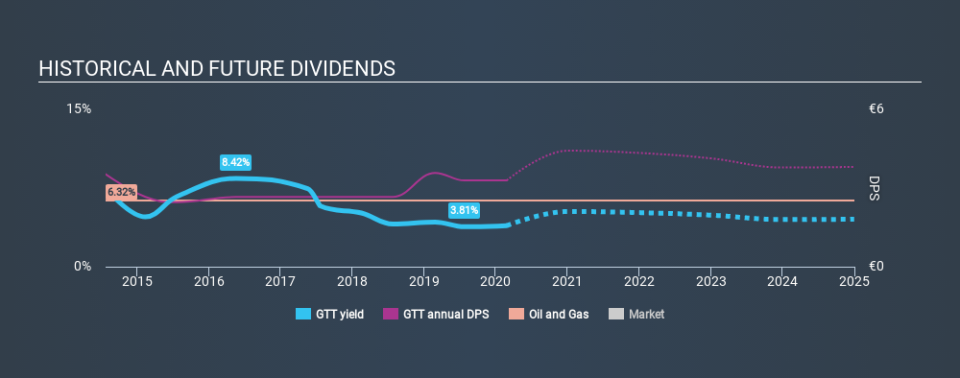

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Gaztransport & Technigaz paid out 99% of its profit as dividends, over the trailing twelve month period. With a payout ratio this high, we'd say its dividend is not well covered by earnings. This may be fine if earnings are growing, but it might not take much of a downturn for the dividend to come under pressure.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Gaztransport & Technigaz paid out 78% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's good to see that while Gaztransport & Technigaz's dividends were not well covered by profits, at least they are affordable from a free cash flow perspective. Even so, if the company were to continue paying out almost all of its profits, we'd be concerned about whether the dividend is sustainable in a downturn.

While the above analysis focuses on dividends relative to a company's earnings, we do note Gaztransport & Technigaz's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Gaztransport & Technigaz's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Gaztransport & Technigaz has been paying a dividend for the past six years. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past six-year period, the first annual payment was €3.53 in 2014, compared to €3.29 last year. The dividend has shrunk at around 1.2% a year during that period. Gaztransport & Technigaz's dividend has been cut sharply at least once, so it hasn't fallen by 1.2% every year, but this is a decent approximation of the long term change.

We struggle to make a case for buying Gaztransport & Technigaz for its dividend, given that payments have shrunk over the past six years.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Gaztransport & Technigaz's EPS are effectively flat over the past five years. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation. Still, the company has struggled to grow its EPS, and currently pays out 99% of its earnings. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. In summary, Gaztransport & Technigaz has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 8 Gaztransport & Technigaz analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.