Is Itesoft (EPA:ITE) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Itesoft S.A. (EPA:ITE) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Itesoft

How Much Debt Does Itesoft Carry?

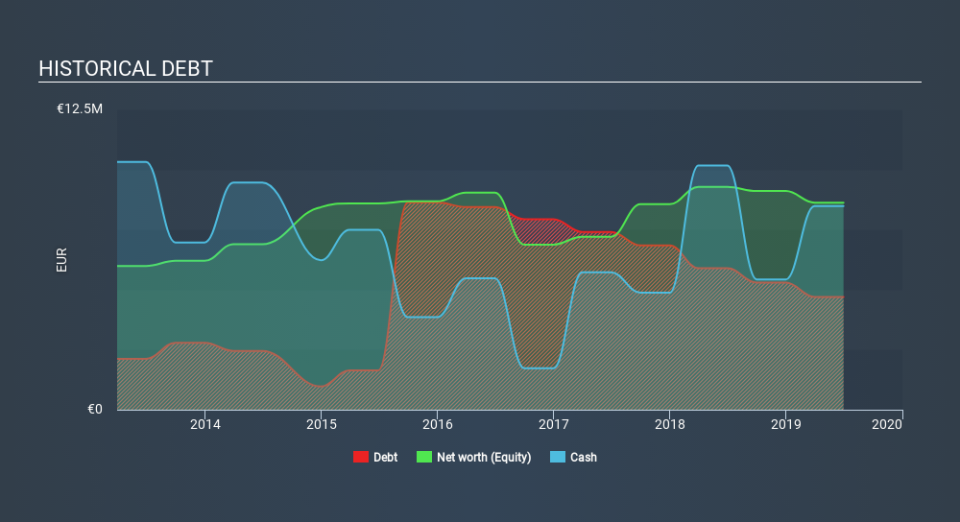

As you can see below, Itesoft had €4.70m of debt at June 2019, down from €5.89m a year prior. But it also has €8.48m in cash to offset that, meaning it has €3.78m net cash.

A Look At Itesoft's Liabilities

Zooming in on the latest balance sheet data, we can see that Itesoft had liabilities of €16.0m due within 12 months and liabilities of €8.68m due beyond that. Offsetting these obligations, it had cash of €8.48m as well as receivables valued at €8.40m due within 12 months. So it has liabilities totalling €7.78m more than its cash and near-term receivables, combined.

Itesoft has a market capitalization of €16.6m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Despite its noteworthy liabilities, Itesoft boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Itesoft's load is not too heavy, because its EBIT was down 80% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Itesoft's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Itesoft may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Itesoft actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While Itesoft does have more liabilities than liquid assets, it also has net cash of €3.78m. And it impressed us with free cash flow of €740k, being 160% of its EBIT. So we are not troubled with Itesoft's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Itesoft that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.