Why the IPO hype party could be coming to an end after Uber's stock slide

Luckin Coffee soared in its IPO, opening at $25 a share on the Nasdaq, even as many analysts questioned its profitability over the millions it has been spending to keep customers buying its drinks.

Luckin is hoping to avoid the same fate as Uber, which has been fighting to rebound after its post-IPO swoon.

“There was this period where the market would accept companies that didn’t make money. Now they want to see a nickel of their return back,” Edward Jones Investment Strategist Nela Richardson said on Yahoo Finance’s The First Trade. “The tolerance is changing as we get later in the cycle.”

“They have to show that there is a path to profitability,” she said.

Michael Purves, chief global strategist at Weeden & Co., blames “momentum” for driving early valuations of some of the IPOs. Some investors are getting on board because of all the hype, not realizing that the fundamentals aren’t there or just hoping the company could be the next Amazon or Facebook.

“There’s an interesting blurriness” around big, game-changing companies, Purves said. For Uber, “the valuation got so high on the private rounds that, in a way, this unimpressive public market performance is a little bit of a hangover. The party was had, almost, in the private rounds.”

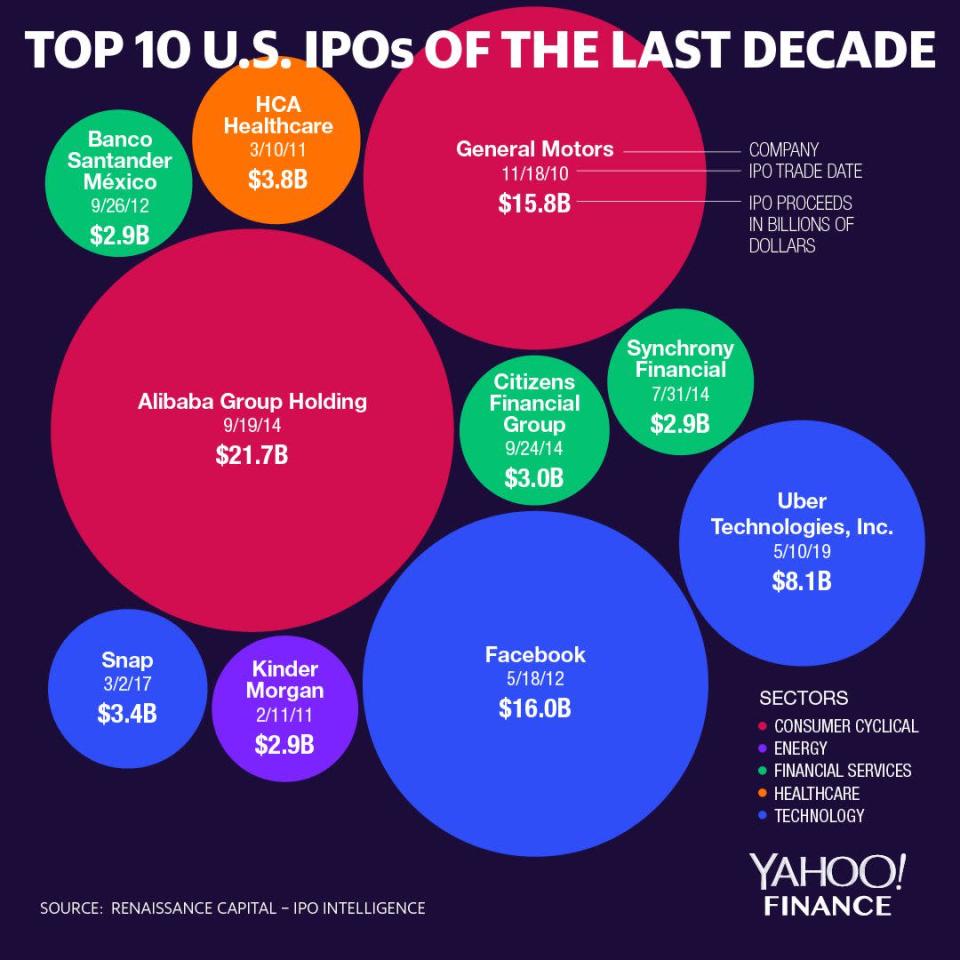

“Facebook, when it went public, had positive earnings growth,” he said. “Uber has really yet to do that.”

But that doesn’t mean investors should write off all of these IPOs. The tech space will always be hot as investors look for the next big thing, Richardson said: “If Lyft and Uber can show that they are part of this trifecta of what tech can offer, then maybe investors will give them a second chance.”

Read more:

Uber CEO to employees: Our stock could still be the next Facebook or Amazon

Lyft's stock is crashing alongside Uber — when will the selling stop?

How Uber’s IPO pricing compares to other recent offerings

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.