Investors' Outsized Bets: Warren Buffett and Seth Klarman

- By Holly LaFon

Many active managers applying a value philosophy run concentrated portfolios that focus on their best ideas. Their tendency to concentrate may be influenced by the model of Warren Buffett (Trades, Portfolio), who said in 2008 that in his early days, he would have 80% of his portfolio in five positions, with 25% in the largest. In 1998, he advocated for having six positions with half in the best idea.

Warning! GuruFocus has detected 3 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL

"Very few people have gotten rich on their seventh best idea," Buffett has said, "but a lot of people have gotten rich with their best idea."

Data shows that some investors GuruFocus tracks have also channeled funds into a specific holding that spans an outsized portion of their portfolios. Investors demonstrating a clear favorite investment include Buffett, Seth Klarman (Trades, Portfolio), Prem Watsa (Trades, Portfolio), Mason Hawkins (Trades, Portfolio), David Tepper (Trades, Portfolio) and Daniel Loeb (Trades, Portfolio).

Warren Buffett (Trades, Portfolio): Apple (AAPL)

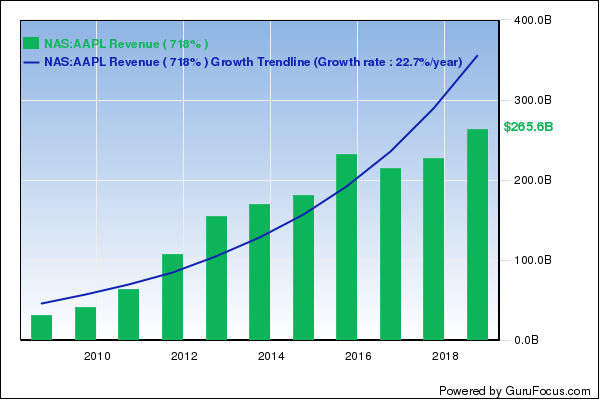

Buffett supported having only five positions for portfolios with assets around $50 million to $200 million. At Berkshire Hathaway (BRK-A)(BRK-B), which has a portfolio valued at $221.02 billion, he has had to diversify, but he still allocates 25.79% of assets to Apple Inc. (AAPL).

Buffett owns 5.32% of the $741.73 billion market cap company, with roughly 252.5 million shares. The monumental holding eclipses his second-largest position, Bank of America Corp. (BAC), which consumes only 11.7% of portfolio space.

While Apple remains a tech giant with one of the most revolutionary products in modern history, the iPhone, it has slipped in recent months from its status as the world's most valuable company it achieved in August when its market cap exceeded $1 trillion. With its price down more than a third since its October peak, Apple was the fourth-largest company by market cap as of Monday, behind Amazon.com (AMZN), Microsoft (MSFT) and Alphabet (GOOGL).

Buffett remains ahead on the holding by about 7.5% according to GuruFocus estimates. Calculations are based on an average estimated share price around $146 and Monday's share price around $157.

But as recently as last May, Buffett said at his shareholder meeting in Omaha, "We would love to see Apple go down in price," to buy more shares of the company at a lower price.

Fundamentally, the company touts some of the checkpoints Buffett looks for. It has steady return on equity at 36.87% for 2017 versus 36.9% for 2016, and strong net margins at 21.14% in 2017 versus 21.09% in 2016. Revenue, net income and free cash flow also soared for the past decade. And it has ample cash, ending the fiscal fourth quarter on Nov. 1 with $237.1 billion on hand.

More than short-term results, Buffett has expressed awe for the company's iPhone ecosystem, he told CNBC in August.

"I do not focus on the sales in the next quarter or the next year," he said. Instead, he focuses on the "hundreds, hundreds, hundreds millions of people who practically live their lives by [the iPhone]."

Buffett continued: "Now it's got competition so you can't push the price, but in terms of its utility to people and what they get for a thousand dollars ... you can have a dinner party that would cost that, and here this is, and what it does for you, it's incredible."

Buffett has not commented on Apple's recent announcement that its revenue would be weaker than expected in the first quarter due in part to lower iPhone sales, primarily in China.

Seth Klarman (Trades, Portfolio): 21st Century Fox (FOXA)

Seth Klarman (Trades, Portfolio), founder of the Baupost Group, is famous for his deep value style of investing that seeks fundamentally sound companies at steep discounts.

Twenty-First Century Fox (FOXA) appears to have most closely matched his criteria. The holding represents almost 19% of his portfolio of 36 common stock positions, far surpassing his second-largest position, Cheniere Energy (LNG), at only 7.8% of the portfolio.

Klarman has watched the position's value climb since starting it in the third quarter of 2015. Starting his buying at prices around $30 on average, Klarman has an average buy price per share around $36. The price hit $48.74 Monday, near a 10-year high, placing his estimated gain around 37%.

Twenty-First Century Fox is a cable, film and satellite company with more than 1.8 billion subscribers, owning assets such as Fox, Fox News Channel, National Geographic and many others. Its financial data includes a 10-year revenue growth rate of 4.2% and operating income growth rate of 10.1%. The company also produced net income for nine of the past 10 years, while its return on equity surpassed the entertainment industry median for most of the past decade. Return on invested capital has steadily grown, with a five-year rate of 7.5%, to 21.79% in 2017, its highest level in at least a decade.

Twenty-First Century Fox ended the third quarter with $7.33 billion in cash and $18.4 billion in long-term debt.

Klarman's investment in Fox will culminate in the company's merger with Disney (DIS), approved in July 2018. The deal will involve Disney acquiring Twenty-First Century Fox and spinning off a new Fox company, consisting of its news and sports assets, at $10 per share. Twenty-First Century Fox shareholders have the choice of receiving either $38 per share in cash or Disney shares at the deal's conclusion, likely sometime in the next three months.

Characteristically media-averse Klarman has not commented on the merger, but Gamco's Mario Gabelli (Trades, Portfolio), a Fox shareholder, made positive statements Saturday.

"I have no problem owning Disney," he said in an interview with Barrons. "I expect new Fox to trade up to $18 to $20 a share two years from now."

Saying Fox's offerings surpassed those of Netflix, Gabelli continued: "I expect Fox to be a sizable cash generator over the next four or five years."

See Seth Klarman (Trades, Portfolio)'s portfolio here. See Warren Buffett (Trades, Portfolio)'s portfolio here.

Read more here:

Podcast Episode: International Small-Cap Investing With Craig Thrasher

Eddie Lampert Wins Bid to Buy Sears From Bankruptcy

Tweedy Browne Global Value Buys 3 Stocks in 4th Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL