How can New Jersey best invest its budget surplus? Here are some ideas — Ciattarelli

It’s budget time in Trenton, and this year’s budget discussion will be unlike any other. Why? Our state government is awash in cash. How much? How about $9 billion to $12 billion.

Unnecessary tax increases and reckless borrowing the governor enacted in his first term are primary reasons for the surpluses. In addition to the $9 billion to $12 billion is another $3 billion in federal pandemic relief money that still remains unspent and unallocated — despite a law mandating that the governor provide a detailed plan.

State treasury officials are smiling with glee. The surpluses do beg the question, however, about the governor’s fiscal management of the state:

Did he have to increase income taxes on the most taxed people in the nation?

Did he have to increase business taxes when New Jersey already has the nation’s worst business climate?

Did he have to borrow $4 billion to balance last year’s budget?

Did he have to continue confiscating each town’s energy receipt taxes and municipal/county 911 communication fees?

The answer to all these questions is, of course, no. There are those who will say the pandemic created economic uncertainty, making fiscal forecasting impossible. This taxpayer would suggest that uncertain times call for a more conservative approach. Not a deliberate strategy to increase the state budget an unprecedented 40% in five years’ time.

We are where we are. What do we now do with these taxpayer-funded surpluses? The governor has yet to offer a detailed plan. Legislative Republicans have put forth a “Give It Back” initiative that returns the surplus to taxpayers by way of $1,000 and $500 rebates. The Assembly speaker seems to agree with this approach, insisting on “the largest tax relief program in state history.” The Senate president said the surpluses should be set aside to protect New Jersey from a recession.

More Ciattarelli: Here are five ways New Jersey can become more welcoming to business

Charles Stile: Lack of marijuana sales isn't a travesty. Lack of concern over veterans home deaths is

Reasonable surplus and rainy-day funds are good budgeting. Excess surpluses are over-taxation. Considering how New Jerseyans are being crushed by fuel and food prices and overall inflation that’s reached a 40-year high, people need relief. The “Give It Back” initiative is the right start. Here are some other detailed proposals.

Fuel costs: Gas and diesel prices are taking significant money out of everyone’s pocket each day. Let’s pump $500 million into the state’s Transportation Trust Fund and, in turn, suspend the gas tax for July and August. That’s a savings of more than 42 cents per gallon.

Taxes and unemployment: Businesses of all sizes need relief, too. Let’s start by eliminating the business tax surcharge. Let’s also fund the state’s unemployment system so employers don’t have to pay an upcoming $1 billion tax increase for an insurance problem they didn’t create.

Education: Our children suffered significant learning loss during the pandemic. Let’s invest in after-school and summer enrichment programs to get our children caught up. Also, to address what our young people and industries so desperately need, let’s invest in more vocational training facilities.

Access: The pandemic painfully exposed a great many injustices suffered by people of color living in our urban centers. Very urgently, we need to address access to health care, the issue of "food deserts" and economic opportunity. We can do this with the right kind of investment in transformative community planning.

State technology: It’s no secret that our state government’s technology systems are antiquated, causing some of the worst response times and user experiences in the country. Let’s invest in modern-day technologies to increase the speed and quality of taxpayer and business interactions.

Debt service: Finally, considering our soaring state debt of nearly $250 billion, let’s protect future generations by retiring some of our long-term bonds and, in so doing, improve our credit rating, which stands today exactly where it was when Murphy took office.

At present, there is no greater duty than devising a detailed plan to invest the surpluses in a responsible way. Now, more than ever, bipartisan participation and robust debate are critical, as is transparency. Billions in taxpayer dollars will be irresponsibly squandered if, as in past years, budget decisions are sadly delayed until the last minute and, worse yet, made behind closed doors by a select few.

The governor needs to step up. Given this unprecedented opportunity for the people of New Jersey, he should call the Legislature into special session. If he doesn’t lead the way, the Legislature must.

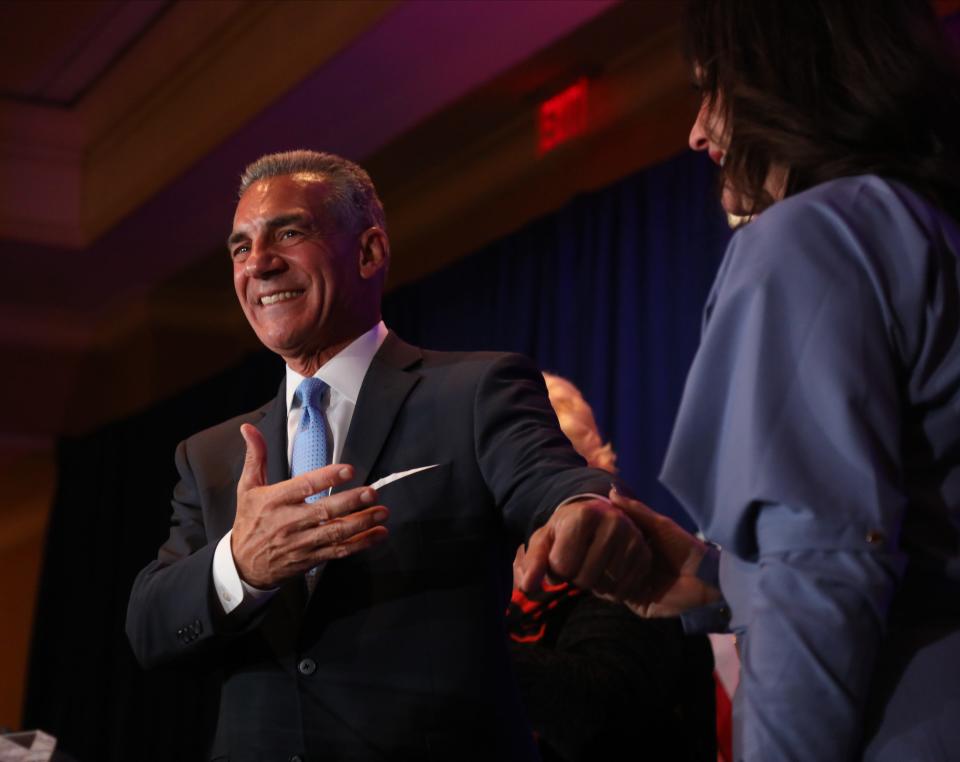

Jack Ciattarelli, the 2021 Republican nominee for New Jersey governor and a likely 2025 gubernatorial candidate, is a regular contributor to the opinion pages of USA TODAY Network New Jersey publications.

This article originally appeared on NorthJersey.com: Jack Ciattarelli: New Jersey can best invest budget surplus