Jackson eyes raising property taxes. Some council members are wary. See what is proposed

- Oops!Something went wrong.Please try again later.

With revenue shortfalls looming at every turn, the City of Jackson has proposed raising property taxes.

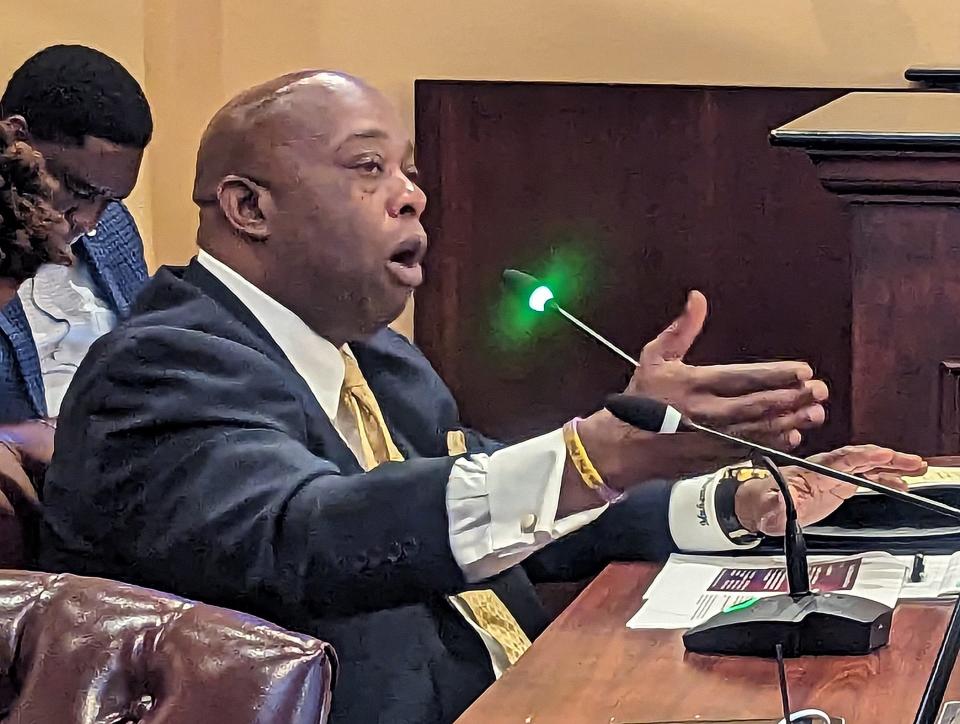

It's a debate likely to play out in the coming weeks as Jackson Mayor Chokwe Antar Lumumba and the Jackson City Council hold budget hearings to figure out what the city's finances will look like for the next fiscal year.

At the end of Wednesday's 8-hour budget hearing, Lumumba and the city's financial division presented a proposed millage rate increase to the council as an option to bring more money to the city.

A millage rate is a figure used by government entities to calculate property taxes. One mill equates to $1 in taxes for every $1,000 of a property’s assessed value or 1 cent on every $100 of assessed property value, according to Experian.com. Property taxes are used to support county and city governments and local school districts, according to the Mississippi Department of Revenue's website.

But the council has the final say, as they are the ones who will vote on whether to approve the increase. To increase the millage, state law requires an advertisement in the newspaper must be posted twice for two weeks prior to a public hearing being held, so that residents can attend and voice if they are in favor or not of the increase.

The current property tax rate Jackson residents pay is 63.03 mills, or 63.03 cents per $100 of assessed property value, according to the administration's presentation. The proposed increase by the mayor's administration would increase the millage rate by 1 or 2 mills, or stated otherwise, 1 or 2 cents per $100 of assessed property value. A 1-cent increase would bring the rate to 64.03 cents per $100 of each assessed property value in the city and provide an additional $1.2 million of yearly revenue for the city. A 2-cent increase would bring the rate to 65.03 cents per $100 of each assessed property value in the city and provide an additional $2.4 million in yearly revenue for the city.

Although the extra money is needed for the city, it still may not be enough to cover all of the city's budget woes, which include figuring out pay raises for the Jackson Fire Department and the revelation of $2 million in rising city insurance premiums that must be paid.

Ward 6 Councilman Aaron Banks said at Tuesday's city council meeting that council members had previously decided they were not in favor of a millage increase. Ward 1 Councilman Ashby Foote said outright in a phone interview Wednesday evening that he would not support an increase. Foote said he would rather see cuts in the budget of city department's, instead of increasing money on the taxpayers.

"In my opinion, I'd rather see that money come from us tightening our belt within the city because there is room for us to come up with money. That's what I believe, of course I'd have to get more votes to support my recommendations," Foote said. "It is a little vague at this point in time because he (the mayor) went and did that without the council okaying it, which is his prerogative from the standpoint of advertising for it. But it's another thing to actually get the council to vote for it to approve the millage (increase)."

Similarly, Ward 7 Councilwoman Virgi Lindsay said Wednesday evening that she appreciated getting a presentation "about where the administration thinks this millage increase would be best used," but, like Foote, would rather see money for the city come from budget cuts.

