IRS set to launch its free tax filing pilot program. Here’s how it will work

When tax filing season opens on January 29, some taxpayers will have the option of filing their 2023 federal tax returns with a brand new, government-run system.

Known as Direct File, the free program will be open on a very limited basis – at first, to federal and state government employees in 12 states with certain tax situations.

The Internal Revenue Service’s plan is to phase in more taxpayers through February and March to include some private sector workers in those 12 states.

The IRS has built the guided filing system in-house, armed with a massive investment from the Democrat-backed Inflation Reduction Act that was passed by Congress in 2022. The law required the IRS to complete a cost and feasibility study about developing a free, electronic tax filing system, which it released in May. The agency then decided to move forward with a pilot program.

If the pilot program is successful, Direct File could eventually rival competing services in the private market.

The IRS tool is meant to be an additional option people have to file their tax returns and will not replace any existing options for filing, said IRS Commissioner Danny Werfel on a call with reporters Wednesday.

Who is eligible for the pilot

At first, Direct File will be open to some federal and state workers in 12 states: Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington and Wyoming.

By mid-March, the IRS expects to open Direct File to some private sector workers in those states who have certain kinds of income and tax situations supported by the tool.

Before starting to file a tax return, Direct File prompts taxpayers to answer screening questions that will determine if they are eligible.

People with income from an employer reported on a W-2, for example, may be eligible – but not if they have other types of income, such as from a side gig or a business.

Those with income from unemployment compensation, Social Security benefits and income interest less than or equal to $1,500 may also be eligible to use Direct File in this year’s pilot phase.

Taxpayers who are itemizing their deductions rather than taking the standard deduction will not be able to use Direct File this year.

But there is no income threshold – unlike the existing Free File Program, which is only available to taxpayers who earn $79,000 or less. That program is provided by an alliance of eight different private companies and has historically had a low usage rate.

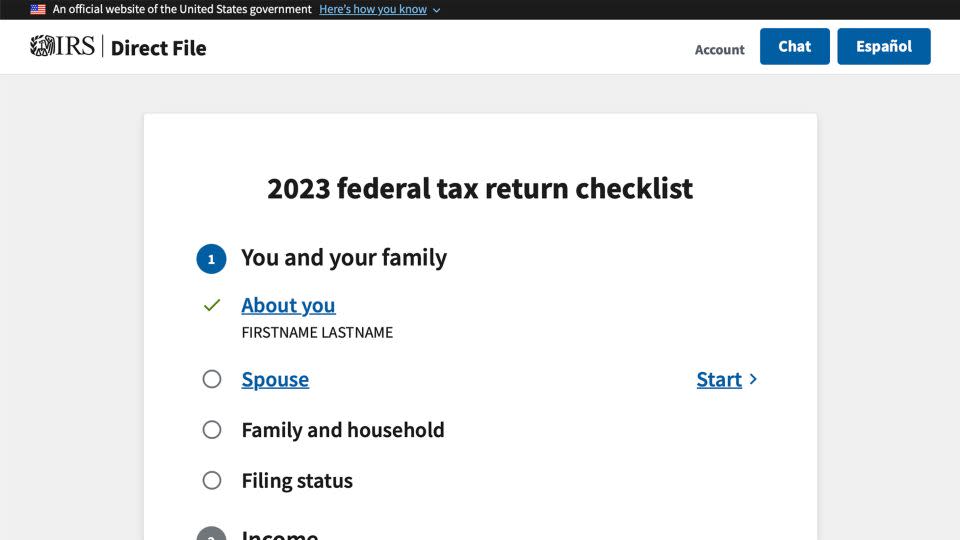

How Direct File works

Direct File is an online tool that can be accessed on a smartphone, laptop and tablet.

It offers step-by-step guidance, in both English and Spanish, to taxpayers filing their federal tax returns by posing questions about their income and tax situations.

At several steps along the way, Direct File shows taxpayers the math behind their calculated refund or liability, according to a demo shared with reporters this week.

Before using Direct File, taxpayers must create an account and verify their identity using Id.Me, a digital identity network already used by other federal government programs.

The IRS will also be offering a live-chat function that connects taxpayers with a customer service representative who will be able to answer questions about using Direct File and provide basic clarification of the tax law. The taxpayer may also get a follow-up phone call if more help is needed.

Direct File does not prepare state tax returns. But taxpayers who are required to file a state return will be directed to their state filing system after completing their federal return, and some of their information will be carried over.

A major overhaul at the IRS

The free federal tax filing program is just one of the many changes happening at the IRS after it received new funding, totaling $80 billion over a decade, from the Inflation Reduction Act. But there are ongoing threats from Republicans to cut the agency’s funding.

Democrats say the money is meant to help the IRS ramp up its enforcement efforts on high-income taxpayers as well as improve its archaic taxpayer services system.

With the funding, the IRS has improved phone service, put a plan in motion to digitize all paper-filed tax returns and is expected to make improvements this year to its existing online tool known as “Where’s My Refund?” so that it will be able to give taxpayers more detailed information about the status of their refund.

The agency also has collected millions of dollars in back taxes by cracking down on millionaires who haven’t paid what they owe.

But Republicans have claimed that the IRS will use the money to hound middle-class taxpayers and small business owners and have made several efforts to claw back the money.

Some lawmakers have repeatedly proposed taking back the funding from the Inflation Reduction Act. Last year, in a deal to address the debt ceiling and avoid a US default, Democrats agreed to allow for $20 billion of the Inflation Reduction Act funds to be rescinded.

The Biden administration has said that the cut won’t fundamentally change what the IRS can do over the next few years. Officials have repeatedly said that taxpayers earning less than $400,000 a year won’t face an increase in taxes due to the new funding.

For more CNN news and newsletters create an account at CNN.com