IVA International Fund's Top 5 Buys in the 1st Quarter

The IVA International Fund (Trades, Portfolio), part of Charles de Vaulx (Trades, Portfolio)'s International Value Advisors, disclosed this week that its top five buys in the first quarter were Anheuser-Busch InBev SA/NV (XBRU:ABI), Publicis Groupe SA (XPAR:PUB), Aena SME SA (XMAD:AENA), Dassault Aviation SA (XPAR:AM) and Sodexco (XPAR:SW).

The fund seeks long-term capital appreciation through investments in equity securities from markets around the globe. The managers emphasize financial strength and fundamental value, with the latter defined as the amount that a knowledgeable investor or corporate competitor would pay for a company's economic and controlling interests.

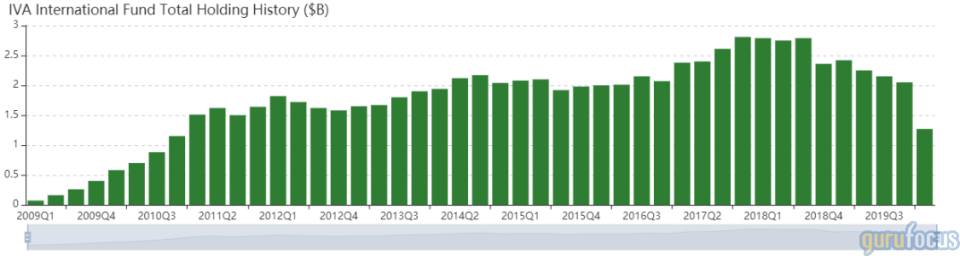

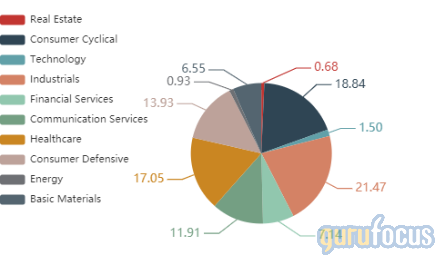

As of the quarter-end, the $1.27 billion equity portfolio contains 92 stocks, with six new positions and a turnover ratio of 12%. The top four sectors in terms of weight are industrials, consumer cyclical, health care and consumer defensive, with weights of 21.47%, 18.84%, 17.05% and 13.93%.

Anheuser-Busch

The fund purchased 566,243 shares of Anheuser-Busch, giving the position 1.98% weight in the equity portfolio. Shares averaged 59.69 euros ($67.42) during the first quarter.

