Jackson County approves property tax relief for seniors starting in 2024

KANSAS CITY, Mo. — The Jackson County Legislature passed an ordinance Monday that will provide some property tax relief for senior citizens, but not right away.

County lawmakers voted 8-1, with one lawmaker abstaining, to enact a property tax credit for eligible taxpayers who are at least 62 years old.

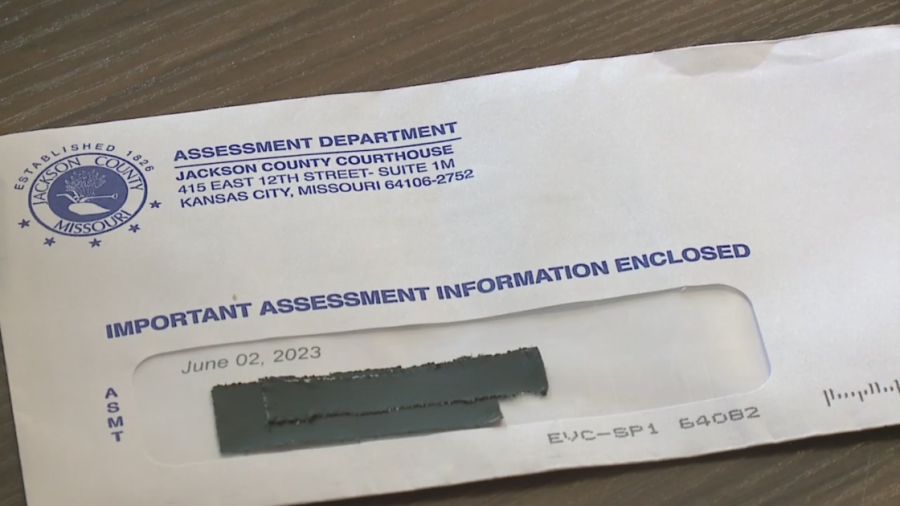

2nd city planning to sue Jackson County over property assessments

“The passage of this ordinance reflects the commitment we have for our constituents throughout the county and our dedication to support and push forward legislation that protects and positively impacts the livelihoods and the day to day life of those in Jackson County,” Chairman DaRon McGee said in a statement.

It all stems from Missouri Senate Bill 190, which was signed into law by Republican Gov. Mike Parson. The new Missouri law freezes property taxes for seniors — but counties have to implement it first.

Senate Bill 190 lets Missouri counties grant a property tax credit “equal to the difference between the real property tax liability on the homestead in a given year minus the real property tax liability on such homestead in the year in which the taxpayer became an eligible taxpayer.”

Frank White speaks about Jackson County property assessment process

“It would freeze the amount that a senior pays when they turn 62, or they’re eligible for social security,” State Sen. Tony Luetkemeyer previously told FOX4. “They would freeze at that rate, and they would never go up in the future.”

Luetkemeyer said the bill would also get rid of income tax for social security payments, bringing Missouri in line with the vast majority of states.

St. Charles County, in the St. Louis area, also passed a new bill last week to implement the tax credit in 2024, sister station KTVI reports.

But in Jackson County, both changes won’t take effect until the 2024 tax season.

The Jackson County Legislature discussed implementing the property tax credit sooner. One county lawmaker proposed an ordinance to start the new ordinance in the 2023 tax season, but it failed by a 8-1 vote last week.

KCPS considers keeping windfall from property assessments

County leaders said the new Missouri law lacks information, which could present challenges to implement it quickly.

“Because the way that the state law was drafted, the lack of information either makes us creative or creates barriers that will have the law challenged if we implement it wrong,” Jackson County Legislator Manny Abarca told FOX4 last week.

Still, many county legislators on Monday said they are happy to see Jackson County’s senior citizens get tax relief.

“SB190 is flawed legislation passed with no regard for how counties would implement it,” Vice Chair Megan Marshall said.

Download the FOX4 News app on iPhone and Android

“However, I am proud this Legislature was able to craft Ordinance #5787, although imperfect, to ensure property tax relief for our county’s most vulnerable homeowners.”

The Jackson County Legislature plans to address how it will implement the tax credit in the coming months to ensure the county has a comprehensive plan.