J. Peterman Owner Eyes IPO

J. Peterman is looking to hit the public markets, decades after “Seinfeld” catapulted the catalog company into the popular imagination.

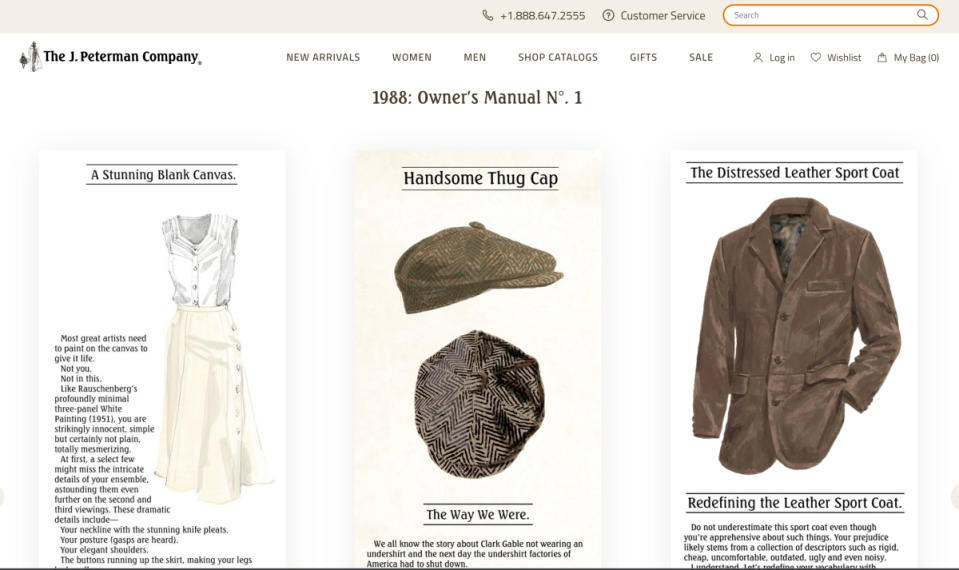

Last week Friday the men’s and women’s wear company filed a registration statement with the Securities and Exchange Commission indicating plans to trade on the Nasdaq Capital Market under the name JP Outfitters Inc. (JP). Owner Santai Global Asset Management Ltd., based in Hong Kong, holds a 90 percent stake in the quirky lifestyle brand known for catalogs filled with product paintings, instead of the usual photographs, and flowery copy that’s more poetic prose than product description.

More from Sourcing Journal

Given the tough market conditions, trying to go public right now wasn’t the most likely move for J. Peterman, especially with credit harder to come by these days. But the IPO would give the company leverage to use equity shares as currency in any future stock-and-equity transactions.

In the regulatory filing, JP described itself as a direct-to-consumer “emerging growth company” that plans to expand by acquiring “orphan brands with their established customer base and integrating them into our operating platform.” It’s only considering brands with a gross margin of 46 percent to 48 percent, similar to the J. Peterman Co. and The Territory Ahead lifestyle brands currently under the corporate umbrella.

The company said it operates an “integrated scalable operating infrastructure.” Seventy-five percent and 60 percent of net sales came from repeat customers, respectively, for the years ended Dec. 31, 2022 and 2021. It reported a loss of $5.7 million on revenues of $26.1 million for the year ended Dec. 31, 2022. That compares with a net loss of $3.6 million on revenue of $28.7 million for the prior year.

“We expect to continue to incur significant losses in the future,” JP said in the filing. “We will need to generate and sustain increased revenue levels in future periods to achieve profitability, and even if we achieve profitability, we may not be able to maintain or increase our level of profitability.”

JP also said investments in product and style mix, material innovation, technology and supply chain sustainability will “substantially” increase its operating expenses “for the foreseeable future.”

JP said it has diversified its supply chain to mitigate disruption. It doesn’t operate stores but periodically hosts popups to engage consumers.

Total assets and liabilities at the end of last year were $14.3 million and $21.1 million, respectively.

Former Pittsburgh Pirates player John Peterman and his partner Don Staley started the company in 1987 with a horseman’s duster. The “Owner’s Manual” catalog, as it’s known, promotes an aspirational lifestyle rooted in adventure.

J. Peterman was acquired by specialty chain Paul Harris after it filed for bankruptcy court protection in 1999. But a year later, Paul Harris also went bankrupt, prompting Peterman to buy back his brand. Co-investor John O’Hurley, the award-winning actor who played a fictionalized version of the entrepreneur behind the J. Peterman catalog company on “Seinfeld,” helped nudge the company along. It wasn’t immediately clear when Santai took over the catalog firm.