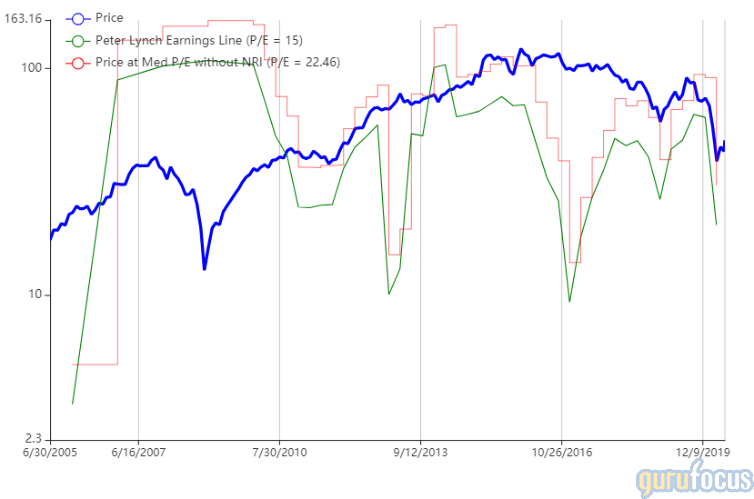

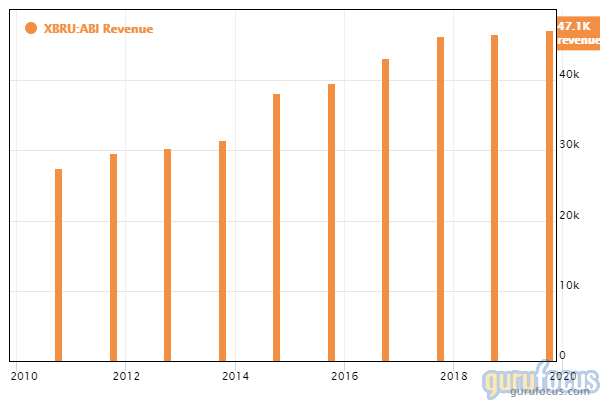

The Belgium-based brewer said in May that revenue for the first quarter declined 5.8% as the coronavirus outbreak sent total volume down 9.3% and beer volume down 10.5%. Volume declined over 30% in April, driven by closures of the company's on-premise channels due to shelter-in-place orders around the globe.

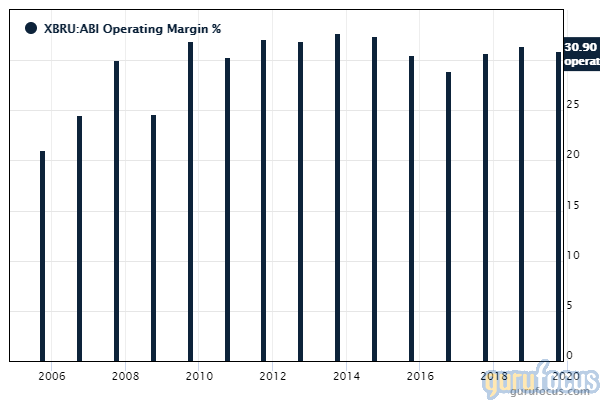

Despite the company's revenue declining approximately 0.10% per year over the past three years, a rate that underperforms over 70% of global competitors, Anheuser-Busch's profitability still ranks 7 out of 10, driven by an operating margin and a Joel Greenblatt (Trades, Portfolio) return on capital that outperform over 83% of global alcoholic beverage companies.

Publicis Groupe

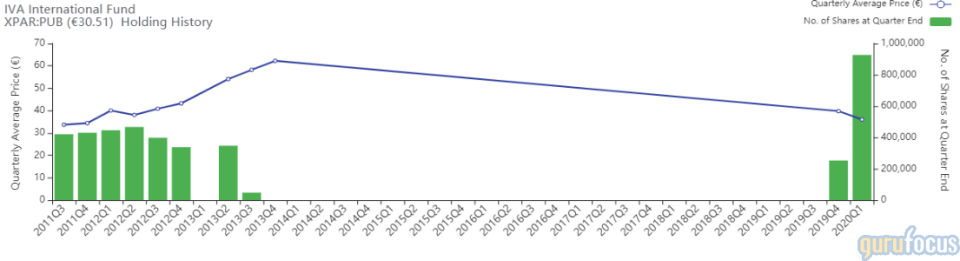

The fund added 674,083 shares of Publicis Groupe, increasing the position 266.64% and the equity portfolio 1.53%. Shares averaged 36.01 euros during the first quarter.

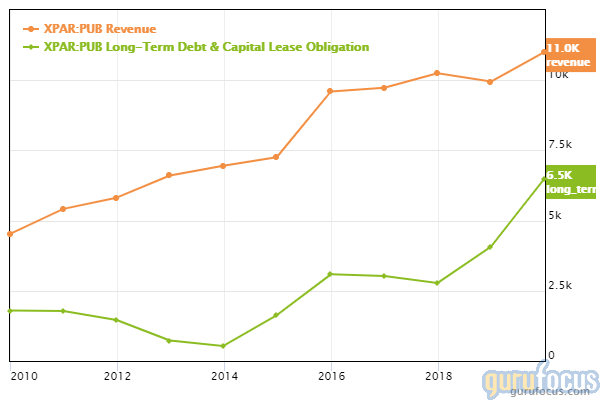

GuruFocus ranks the French advertising company's profitability 8 out of 10 on the back of consistent revenue growth, as evidenced by its 4.5-star predictability rank. Despite this, Publicis Groupe's financial strength ranks 4 out of 10 on warning signs like debt ratios, underperforming 80% of global competitors and a weak Piotroski F-score of 3.

