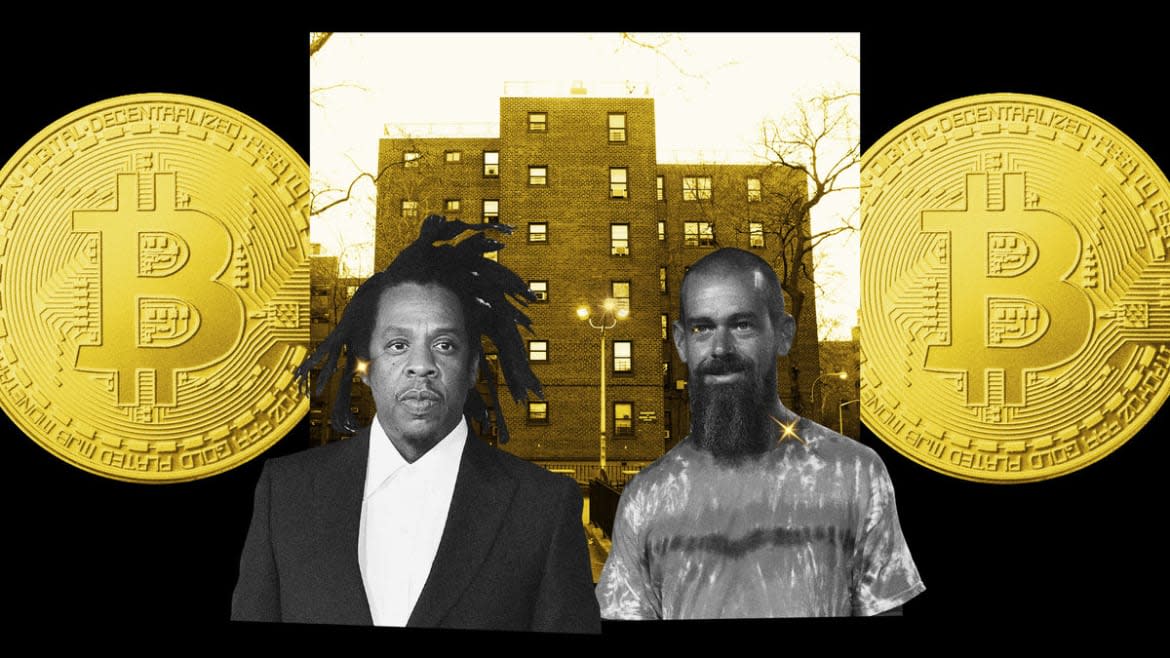

Jay-Z’s Selling Bitcoin in the Projects. Not Everyone’s Buying.

- Oops!Something went wrong.Please try again later.

It was an eyebrow-raising venture from the outset: two billionaire crypto evangelists funding a 12-week “Bitcoin Academy” for residents of a public housing complex in Brooklyn, with classes ranging from “Careers in Crypto” to a seminar on “Why Decentralization Matters.” Three months later, class has been dismissed, and tenants at the Marcy Houses have very different opinions about the whole affair—backed by Twitter co-founder Jack Dorsey and rapper Jay-Z, who reportedly grew up in Building 524.

Some residents are still ardent skeptics: “How are you helping us if you’re asking us to put in five dollars, 10 dollars, and we’re all on fixed income?” questioned Lydia Bryant, 57, adding that people’s money would likely be safer in “a real stock” instead of crypto.

Some didn’t pick up much: “I took the class but I really didn't comprehend a lot,” said a retiree who used to work as a school bus matron in Queens.

But some are newfound Bitcoin believers, convinced that the crypto markets will go up. “I thought Bitcoin was a scam,” said 56-year-old Danny Craft, an academy grad. “I come to find out, you’ve just got to know how to work it. When you put money into it, you just let it sit there and you let it grow.”

In terms of student sentiment, it didn’t hurt that graduates received a surprise: $1,000 in crypto for completing the program. One alumna told The Daily Beast she has already started moving some of her other assets into crypto, with plans to buy more with every paycheck.

“If you take it out, then you lose the benefit of having something in the long run,” she argued. She said one of her takeaways from the academy was that her money would likely double or triple over time.

And if the opposite happened, was she worried? “As long as it goes back up.”

Founded in 2009, Bitcoin’s value soared exponentially to an all-time high north of $60,000 per token last year. But it remains very unstable. Over the past 12 months, the price has plummeted by more than half, and on Monday and Tuesday alone it slipped close to 10 percent.

For someone like Dorsey—whose Twitter bio simply reads “#bitcoin” (plus a Bitcoin emoji), and who is worth an estimated $4.7 billion—that volatility is manageable.

But from the perspective of some Marcy residents, the risks are far greater, particularly if they begin pouring in their own savings.

“For you to take your money that you worked for, or your government-assisted funds, and invest it in something like Bitcoin that’s really risky, that’s a no-win,” said one tenant, who asked not to be named out of concerns about “backlash” from some of her crypto-bullish neighbors.

Even the $1,000 grant, she said, is unlikely to produce a life-changing return in a place where some “people are broke and struggling to live.”

The retired bus matron, meanwhile, said that while she doesn’t fully grasp how Bitcoin works, she gathered enough to know “I can’t be gambling with money that I get for my retirement.”

Others felt the academy sufficiently highlighted the risks of crypto, and said the courses gave attendees information to make their own financial choices.

“The class wasn’t telling them… ‘Yo, take your life savings and convert it into Bitcoin,’” said Matthew Powell. He attended the sessions with Craft, his childhood friend; both said they understood that digital currency markets come with risk.

Powell said he had “messed with Bitcoin” prior to enlisting in the academy, but when the price dropped, he cut his losses and bailed. His newfound insight from the courses: “Take something, put it there, and just let it sit.”

In a statement, a spokesperson for The Bitcoin Academy said the group considers the first session “a pilot, and [we] will certainly iterate and improve as we go. We surveyed students along the way and are in the process of reviewing their feedback so we can understand more about the classroom experience and get data about their interests and goals as we think about how to design the next phase of the program.”

Seated on a cluster of benches on the south side of the Marcy complex, another Bitcoin Academy grad, who goes by the name Queen Bee, said she found the coursework engaging. The classes came with a different free dinner each session, she said, including oxtail, fish, shrimp, and “vegan night.”

Attendees were given access to WiFi devices and smartphones if needed, and though Queen Bee said she had to miss some sessions because of COVID and a hospitalization, she received her $1,000 bonus. She doesn’t plan to sell, since that would incur a tax liability, and she said she has no interest in paying taxes on something that was given to her for free.

Sitting next to her, another attendee, Tina, also had positive feedback about the course, though she missed sessions after her husband became ill, before he passed away. “I would do it again,” she said.

Built in 1949, the Marcy Houses were made famous by Jay-Z. When he was young, he has said, the area was notoriously dangerous. “I’m from Marcy Houses, where the boys die by the thousand,” he rapped on his 2017 track, “Marcy Me.”

The rapper has given back to the community in recent years, and multiple residents complimented his generosity. “He is so good for our people,” said Jessie Mackey, a 65-year-old tenant who had to miss most of the Bitcoin events to care for her sister.

Edith Williams, who said she attended one session, is pushing her grown children to sign up for the next academy cohort, assuming they get the chance. She has invested some money in crypto and plans to wait a few months to see if it goes up. And if it does, she said, she has no intention of cashing out: “Let it roll, let it roll, let it roll.”

Get the Daily Beast's biggest scoops and scandals delivered right to your inbox. Sign up now.

Stay informed and gain unlimited access to the Daily Beast's unmatched reporting. Subscribe now.