Do Investors Have Good Reason To Be Wary Of Wasion Holdings Limited's (HKG:3393) 3.9% Dividend Yield?

Dividend paying stocks like Wasion Holdings Limited (HKG:3393) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

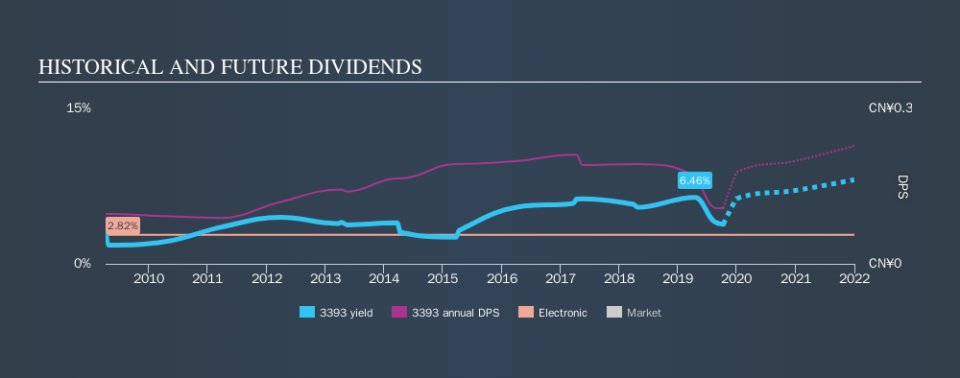

With Wasion Holdings yielding 3.9% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. The company also returned around 1.1% of its market capitalisation to shareholders in the form of stock buybacks over the past year. Some simple analysis can reduce the risk of holding Wasion Holdings for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Wasion Holdings paid out 73% of its profit as dividends. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while Wasion Holdings pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Consider getting our latest analysis on Wasion Holdings's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Wasion Holdings has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was CN¥0.097 in 2009, compared to CN¥0.11 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.1% a year over that time. The dividends haven't grown at precisely 1.1% every year, but this is a useful way to average out the historical rate of growth.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. In the last five years, Wasion Holdings's earnings per share have shrunk at approximately 6.6% per annum. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

To summarise, shareholders should always check that Wasion Holdings's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Wasion Holdings gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In this analysis, Wasion Holdings doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 4 analysts we track are forecasting for the future.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.