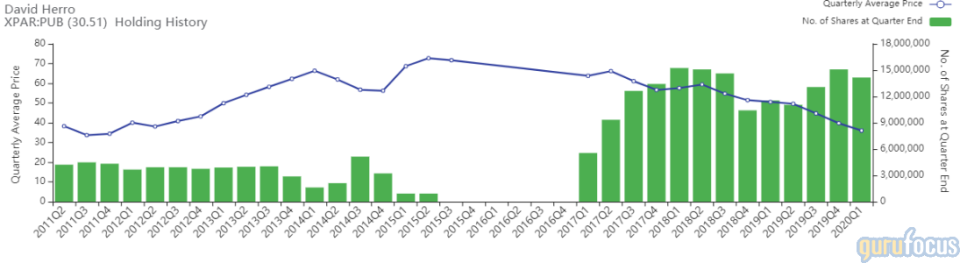

Other gurus with holdings in Publicis Groupe include David Herro (Trades, Portfolio) and Bernard Horn (Trades, Portfolio).

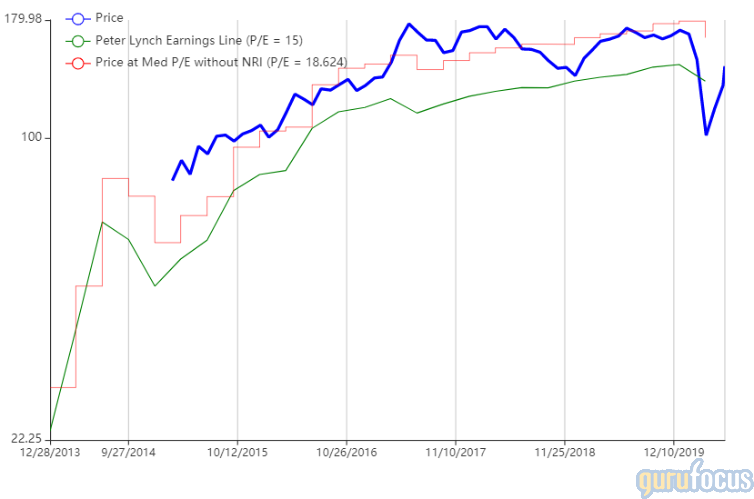

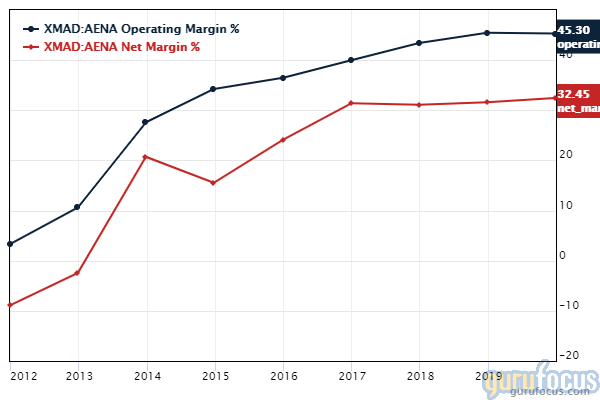

Aena

The fund purchased 166,964 shares of Aena, giving the position 1.44% weight in the equity portfolio. Shares averaged 150.21 euros during the first quarter.

The Spanish airport management company manages approximately 46 airports in Spain and approximately 16 other airports in Europe and the U.S. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins, a high Piotroski F-score of 7 and a return on assets that outperforms 90.27% of global competitors.

AzValor Iberia FI also purchased a stake in Aena during the first quarter.

