How Investors Need To Prepare Now for a Biden Administration

- Oops!Something went wrong.Please try again later.

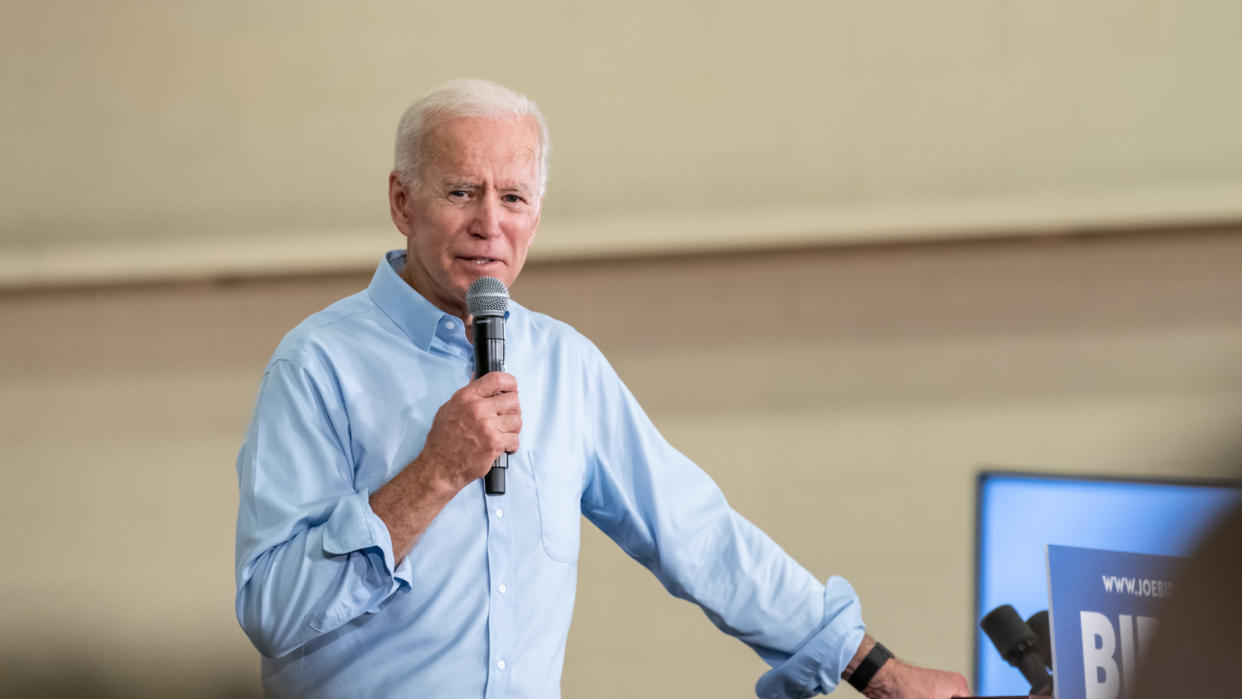

Whenever there’s a changeover in the presidential administration, it can have major ramifications on the economy and the stock market. Now that former Vice President Joe Biden has been announced as the next POTUS, investors can start planning with more certainty as to how they wish to position their portfolios.

Read: 25 Top-Paying Dividend Stocks That Will Make You Rich

Based on what Biden has publicly announced as his policy changes — and investor speculation on what these may mean for the markets — individual stocks have already started making moves. If you want to make money during the Biden administration, look at the markets from an investment perspective only, with politics removed from the equation. Here are some themes and options to consider.

Last updated: Dec. 2, 2020

Get Into the Stock Market

As of December, it’s still to be determined if the Republicans will hold their majority in the Senate or if the Democrats will win the runoff election in Georgia and take control. As an investor, you might be rooting for a Democratic victory so that you can be more certain as to which legislation will actually get passed over the next four years. But if you’re looking to make money, be careful what you wish for — statistics show that the best return for investors comes with a Democratic president and a divided Congress.

How can that be? There are a number of reasons, but one is that the market tends to do better when the status quo is maintained. With a Republican Senate and a Democratic House, it’s less likely that any radical proposals that might unsettle the market will make it through Congress. Although the outcome of the runoff election in Georgia is still uncertain, unless the Democrats pick up both seats, Congress will be divided. From a historical, statistical perspective, that would make it a good time to invest in the stock market.

Check Out: 10 Best Penny Stocks To Watch

Invest In Clean Energy

One element that is almost certain to change during a Biden presidency is a renewed emphasis on clean energy and solving the global climate change problem. Whereas President Donald Trump’s administration saw a withdrawal from the Paris Agreement and an increase in fossil fuel production, Biden is likely to reverse both of these policies.

From an investment perspective, the way to take advantage of this seemingly certain shift in policy is to invest in clean energy companies. Any stocks tied to wind, solar or hydroelectric power, along with ancillary industries, seem poised to benefit from the policies of the Biden administration.

Buy Stocks in Developed Nations

President-elect Biden is more likely to be a “traditional” president than outgoing President Trump, and that may translate to more stability among developed nations around the globe. The reason for this is that Biden is likely to have fewer trade wars and less of an “America-first” agenda than Trump. With more certainty in marketplaces and supply chains, this could result in expanding global manufacturing and more predictable product flow. It may also result in lower costs for customers, as tariffs will no longer be passed through to end users.

From an investment standpoint, this may make it a good time to pick up stocks in Japan and developed nations in Europe, which may benefit from the boost in global trade and manufacturing.

Shift To Low-Tax Investments and Accounts

Something that seems likely over the course of a Biden presidency is higher taxes. Although Biden has announced his intention to keep middle-class taxes low, he has also discussed his plans to raise taxes on those making at least $400,000. Capital gains taxes may also be raised, and other tax benefits that typically appeal to higher earners could vanish or be reduced.

If you’re a high earner, you can adjust to these changing policies by minimizing your taxable investments. Wherever possible, put your investable funds in a tax-sheltered account, such as a 401(k), IRA or annuity. If possible, take your taxable gains before the calendar turns over so that you can continue to benefit from current tax laws.

See: The Best and Worst States for Taxes

Consider Cannabis

Cannabis stocks have been volatile, as pockets of legalization and other political factors have either paved the way or made the path to profitability more difficult for these companies. With Biden and the Democrats taking control of the executive branch, however, the future is likely brighter for cannabis companies.

Although the Democratic party doesn’t support full-blown legalization of cannabis for recreational use, it does support legalizing medical marijuana and decriminalizing marijuana use. While this is far from an open runway for the cannabis companies, it does continue opening doors in that direction. If you’re a believer in the demand for the product, having a Democratic administration is more likely to remove roadblocks to profitability than to create more.

More From GOBankingRates

Are You Spending More Than the Average American on 25 Everyday Items?

Guns and 32 Other Things You Definitely Do NOT Need To Buy During the Coronavirus Pandemic

This article originally appeared on GOBankingRates.com: How Investors Need To Prepare Now for a Biden Administration