"It takes four votes to pass the budget and I don't know if there are four city council members who would agree to a millage increase and that's why we also asked the mayor to look at where he would recommend budget cuts. There's really not much fat, if any fat at all in this budget, but look at where things could be delayed for a year or shifted or cut in case this proposed millage increase would not be approved," Lindsay said.

Lindsay wouldn't say if she was currently in favor of the millage increase, but would like to "wait and hear back from the mayor on what his proposed cuts are going to be."

What does a millage increase mean for residents?

For owner-occupied residential properties, the assessed value is equal to 10% of the market value, according to the presentation. The rate for all other real estate, such as businesses or rental properties, is 15%.

Here's an example of a 1 mill increase taking the city's tax rate from 63.03 total mills to 64.03 total mills for owner-occupied residential properties: If your property value is $100,000 then 10% of your assessed value would be $10,000. At a millage rate increase of 1, your property taxes would increase $10 per year. At a millage rate increase of 2, your property taxes would increase $20 per year.

Here's an example of a 1 mill increase taking the city's tax rate from 63.03 total mills to 64.03 total mills for business owners or landlords: If your property value is $100,000, 15% of your assessed value would be $15,000. At a millage rate of 1, your property taxes would increase $15 per year. At a millage rate increase of 2, your property taxes would increase $30 per year.

In comparison to some of Mississippi's other cities such as Gulfport and Southaven — Mississippi's second and third largest cities, respectively — Jackson's current millage rate of 63.03 is higher. Gulfport's is 34.00 mills, or 34.00 cents per $100, while Southaven's is 43.73 mills, or 43.73 cents per $100, according to the Mississippi Department of Revenue. Hattiesburg's is 53.13 mills, or 53.13 cents per $100. Biloxi's millage rate is 30.10 mills, or 30.10 cents per $100.

Here are a few of the Jackson's budget challenges

Pay raises for the Jackson Fire Department have been at the top of the list for council members. Firefighters have been attending council meetings and calling out in protest in an effort to put pressure on the council. Due to being overworked and underpaid compared to other nearby municipalities, the department has had trouble hiring and retaining firefighters.

Lumumba has asked the firefighters for patience as the city tries to figure out a way to make the pay raises happen, while Banks said on Tuesday the council is "going to do the best we can to get some type of raise."

But staff shortages and retaining employees are an issue in nearly every department, including the Jackson Police Department and the 911 call center. Ward 3 Councilman Kenneth Stokes has said multiple times in the past months that he would like to see pay raises for all city employees. According to the city's website, there are currently 59 job openings.

The Department of Public Works is also facing staff shortages amid issues with aging infrastructure and broken traffic lights throughout the city. The department is currently without a director, which is the city's highest paid position after the council increased the annual salary to $164,000. The previous director, Khalid Woods, resigned after less than two weeks on the job for unspecified reasons.

Council members have also been discussing the possibility of closing down the Jackson Zoo to free up some more funds for the city. Banks said Wednesday, "it's irresponsible if we don't discuss it," though Lumumba and Ward 5 Councilman Vernon Hartley firmly pushed back against the idea.

Things took a dramatic turn on Tuesday at an emergency meeting where council members discovered they will now have to find millions to pay for increased city property insurance premiums. The policy is about $2 million more per year than the city's previous insurance policy with Liberty Mutual.

In a 4-1 vote, the council approved a $2 million proposal from Lexington Insurance who will provide insurance for commercial property and boiler and machinery insurance for the next year.

The city received the quote from Lexington in May. Council members wondered why they weren't immediately notified about the change in policy then. Ward 2 Councilwoman Angelique Lee, as well as the other council members, had choice words about the lack of communication from the city to the council.

"Why was the council not apprised of this in May?" Lee asked. "And why are we just now finding out when it's an emergency state? And to me it sounds like a lot of passing the buck. Someone is responsible and someone's going to have to pay."

Ward 4 Councilman Grizzell agreed with Lee, as well as Ward 5 Councilman Vernon Hartley. Foote also agreed with the other council members, but said he would not support the change in policy because "the administration needs to know that they've got to be proactive, they've got to have prior planning to prevent this kind of situation."

Liberty Mutual decided not to renew the policy because the city failed to implement risk control measures that the insurance company asked for in 2021. The conditions of city-owned buildings and problems with the city's water system stemming from 2022 also were an issue, according to city deputy attorney Terry Williamson.

Lee asked why the city wasn't able to come into compliance with Liberty Mutual's demands, but no one from the city could explain. She suggested a "complete overhaul" of the city's departments.

"I'm feeling like this is not satisfactory and I'm feeling like we are just doing a piss-poor job in every department. I don't feel like any department is being properly managed," Lee said.

Foote agreed with Lee, saying "it makes it harder for the city to succeed when we're constantly trying to put out dumpster fires.

This article originally appeared on Mississippi Clarion Ledger: Jackson MS proposes property tax increase to fund budget demands