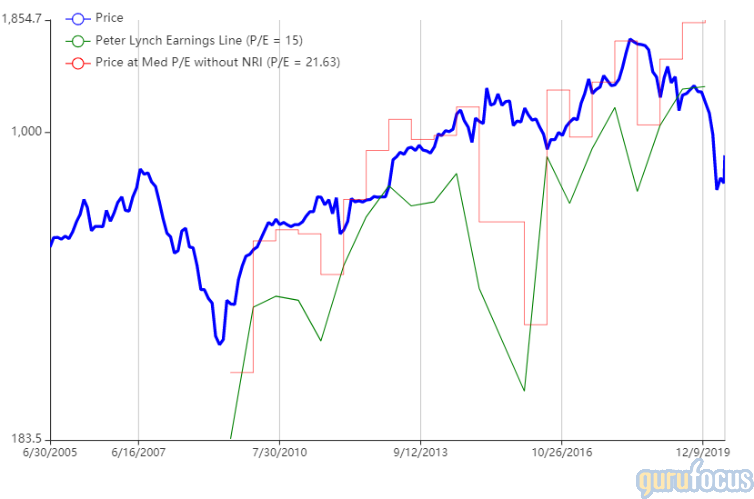

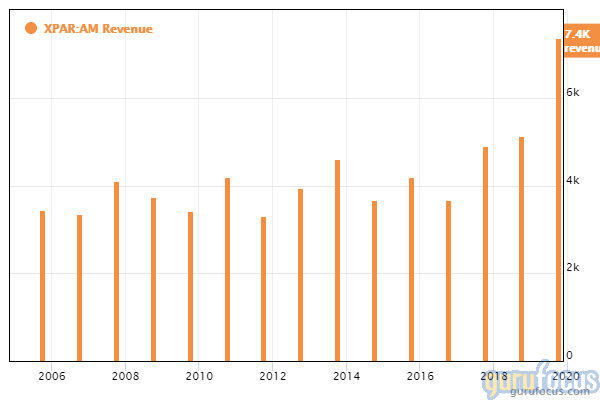

Dassault Aviation

The fund purchased 18,811 shares of Dassault Aviation, giving the position 1.22% weight in the equity portfolio. Shares averaged 991.72 euros during the first quarter.

Dassault Aviation designs and builds military fighter and business jets. GuruFocus ranks the French aerospace and defense company's profitability 7 out of 10 on several positive investing signs, which include expanding operating margins, a three-year revenue growth rate that outperforms 93.10% of global competitors and a return on equity that outperforms 81.86% of global peers.

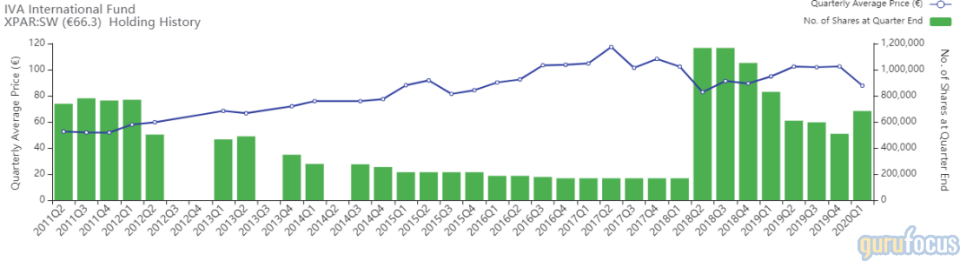

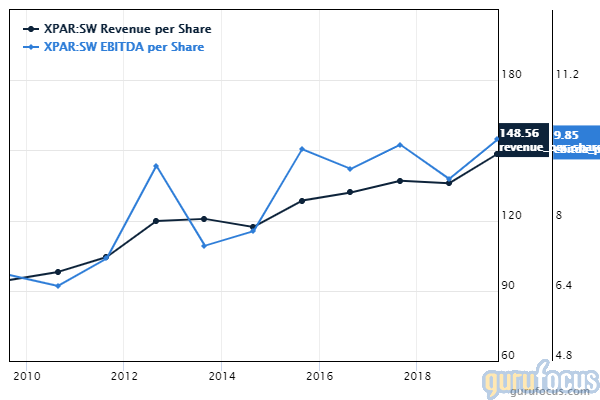

Sodexco

The fund purchased 174,563 shares of Sodexco, increasing the position 34.36% and the equity portfolio 0.93%. Shares averaged 87.72 euros during the first quarter.

GuruFocus ranks the French foodservice company's profitability 8 out of 10 on the heels of a 4.5-star business predictability rank and a Greenblatt return on capital that outperforms 85% of global competitors.

Disclosure: No positions.

Read more here:

Top 6 Buys of Bernard Horn's Polaris Fund in the 1st Quarter

Charles de Vaulx Exits 4 Stocks, Boosts 2 Holdings in 1st Quarter

Michael Burry's Firm Axes Alphabet, Buys 5 Stocks in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.