Jana Partners Continues Trend of Selling HD Supply

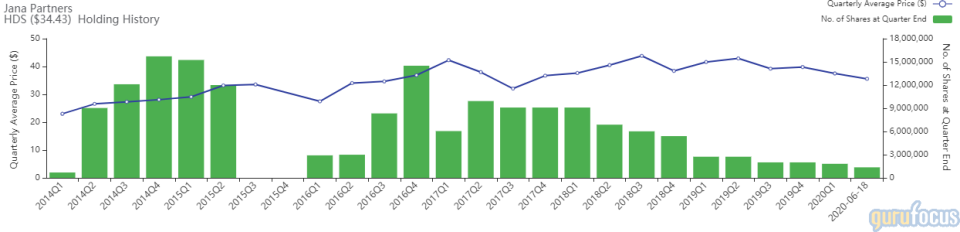

Investment firm Jana Partners (Trades, Portfolio) revealed it reduced its holding of HD Supply Holdings Inc. (NASDAQ:HDS) by 25.23% according to GuruFocus Real-Time Picks.

The investment management firm specializes in event-driven investing and was founded in 2001 by Barry Rosenstein. The firm typically applies a fundamental value discipline to identify undervalued companies that have one or more specific catalysts to unlock value.

The sale was on trend for the firm as it has been selling shares since the third quarter of 2017. On June 18, the firm sold 459,129 shares of the company at an average price of $35.58. The sale had an overall impact on the portfolio of -1.90%. GuruFocus estimates the firm has gained an estimated 19.11% on the position overall.

Through a combination of acquisitions and organic growth, HD Supply has become one of the largest industrial distributors in North America. It is the market leader in the two sectors in which it operates (facilities and home improvement maintenance, repair and operations and specialty construction). Today, HD Supply offers 650,000 stock-keeping units and serves 500,000 customers through 270 branches across the U.S. and Canada.

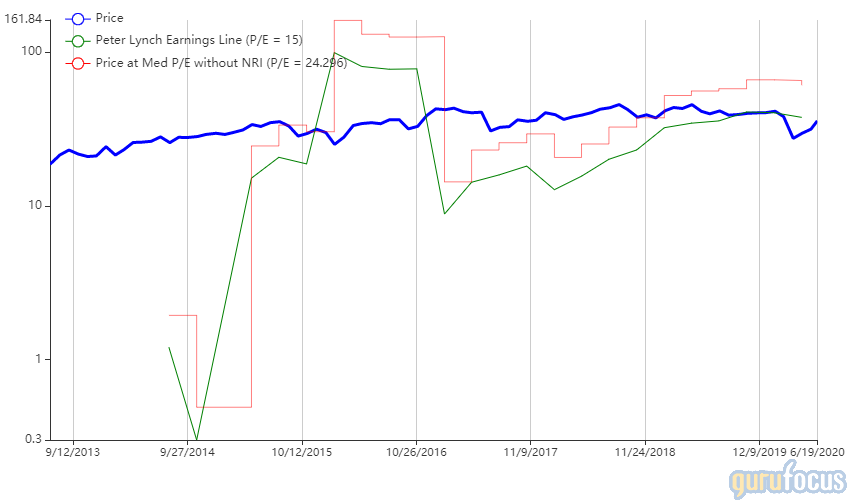

On June 19, the stock was trading at $35.38 per share with a market cap of $5.68 billion. According to the Peter Lynch chart, the company was trading close to its intrinsic value and was fairly priced.

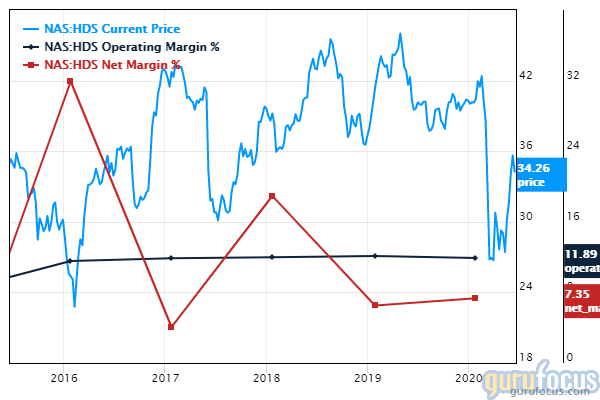

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 6 out of 10. The cash-to-debt ratio of 0.01 places it lower than 88.08% of the industry, but the company has drastically reduced debt levels since 2013. HD Supply boasts a high operating and net margin percentage that beats the majority of the industry.

Top guru shareholders include FMR LLC (Trades, Portfolio), Vanguard Group Inc. (Trades, Portfolio), Fiduciary Management Inc. /WI/ (Trades, Portfolio), BlackRock Inc. (Trades, Portfolio) and Seth Klarman (Trades, Portfolio).

Portfolio overview

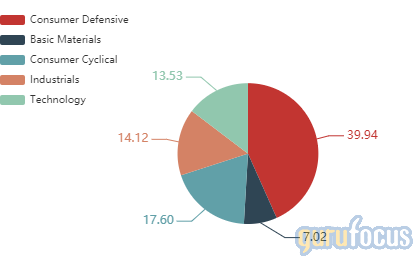

At the end of the first quarter, the firm was invested in 11 stocks, with three new holdings. By weight, the firm is most invested in the consumer defensive (39.94%), consumer cyclical (17.60%) and industrials (14.12%) sectors.

New holdings as of the end of the first quarter included Perspecta Inc. (NYSE:PRSP), Hillenbrand Inc. (NYSE:HI) and New Relic Inc. (NYSE:NEWR).

Disclaimer: Author owns no stocks mentioned.

Read more here:

Video Game Studios Seeing Steady Growth

Guru Consensus Picks With Large Gains

Biggest Year-to-Date CEO Sells

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.